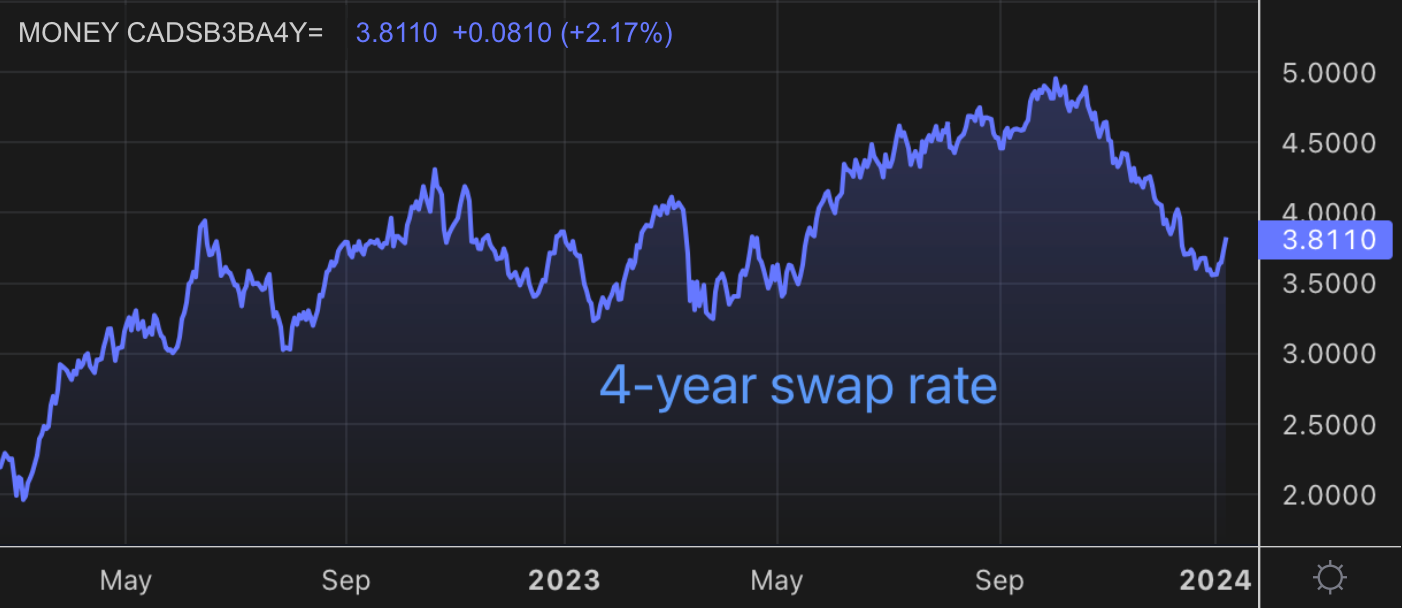

In the last three months of 2023, the 4-year swap rate—a leading indicator of fixed mortgage pricing—plunged 125 bps. The descent trimmed down fixed rates by about 60 bps.

For the average Joe/Josephine getting a new $300,000 mortgage, that means a cool $8,700 that they don't have to fork over in interest over the next five years. It's like finding a forgotten tax refund in your junk drawer.

Now, a 125 bps drop is no small decline, but it's a somewhat typical move when the market thinks rates have peaked. In the short term, however, some say the drop in yields was excessive, and maybe we all overdid it with the confetti and rate cut talk.

Or did we?

Comments

Sign in or become a MortgageLogic.news member to read and leave comments.

Just enter your email below to get a log in link.