💡

In brief: It could be a climactic week for rates on multiple levels (the Fed hike, employment reports, banking stresses, etc.). Borrowers needing financing through August should be prepared to lock rates quickly if bond yields spike, although that's not the expectation.

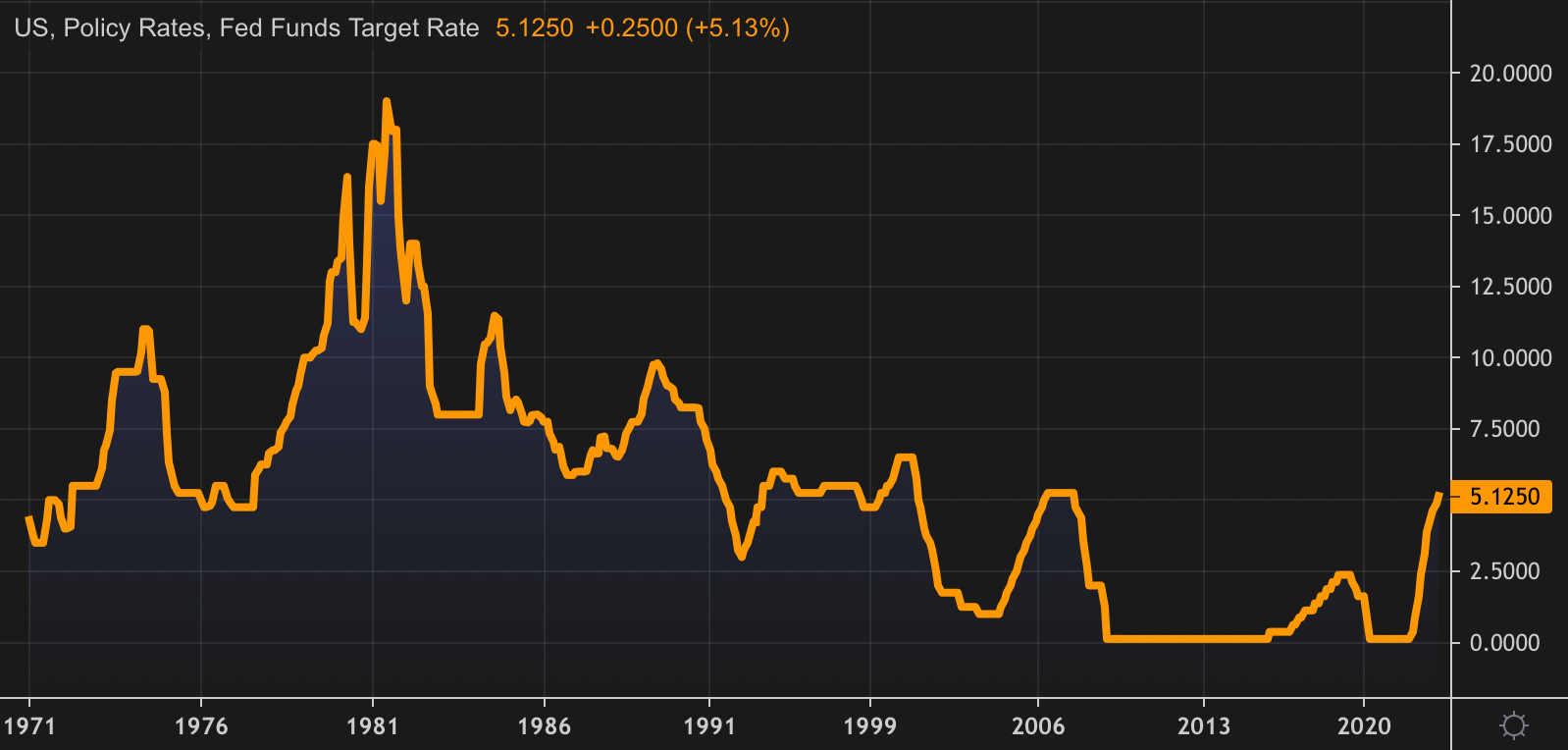

The Fed's likely and much-anticipated 25-bps hike on May 3 is expected to be its last act of tightening this hiking cycle.

If so, it would leave the world's most influential policy rate at the 5.125% peak forecast by the Fed itself in its latest Summary of Economic Projections.

