Avid rate-watchers monitor interest rate spreads all the time. Among other things, spreads help project the likelihood of a recession and the path for interest rates.

A spread, or "term spread," simply refers to the difference in yield between two maturities. For example, the most-quoted term spread is the 10-year-minus-2-year, or "10y-2y" for short.

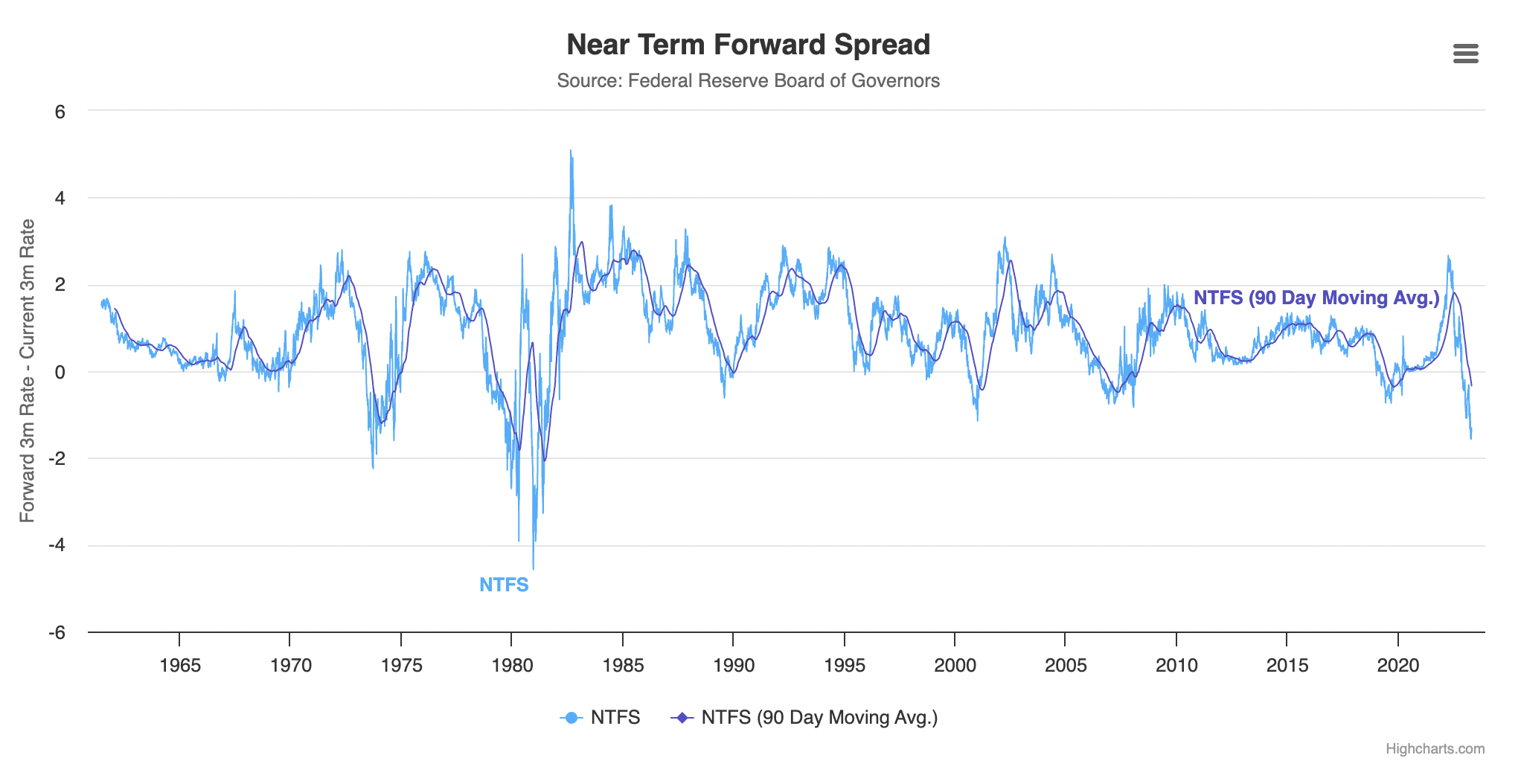

That said, of all the different spreads out there, few are more accurate at predicting recessions than the near-term forward spread (NTFS).

Comments

Sign in or become a MortgageLogic.news member to read and leave comments.

Just enter your email below to get a log in link.