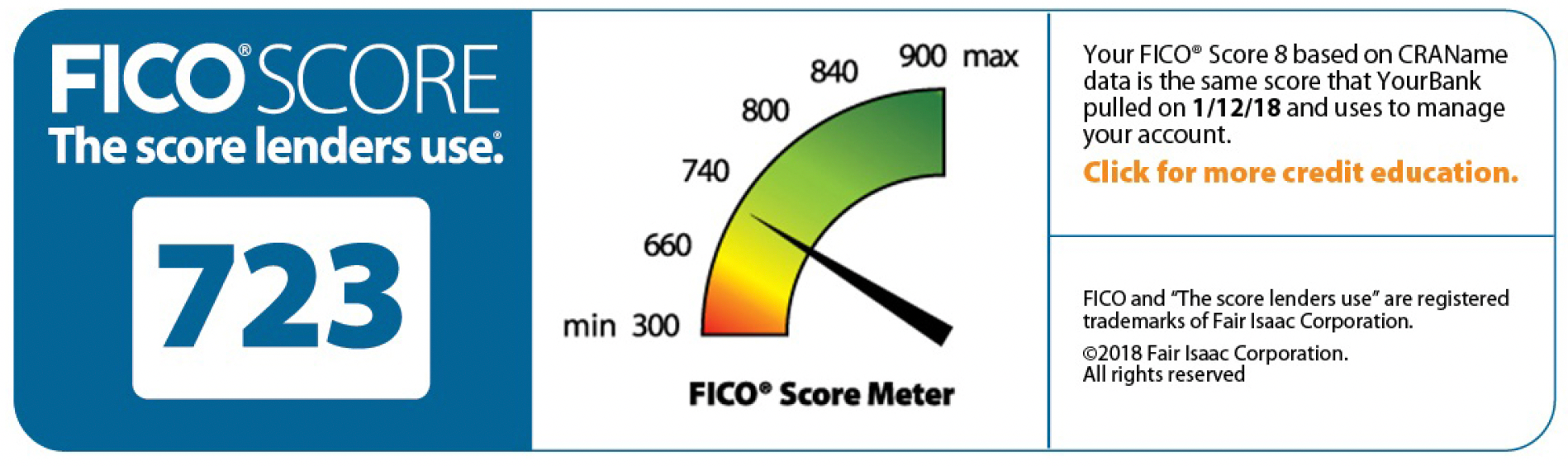

"Many of the credit scores shared with consumers today in Canada are not the scores being used to make lending decisions," says credit analytics firm, FICO.

As a result, mortgage applicants who are declined because of a low score are often perplexed when their free score is higher.

U.S.-based FICO is hoping to address this and ramp up its Canadian visibility at the same time. The company now allows Canadian mortgage lenders and brokerages to distribute its scores to consumers. It costs nothing apart from the regular fee the provider pays to pull the credit score.

Comments

Sign in or become a MortgageLogic.news member to read and leave comments.

Just enter your email below to get a log in link.