The government’s latest answer to housing unaffordability — giving first-time borrowers more tax breaks to build a down payment — has officially launched.

It’s called the First Home Savings Account (FHSA), and in a nutshell:

- You must be a first-time buyer (FTB), as the feds define it.

- You can save up to $8,000 a year ($40,000 lifetime)

- Contributions to your FHSA are tax-deductible

- Gains and withdrawals are tax-free if used to buy a qualifying principal residence.

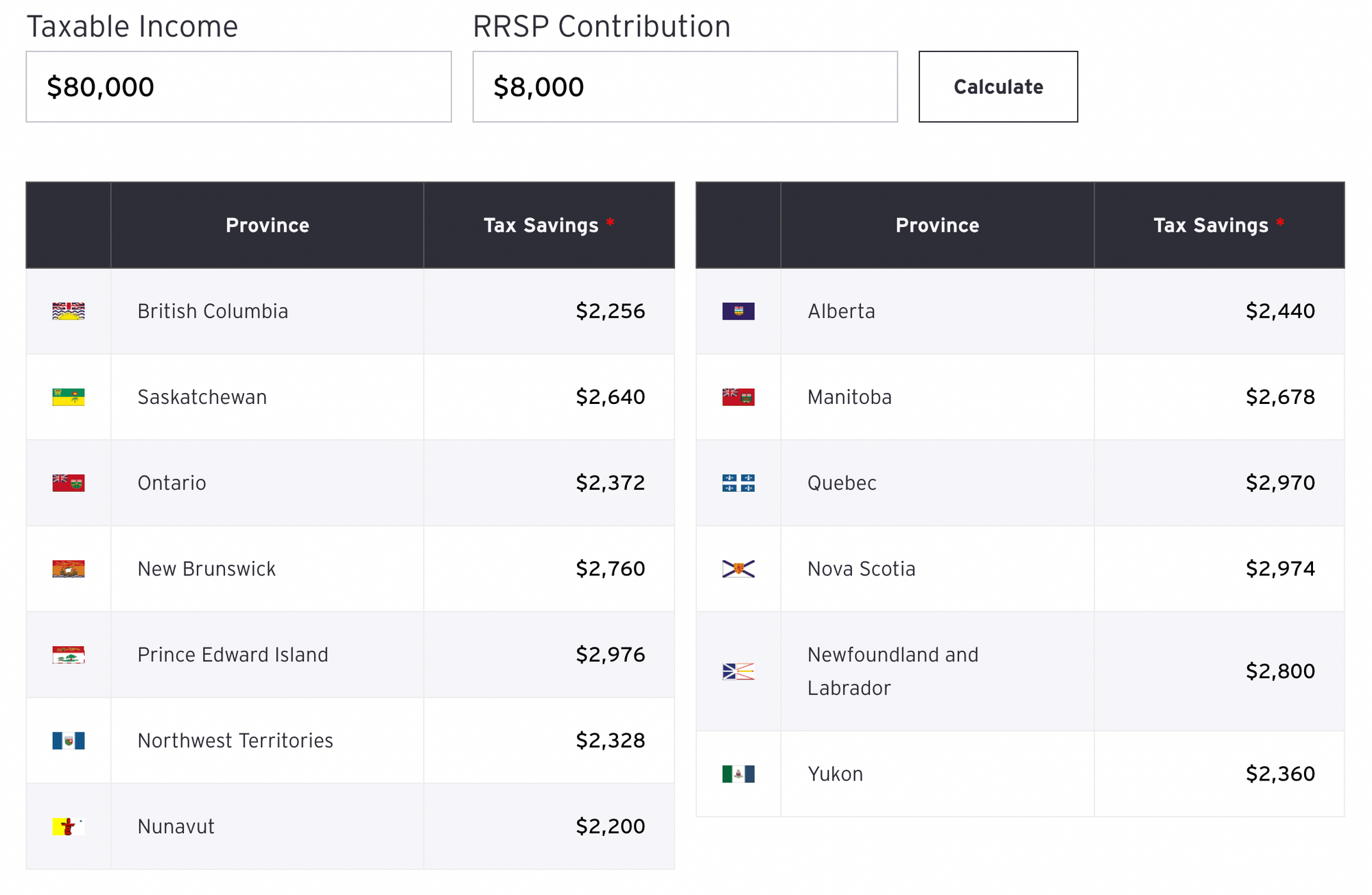

Essentially it's a gift from the tax gods. For someone earning $80,000, for example, deducting $8,000 might save anywhere from $2,200 to $3,000 in tax, depending on the province.

Folks can get a quick and dirty idea of potential tax savings—based on their income—using this EY RRSP contribution calculator.

Note that most financial institutions, including big banks, aren’t live with FHSAs just yet. QuestTrade is one popular exception. It's already accepting new account applications as of today.

Good-to-know points

- Unlike the Home Buyers’ Plan (HBP), FHSA funds need not be repaid

- Non-FTBs can still use one so long as they didn’t live in a home they or their spouse/partner owned in this or the prior four calendar years (i.e., after 2018)

- You can carry over FHSA contribution room to the next year

- Users have 15 years to apply FHSA funds to a home purchase

- Those who don’t buy a home can transfer FHSA funds to an RRSP

- Non-“qualifying withdrawals” are added to your taxable income.

- Unlike an RRSP, you can't deduct contributions made in the first 60 days of the year from your prior year’s income.

- You can use both the FHSA and HBP to buy a qualifying home.

- Two FHSAs can be used to buy a home if both buyers are first-timers.

Here’s CRA's page with complete details.

Strategies & considerations

Due to the extra tax benefit, using an FHSA before an RRSP or TFSA is an easy call for future home buyers.

For parents who want to help their kids own, tax advisor Jamie Golombek suggests gifting children $8,000 a year for their FHSA. That way, their kids can invest and grow savings early on — and enjoy a tax deduction.

FHSA deductions can even be deferred (carried forward) to a future year when you’re in a higher tax bracket, saving even more tax. A similar strategy applies to RRSPs.

Marketing opp

Ottawa doesn’t hand out free money to above-average-income earners very often. So most prospective FTBs who plan to save and buy should jump on this opportunity.

That makes today’s FHSA launch a prime time to contact past and prospective clients. Offering to be a resource and central point of contact for clients with FHSA questions should pay dividends. If you're a mortgage or financial planning professional, a simple informational bulletin celebrating this money-saving opportunity is all it takes—preferably one linking back to your website for more details.

Just make sure to disclaim information as needed so it's not perceived as tax or investment advice. For that, refer to tax and investment professionals or point clients toward public information sources.

Note: MLN members are free to use snippets from this article in their marketing emails, newsletters, social media and websites subject to our own little disclaimer, which is: This is general information that's subject to change. It's provided as-is and is not meant to be advice, including but not limited to tax, legal or investing advice. Caveats apply to some of the points mentioned. Readers should consult a tax professional for guidance applicable to their circumstances.

Comments

Sign in or become a MortgageLogic.news member to read and leave comments.

Just enter your email below to get a log in link.