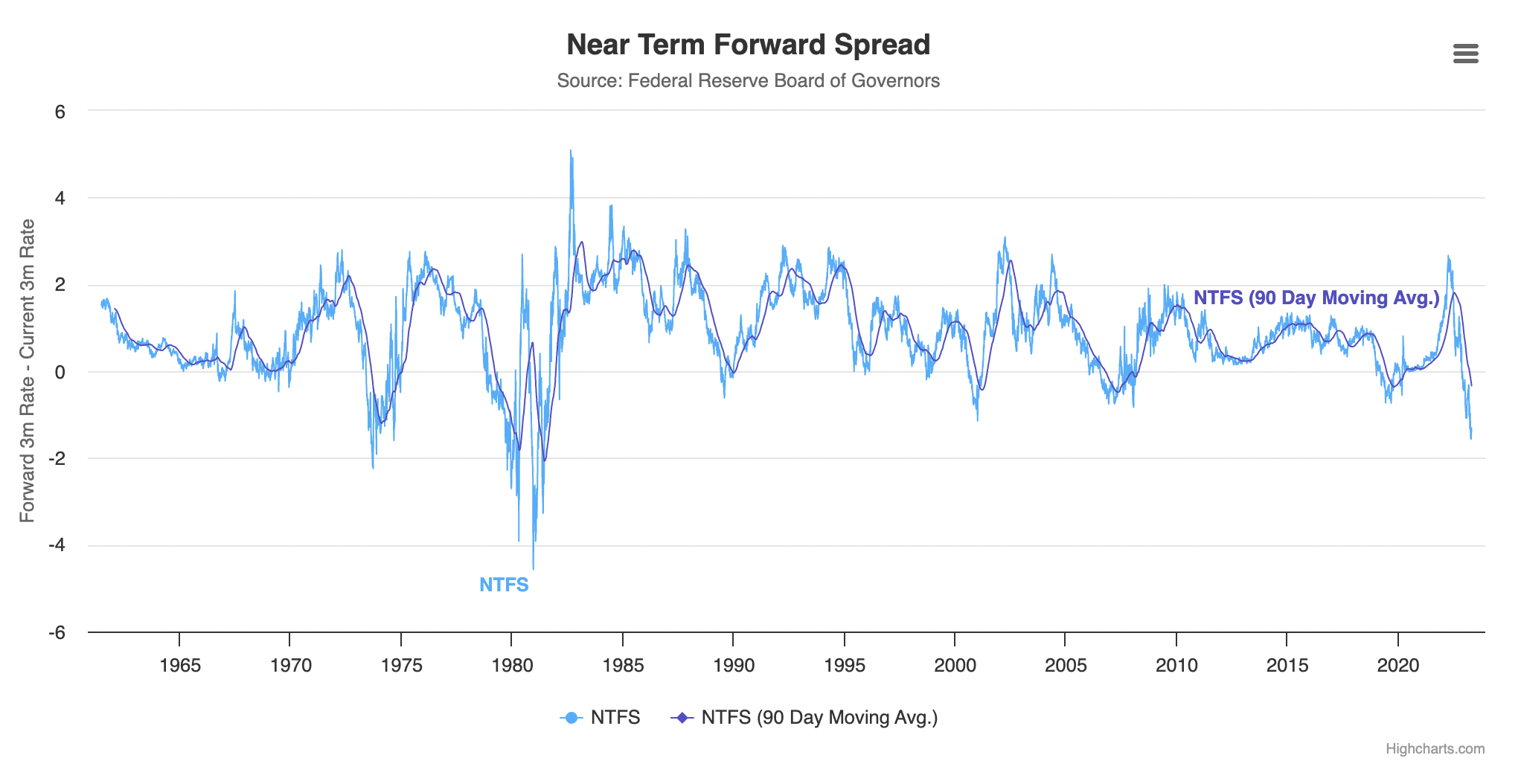

The focus would then shift to speculation on rate-cut timing, and another waiting game would ensue. For the Bank of Canada and Fed to turn dovish at that point, one of two things would have to happen:

You don't have access to this post on MortgageLogic.news at the moment, but if you upgrade your account you'll be able to see the whole thing, as well as all the other posts in the archive! Subscribing only takes a few seconds and will give you immediate access.

This post is for MLN Pro subscribers only

Subscribe now

Back to top