Today's report...

Goldman on where rates and stocks may go from here

(Click link above for story)

This & That

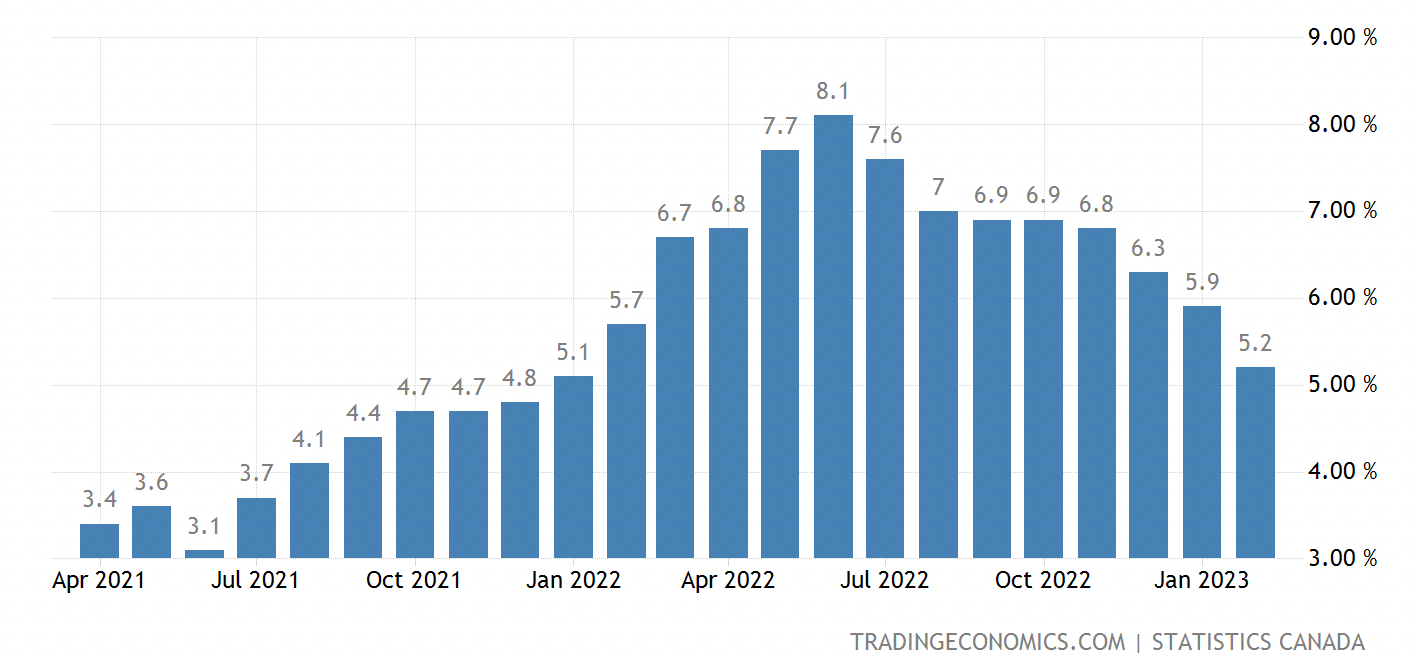

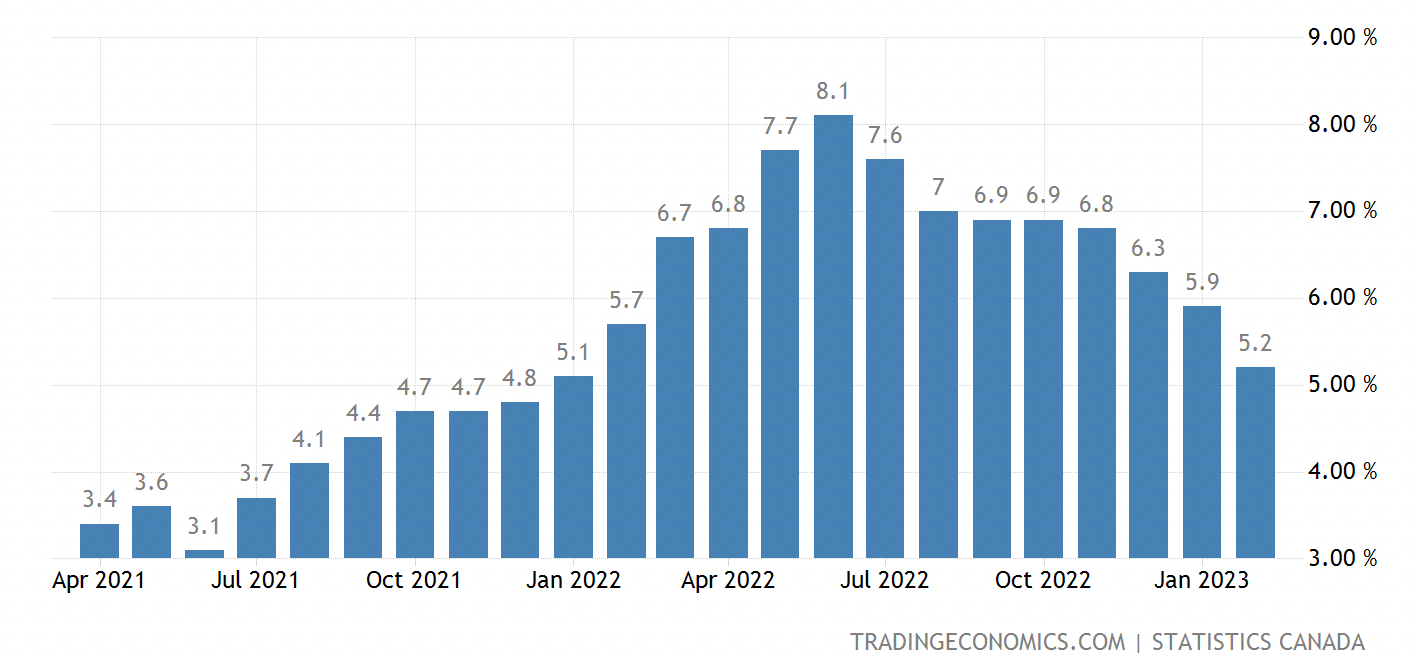

- Pivotal number: Canadian CPI—due today at 8:30 a.m. ET—is expected to have a 4-handle for the first time since 2021.

Today's report... Goldman on where rates and stocks may go from here (Click link above for story) This & That * Pivotal number: Canadian CPI—due today at 8:30 a.m. ET—is expected to have a 4-handle for the first time since 2021.

(Click link above for story)

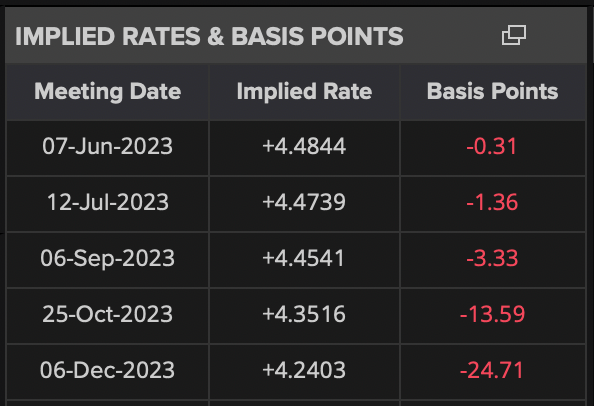

Since rates peaked in the early 1980s, there have been six Fed hiking cycles. Those cycles have lasted about 20 months on average. So far, we're 13 months into this one, and markets think we have just one hike left.

Since rates peaked in the early 1980s, there have been six Fed hiking cycles. Those cycles have lasted about 20 months on average.

So far, we're 13 months into this one, and markets think we have just one hike left.

