Online mortgage marketers have a big problem. It starts with "Goo" and ends with "gle."

Back to topOnline mortgage marketers have a big problem. It starts with "Goo" and ends with "gle."

Online mortgage marketers have a big problem. It starts with "Goo" and ends with "gle."

Online mortgage marketers have a big problem. It starts with "Goo" and ends with "gle."

Back to top💡Also below: • The Latest from RateLand • Value Zone • Equitable's New 3-year ARM Rate • Mortgage Bytes Markets are betting on 2024 rate cuts like they've got insider information. But overconfidence in a position can bite one in the posterior. Mortgage shoppers should all be asking the same

Markets are betting on 2024 rate cuts like they've got insider information.

But overconfidence in a position can bite one in the posterior. Mortgage shoppers should all be asking the same question: What could go wrong?

One thing that could go wrong is inflation snubbing the Bank of Canada's 2.4% year-end forecast.

If y/y CPI hovers in the high 2s or treacherous 3s this year, the probability of sustained rate cuts plummets.

But what could cause such a letdown?

And for the mortgage crowd, what's plan B if rate relief in 2024 doesn't pan out?

Back to topAfter CMHC unceremoniously dumped its First Time Home Buyer Incentive, the future of shared equity down payments came into question. But Ourboro wants people to know that this strategy is very much alive. The shared equity provider just expanded into Ottawa from its present service areas: the GTA (all seven

After CMHC unceremoniously dumped its First Time Home Buyer Incentive, the future of shared equity down payments came into question. But Ourboro wants people to know that this strategy is very much alive.

The shared equity provider just expanded into Ottawa from its present service areas: the GTA (all seven regions of TRREB), Kitchener/Waterloo, Guelph, Hamilton, and London. We're told that other provinces could come within 12-18 months.

The company says it has now closed 100 shared equity deals (worth $80 million). That may not sound like much, but Chief Product Officer Alex Kjorven dubs it "a phenomenal milestone from a proof of concept perspective."

Back to topℹ️See also (below): Deadline looms for Ontario mortgage agents and brokers. Friday's job numbers came rolling in like a pair of dice, and thankfully, the bond market didn't crap out. This month's employment double header showed some sparks, but yields fell nonetheless. The

Friday's job numbers came rolling in like a pair of dice, and thankfully, the bond market didn't crap out. This month's employment double header showed some sparks, but yields fell nonetheless.

In Canada: +40,700 jobs (vs +20,000 consensus); unemployment rose to 5.8% (vs 5.8% consensus); average hourly wages rose 5.0% (vs 5.3% last month).

In the U.S.: +275,000 jobs (vs +200,000 consensus); unemployment climbed to 3.9% (vs 3.7% consensus); average hourly earnings slowed to 4.3% (vs 4.4% last month).

💡This is an updated version of the story published at 10:30 a.m. ET The Bank of Canada, in a non-thriller, kept its key rate static at 5% on Wednesday. Consequently, Canada's benchmark prime rate is still glued at 7.20%, where it has been for eight

The Bank of Canada, in a non-thriller, kept its key rate static at 5% on Wednesday.

Consequently, Canada's benchmark prime rate is still glued at 7.20%, where it has been for eight long months.

The Bank said it's "still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation."

Governor Tiff Macklem said that's true even if "we look beyond shelter," adding that he's factoring in some kind of housing comeback.

Some fretted the BoC would scowl at the peppier-than-expected economy, but Macklem put them at ease. "In the six weeks since our January decision, there have been no big surprises," he assured.

The timing for the first dip in prime rate still boils down to one thing: inflation. Before providing rate relief, the BoC prefers to see both lines in the chart below (Canadian and U.S. inflation) making new cycle lows and dipping meaningfully into the 2% range.

Mortgage brokers are lining up to sign on with BMO, but the bank is taking it slow. A few months into its official channel launch, it's brought on just over 100 brokers. "We're expanding that quickly," says Hassan Pirnia, Head of Personal Lending and

Mortgage brokers are lining up to sign on with BMO, but the bank is taking it slow. A few months into its official channel launch, it's brought on just over 100 brokers.

"We're expanding that quickly," says Hassan Pirnia, Head of Personal Lending and Home Financing at BMO. He assures us the bank isn't playing hard to get with brokers. It's just trying to ensure its processes are bulletproof before ramming through big volumes.

Apart from its broker contract (which one broker called "a bear") and starting fixed rates, the buzz around BMO's offering has been upbeat.

Streetwise Mortgages broker Dalia Barsoum, for example, finds the bank's products quite "investor-friendly"—for four key reasons:

Back to top💡ICYMI: A.I. has put mortgage marketers on notice: Sprint or get sprinted over in 2024. The story. It's not every day the reverse mortgage world gets a shake-up, but Bloom Finance is about to crash the party. After several quarters of development, the company launches its new

It's not every day the reverse mortgage world gets a shake-up, but Bloom Finance is about to crash the party.

After several quarters of development, the company launches its new Bloom Home Equity Prepaid Mastercard this week.

The Bloom card lets 55+ homeowners draw against their equity at will, simply by using a charge card. The product is the first of its kind in Canada—a veritable game changer that cuts interest expense while helping seniors access their home equity on demand.

The product comes from Bloom Finance, a David competing against the Goliath of the reverse mortgage business, HomeEquity Bank — as well as the #2 player, Equitable Bank.

If you're a senior who wants to tap your nest egg more cheaply and efficiently, or you're an advisor dishing out such advice, give the Bloom Card a peek. Here's why...

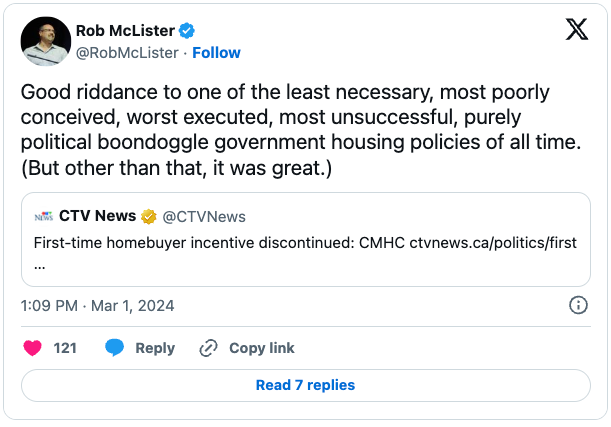

Back to top💡Reader note: The March 1 Rate Simulator update is live with the latest forward rate outlook. Download here. The First Time Home Buyer Incentive was a policy flop, and now, thankfully, it's flopping off the radar. In a sudden change, CMHC announced that the last date for new

The First Time Home Buyer Incentive was a policy flop, and now, thankfully, it's flopping off the radar.

In a sudden change, CMHC announced that the last date for new applications to its shared-equity program is March 21. The housing agency says, "The changes do not impact homebuyers that were already approved for the FTHBI."

If you want a quick summary of our thoughts on this clown car program, the following tweet sums it up. Scroll on for the nitty-gritty.