🗞️

Also in this edition:

• OSFI on its 2024 Mortgage Tightening Plans

• The Value Zone

• Mortgage Bytes

• OSFI on its 2024 Mortgage Tightening Plans

• The Value Zone

• Mortgage Bytes

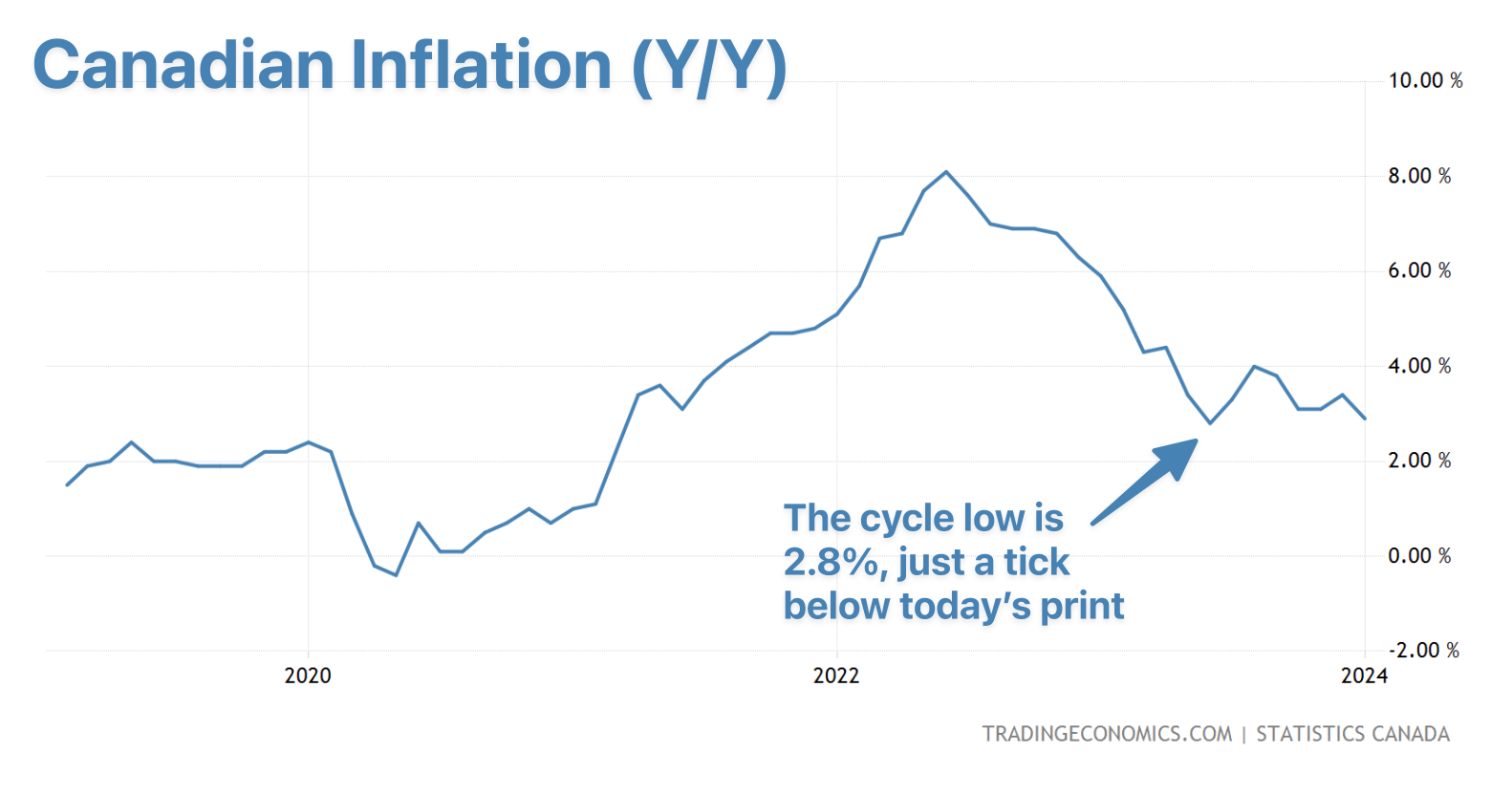

We won't swing from the chandeliers just yet, but the fact is, Canada's mortgage market just got precisely what the doctor ordered—significantly better-than-expected inflation. And it came just in the nick of time, as the rate market was getting jittery.

Here's the latest CPI report card from StatsCan:

• Y/Y inflation: 2.9% (vs. 3.3% est. & 3.4% prev.)

• M/M inflation: 0.0% (vs. 0.4% est. & -0.3% prev.)

• Avg core inflation: 3.35% (vs 3.6% est. & 3.6% prev.)

BoC rate hikes are providing much of the air that keeps inflation pumped up. Strip out mortgage interest from the calculation, and inflation is hitting the bullseye at 2%.

💡

"The difference between annual headline CPI (2.9%) and shelter inflation (6.2%) is now at a its widest level since 1982," says National Bank.