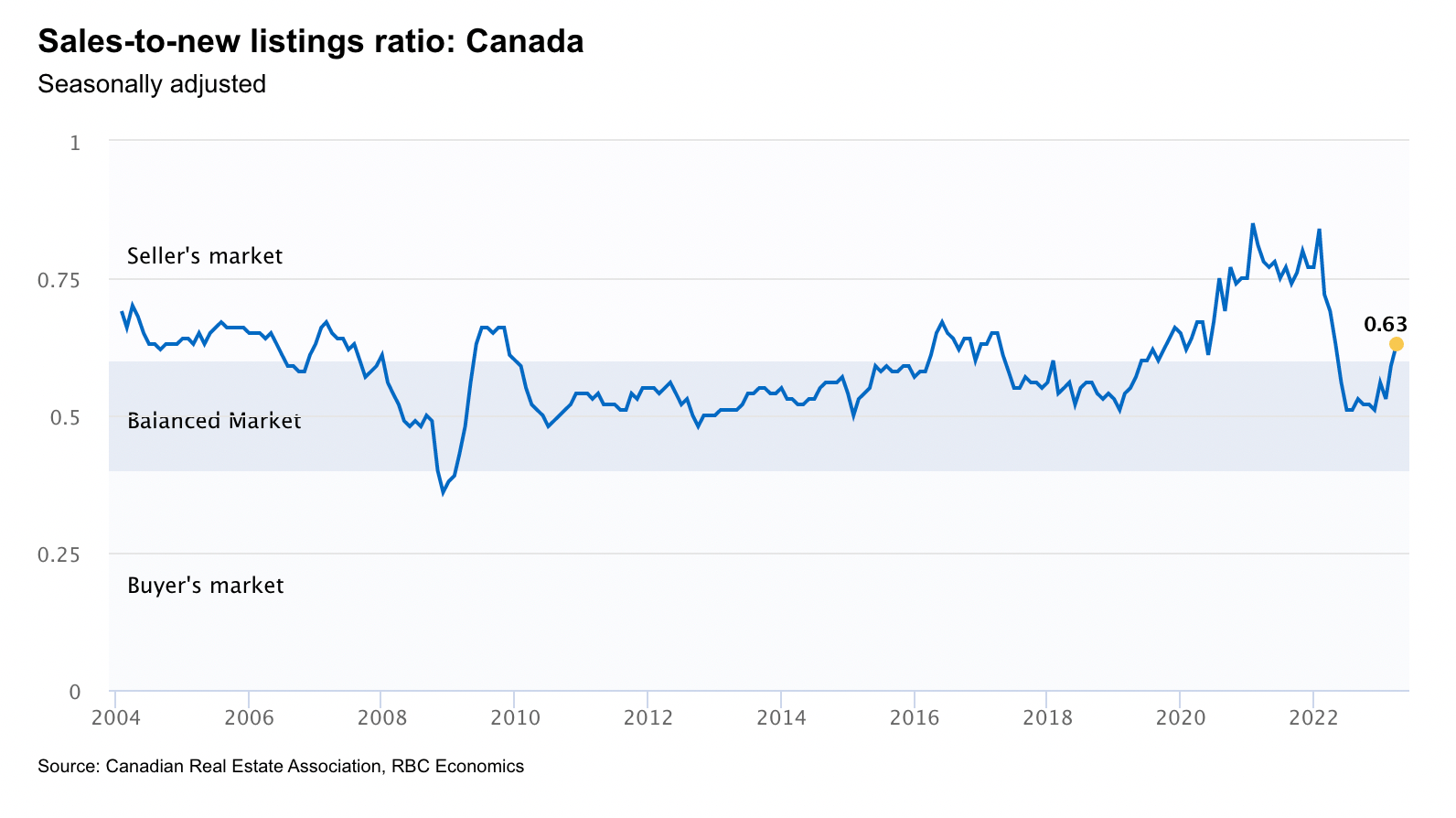

Back to topToday's reports... • Appraisal innovations from ValueConnect • The latest from RateLand (Click links above for stories) This & That * Market turn: Canada's national average home price has increased 12.1% (over $74,000) in just two months. "...The supply issue is still with us," says

(Click links above for stories)

Central bankers are pushing back on 2023 rate cut expectations. And they're succeeding. As of Friday's close, market expectations are now down to just a 4 in 10 chance of BoC easing this year, and only a single 25 bps rate cut at that. Following last

Central bankers are pushing back on 2023 rate cut expectations. And they're succeeding.

As of Friday's close, market expectations are now down to just a 4 in 10 chance of BoC easing this year, and only a single 25 bps rate cut at that. Following last month's Silicon Valley Bank meltdown, markets were pricing in cuts by this summer.

Meanwhile, North American funding costs are running higher. For example, Canada's four-year swap, a leading fixed-rate indicator, is up 44 bps in the last ten days.

Back to topBack in the day, appraisers dealt with only a handful of lenders. Today they deal with dozens. That means appraisers must know far more lender specifications, like how old comparables can be, what sort of comps to use, etc. All these different lender rules boost the chances appraisers will get

Back in the day, appraisers dealt with only a handful of lenders. Today they deal with dozens.

That means appraisers must know far more lender specifications, like how old comparables can be, what sort of comps to use, etc.

All these different lender rules boost the chances appraisers will get something wrong when drafting appraisal reports.

Back to topThe banking regulator's Assistant Superintendent, Tolga Yalkin just spoke at a C.D. Howe Institute event in Toronto. We wanted to pass along some of his quotes (highlighted below) straightaway...

The banking regulator's Assistant Superintendent, Tolga Yalkin just spoke at a C.D. Howe Institute event in Toronto.

We wanted to pass along some of his quotes (highlighted below) straightaway...

