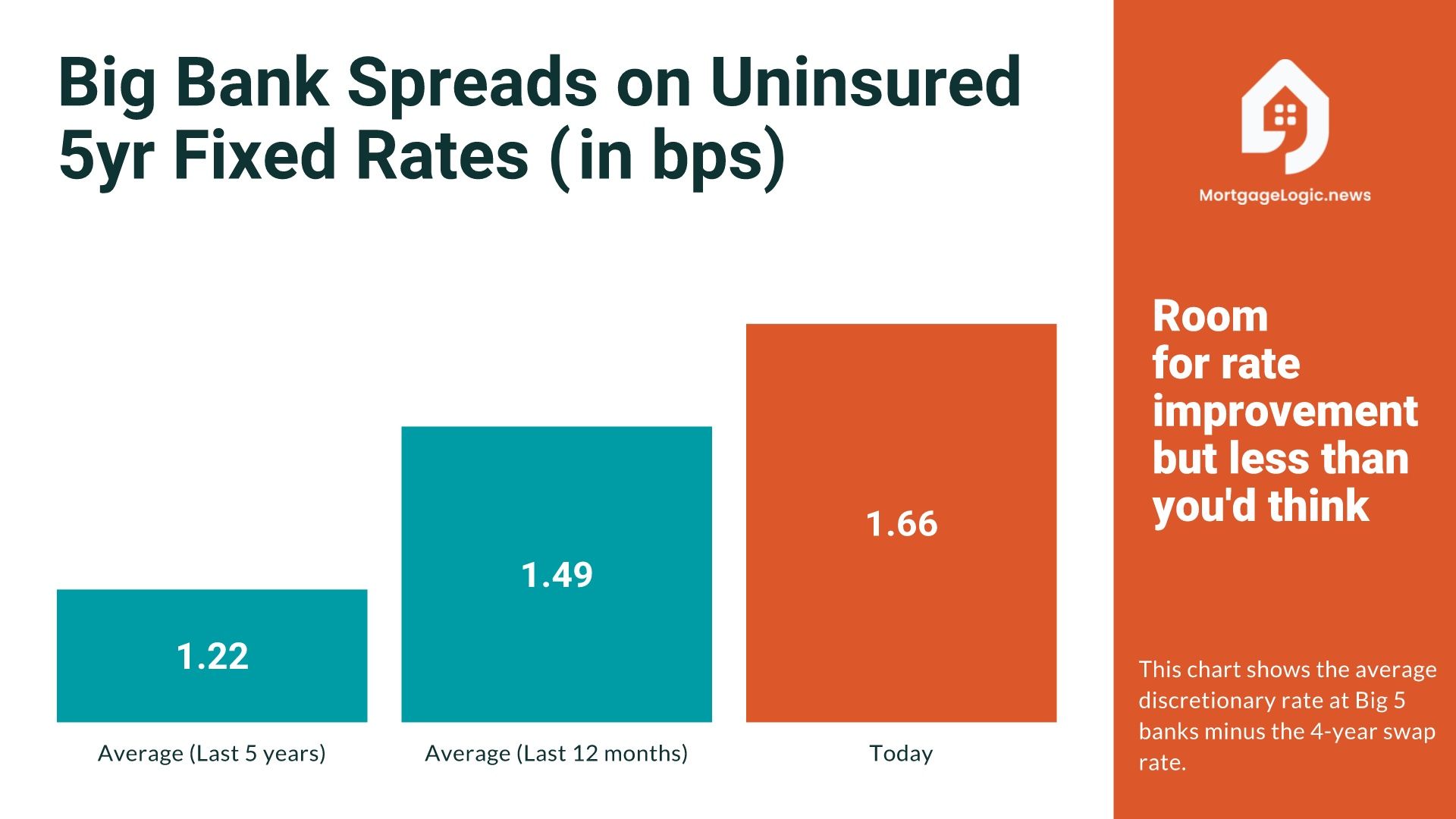

Canada's Big 5 banks are not in a discounting mood. They've been pricing fixed rates well above normal for months, relative to common funding cost benchmarks.

For context, look at the last five years for example. Over that span, uninsured 5-year fixed rates averaged 122 bps over the 4-year swap rate—our preferred funding cost benchmark.

Today, they're 166 bps over, 36% more.

Bigger premiums should be expected at this tentative point in the economic cycle, but at 44 bps above average one might also expect room for rate improvement.

For uninsured borrowers waiting for meaningfully lower fixed rates, however, history shows that it could be five to nine months before spreads normalize.