MLN NewsStream

💡If these bulletins impart a trifle of value in your daily life, your support for CMP's 'Industry Service Provider of the Year' would be sincerely appreciated! CMP accepts nominations here.

Canada's closely-watched 5-year bond yield is suddenly 38 bps higher year-to-date. That's swung bond market sentiment from partly sunny to cloudy in a hurry.

It makes this an opportune moment to dust off an old cliche: rates don't drop in a straight line. We've got to brace for intermittent zig-zags, the o...

Tracy Gomes Lays Out the Blueprint for Scotiabank's Mortgage Future

After almost 18 years, the man who built Scotiabank’s mortgage broker business retired last month. John Webster’s departure and Scotiabank’s pullback from mortgages last year left some wondering how committed the bank was to brokers and rate competitiveness.

To find out, we connected with the person stepping into Webster’s big shoes, Tracy Gomes, Senior Vice President of Real Estate Secured Lending at Scotiabank.

In this important interview, a gracious and transparent Gomes talks about how bro...

Inflation Approaching Make or Break Moment. Mortgagors on Edge

💡Reader note: Stay tuned for tomorrow's MLN exclusive with Scotiabank's new mortgage head, Tracy Gomes. She outlines the bank's broker and digital mortgage plans for 2024.

The Bank of Canada is feeling tension after Tuesday's frustrating inflation data. But economists never expected great things from this report to begin with. Inflation's acceleration last month was as foreseeable as sunrise, mainly because the year-ago comparable was so unfavourable.

It's what happens this quarter that reall...

Yield Curve U-Turn: Mortgage Market Un-Inversion in Progress

Predicting lower rates has become a national pastime. With millions of mortgage shoppers becoming armchair forecasters, rate-cut expectations have led to a higher-than-normal share of Canadians considering short-term mortgages.

Yet, for months, such borrowers have been frustrated by the fact that longer-term rates (e.g., 5-year terms) have fallen much quicker than 1- and 2-year rates. Well, hold on to your toques because there's finally good news on that front....

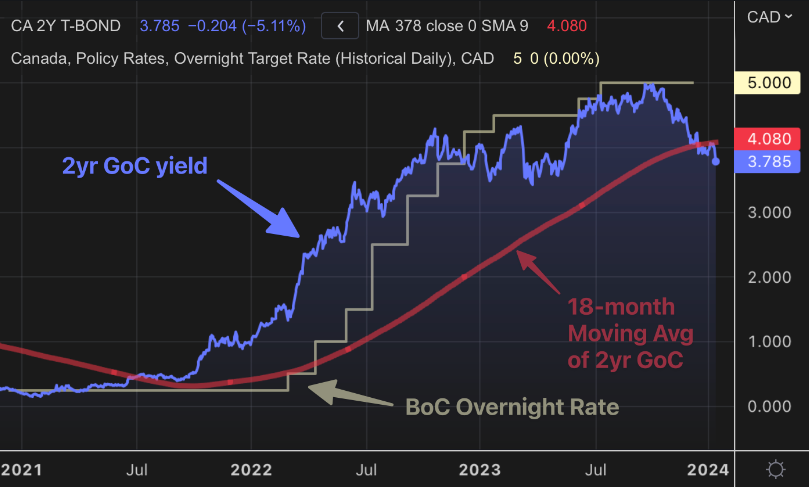

2-Year Bond Yields Dive, Signaling Rate Relief Ahead

Two-year bond traders are going all-in on rate-cut bets. Exhibit A is the following chart. It shows Canada's 2-year yield, a leading indicator for BoC rates. It just made an 8-month low on Friday after failing to rebound above its 18-month average.

To some, technical analysis might seem like financial voodoo, but history doesn't lie. When the 2-year yield undershoots its 18-month moving average without a significant bounce, that's historically been a harbinger of BoC cuts within three to twelve...