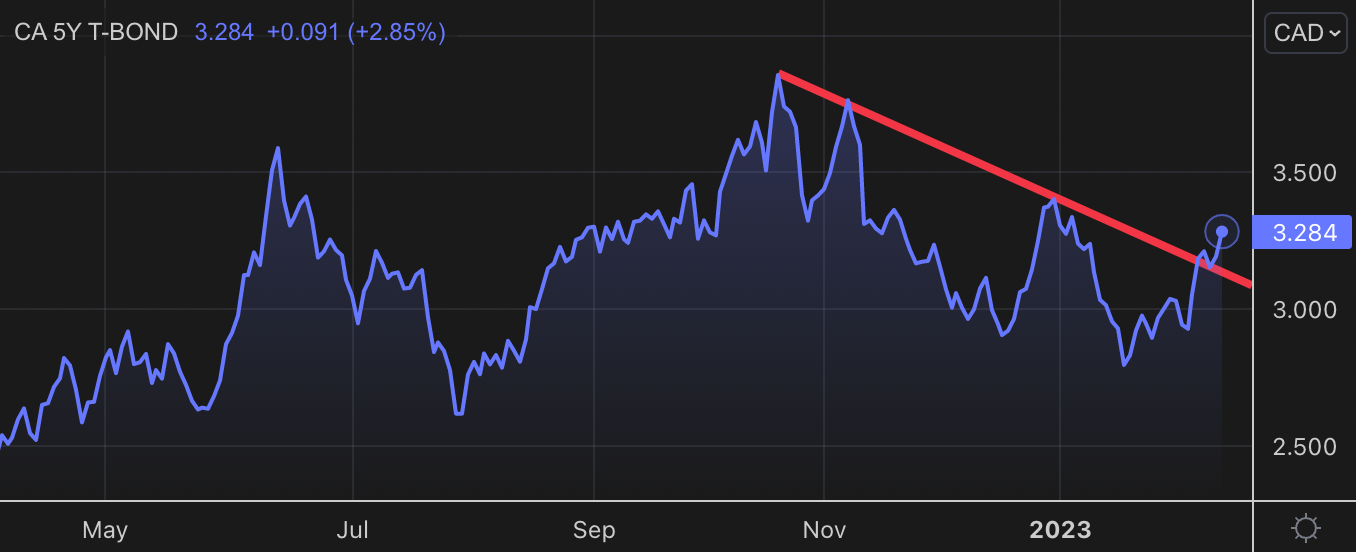

After 11 harrowing months of rate tightening borrowers finally got the news they'd been waiting for. On January 25, the BoC announced it was indefinitely pausing rate hikes and moving to the sidelines.

And make no mistake, this pause was no "transitory" moment. No sir.

This time the BoC is confident (somewhat) that the forward guidance it's feeding us will likely pan out. After all, credibility in central banking relies on doing what you've proposed. The last thing Team Macklem wants this time around is to inadvertently mislead Canadian borrowers — again.

The big money questions are now twofold:

- How long will pause mode last?

- What's the chance that the next BoC move is a hike, not a cut?

Let's take a quick dive into both topics...

You don't have access to this post on MortgageLogic.news at the moment, but if you upgrade your account you'll be able to see the whole thing, as well as all the other posts in the archive! Subscribing only takes a few seconds and will give you immediate access.

This post is for MLN Pro subscribers only

Subscribe now

Back to top