MLN NewsStream

What we're staring at above is Canada's 5-year yield, which cascaded 72 bps in just 29 days. It's the first time we've closed under 3% since May 2023.

Yield drops like this are as common as a one-handed economist, and multiple factors are fueling the tailspin:...

How to Pitch the New 30-Year Insured Amortizations

Effective today, 30-year amortizations are back for high-ratio borrowers. It's their first sighting since going extinct in 2012.

Given that 30-year insured ams. are exclusive to newbie buyers purchasing freshly-built homes, many mortgage originators are wondering, "How can I effectively promote this program?"

Below are eight tactics to help do just that—and fire up your insured purchase business:...

How the BoC Fuels the Fire It Fights

The purpose of higher policy interest rates is to lower inflation. But when the Bank of Canada hikes rates, it also pumps up the single biggest driver of inflation: mortgage interest costs.

Essentially, the Bank is keeping inflation 'inflated' because of its very own actions. If Alanis Morissette wrote a song about this, it would probably be called 'Ironic.'

Unlike most of its global peers, the Bank of Canada lets mortgage interest costs directly influence the consumer price index it targets....

How Home Trust and Equitable Bank Help Salaried Non-Prime Borrowers Seize Investment Opportunities

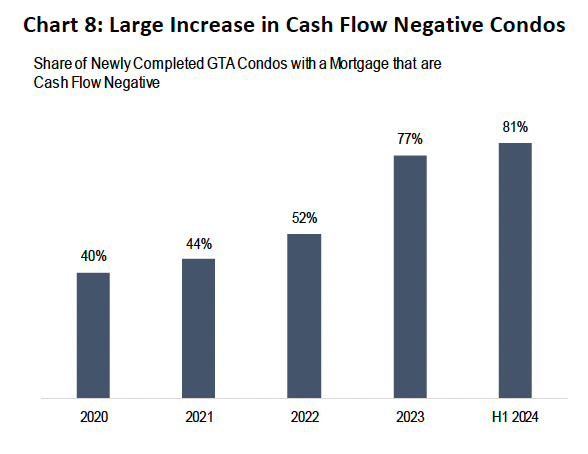

Even with today's lowest "A" lender rates, getting positive cash flow out of most new rentals is like milking a stone. And, it gets that much harder when you borrow at non-prime rates north of 6%.

That's partly why elevated rates are hammering investor-heavy pockets of Canadian real estate (case in point: Toronto condos).

The bad news is that people are starting to dump Toronto condos like stolen goods. The good news is that opportunities will come of it. History shows that when Canadian housi...

Navigating Canada’s Freshly Cut Rate Landscape

Canada's rate outlook shifted a bit after Wednesday's BoC rate cut, and that shift benefits rate floaters.

To paint the picture, here's a hot-off-the-press chart of the forward rate outlook from CanDeal DNA....