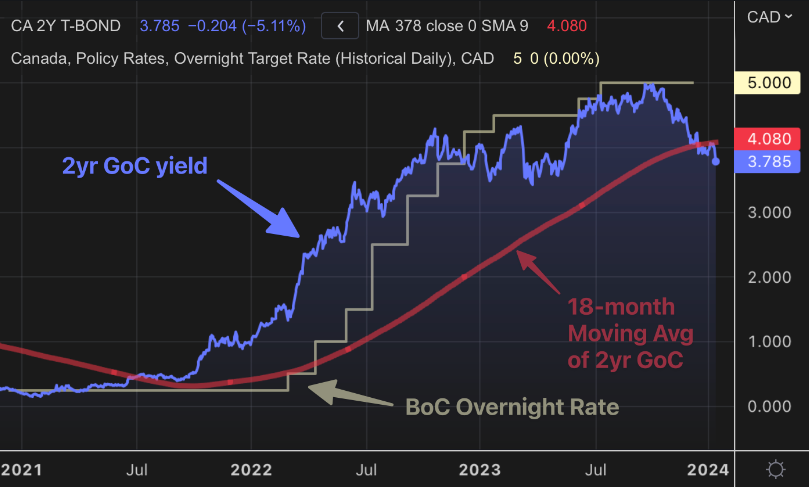

Two-year bond traders are going all-in on rate-cut bets. Exhibit A is the following chart. It shows Canada's 2-year yield, a leading indicator for BoC rates. It just made an 8-month low on Friday after failing to rebound above its 18-month average.

To some, technical analysis might seem like financial voodoo, but history doesn't lie. When the 2-year yield undershoots its 18-month moving average without a significant bounce, that's historically been a harbinger of BoC cuts within three to twelve months.