MLN NewsStream

Most in the mortgage broker business saw this coming, but now it's official.

In an email to its brokers on Tuesday, HSBC Canada said that its acquirer—RBC—"will not be entering into new partnerships within the broker channel at this time."

Optimists had crossed their fingers for RBC to take a shot on brokers. After all:...

January Inflation Boosts Summer Rate Cut Hopes

🗞️Also in this edition:

• OSFI on its 2024 Mortgage Tightening Plans

• The Value Zone

• Mortgage Bytes

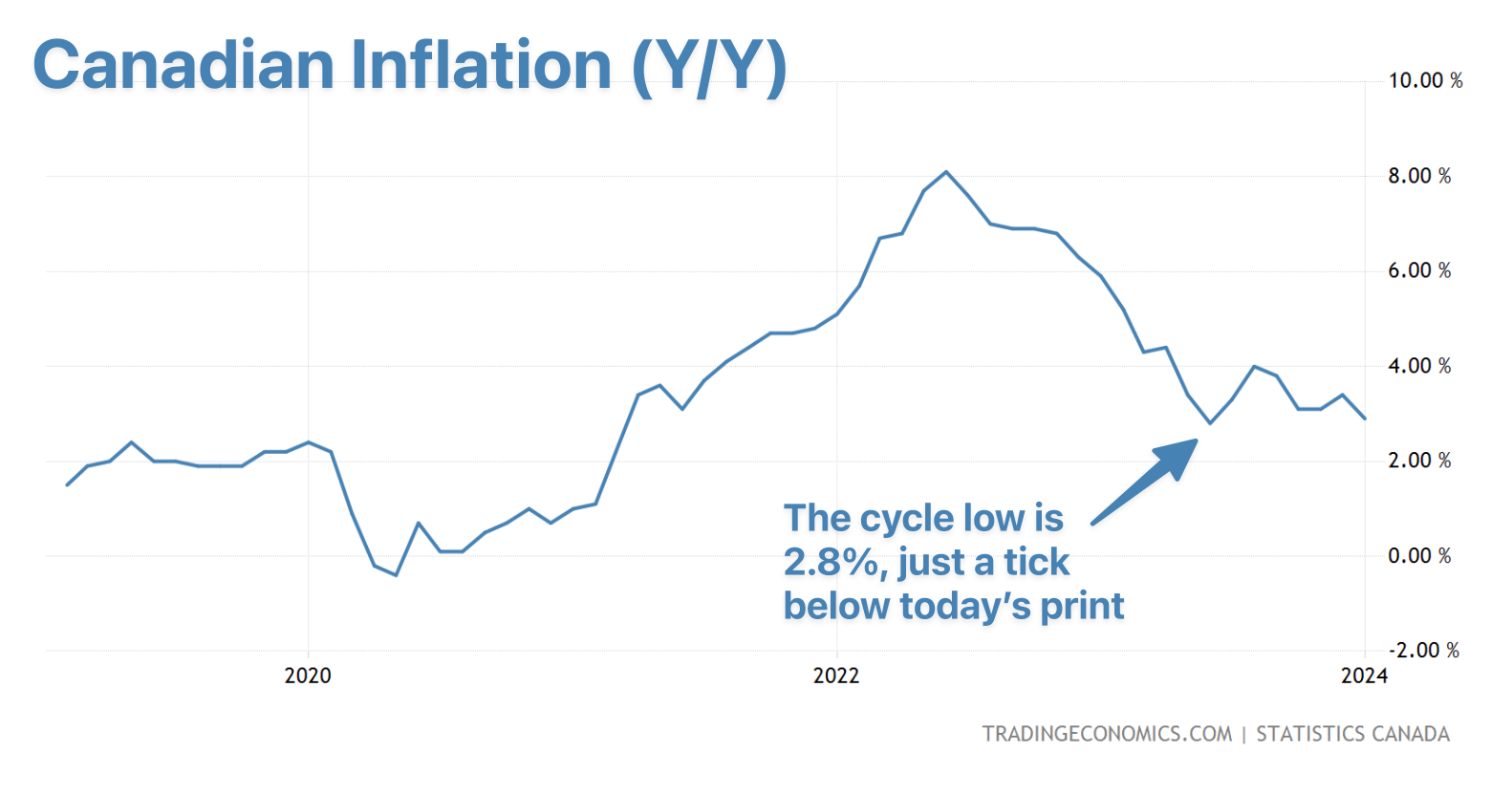

We won't swing from the chandeliers just yet, but the fact is, Canada's mortgage market just got precisely what the doctor ordered—significantly better-than-expected inflation. And it came just in the nick of time, as the rate market was getting jittery.

Here's the latest CPI report card from StatsCan:

• Y/Y inflation: 2.9% (vs. 3.3% est. & 3.4% prev.)

• M/M inflation: 0.0% (vs. 0.4% est. &...

Will Winter Homebuyers' Bets Pay Off?

⏩The short of it: Thousands of Canadians are choosing to pay higher rates to buy before demand picks up. Are they financial visionaries?

Scotiabank Economists expected that winter homebuyers would try to snatch up homes at the lowest possible price – before expected rate cuts.

But they didn't expect it to happen this soon.

Wagering that rate cuts eventually lead to "an uptick in activity and prices" is a "reasonable bet on the part of buyers," wrote Farah Omran, Scotiabank Senior Economist, o...

Government's Short-Term Rental Clampdown Could Cost Landlords Big Time: Opinion

The Liberal government's jihad against short-term rentals (STRs) is hitting landlords' wallets harder than a surprise tax audit — particularly landlords who convert their short-term rentals to long-term rentals.

Some of you may have seen this post on X:...

The Bond Boogeyman May Be Less Scary Than We Think for Canada's Spring Market

Higher yields are spawning ominous headlines like: "Canadian Bond Yields Surge, Mortgage Costs To Climb Ahead of Spring Market."

It sounds like a cliffhanger, but the reality is less sensational. At this point, there's no clear indication that rates will shoot up enough to derail the spring market. Here's why....