Back to top📰ICYMI: For anyone interested in the mortgage broker business, MLN's interview with industry leader Luc Bernard is a must-watch. View now Markets predicted the Bank of Canada would leave its key rate at 4.50%, and it did. "We've come a long way" since

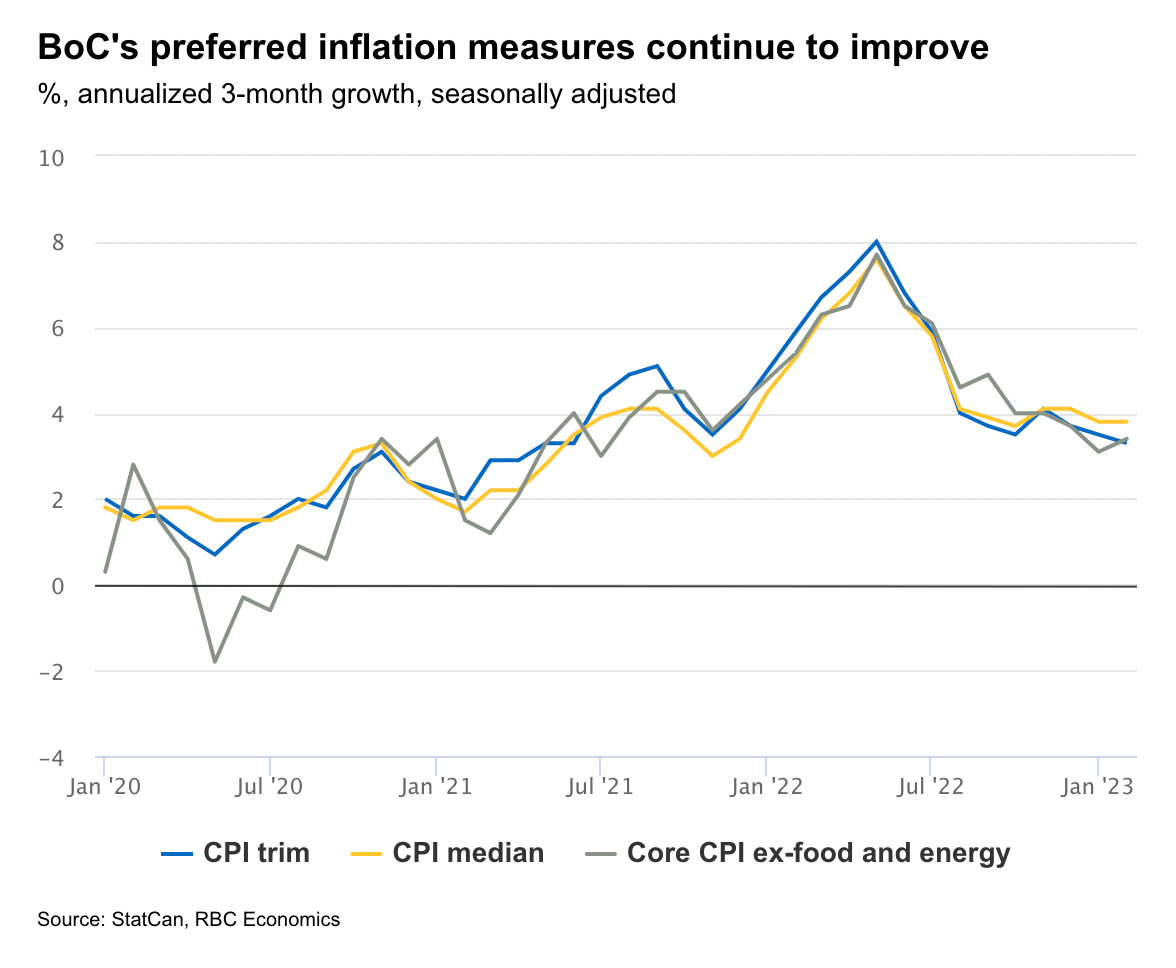

Markets predicted the Bank of Canada would leave its key rate at 4.50%, and it did.

"We've come a long way" since last summer, BoC governor Macklem said today. "We are encouraged inflation is declining..."

What matters most for mortgage rates, however, is not where we've come from, but where we're going. The Bank shared these clues in today's official statement and press conference:

Inflation is falling "mostly for mechanical (arithmetic) reasons," former BoC governor Stephen Poloz told BNN today. For that reason, he expects headline CPI—the metric Canadians care about the most—to have a 2-handle later this year.

Before the Bank of Canada "declares victory," inflation expectations must come down, and they absolutely will in time, Poloz says.

By the way, if Stephen Poloz is not Canada's most informed and sensible monetary economist, we don't know who is. MLN hopes to bring you an interview with him in the not-too-distant future.

"At current interest rates, the share of income spent on interest payments will continue to rise as homeowners renew their mortgages."—BoC

"...Higher debt-servicing costs leave many households with less money for other spending," the Bank explained today. "This slows overall demand growth—which, in turn, relieves price pressures and helps bring down inflation."

Back to top