Canada's inflation rate landed precisely where the consensus thought: 3.4%. That's down 1%-point from the 4.4% print last month.

While Bay Street expected it, most laypeople didn't. That's key. Inflation is now in the 3's for the first time in 22 months. That's a significant relief from 8.1% last June. If consumers believe CPI is dropping this fast, they're less prone to aggravate inflation by front-running purchases and demanding higher pay.

Here's the highlight reel from today's report:

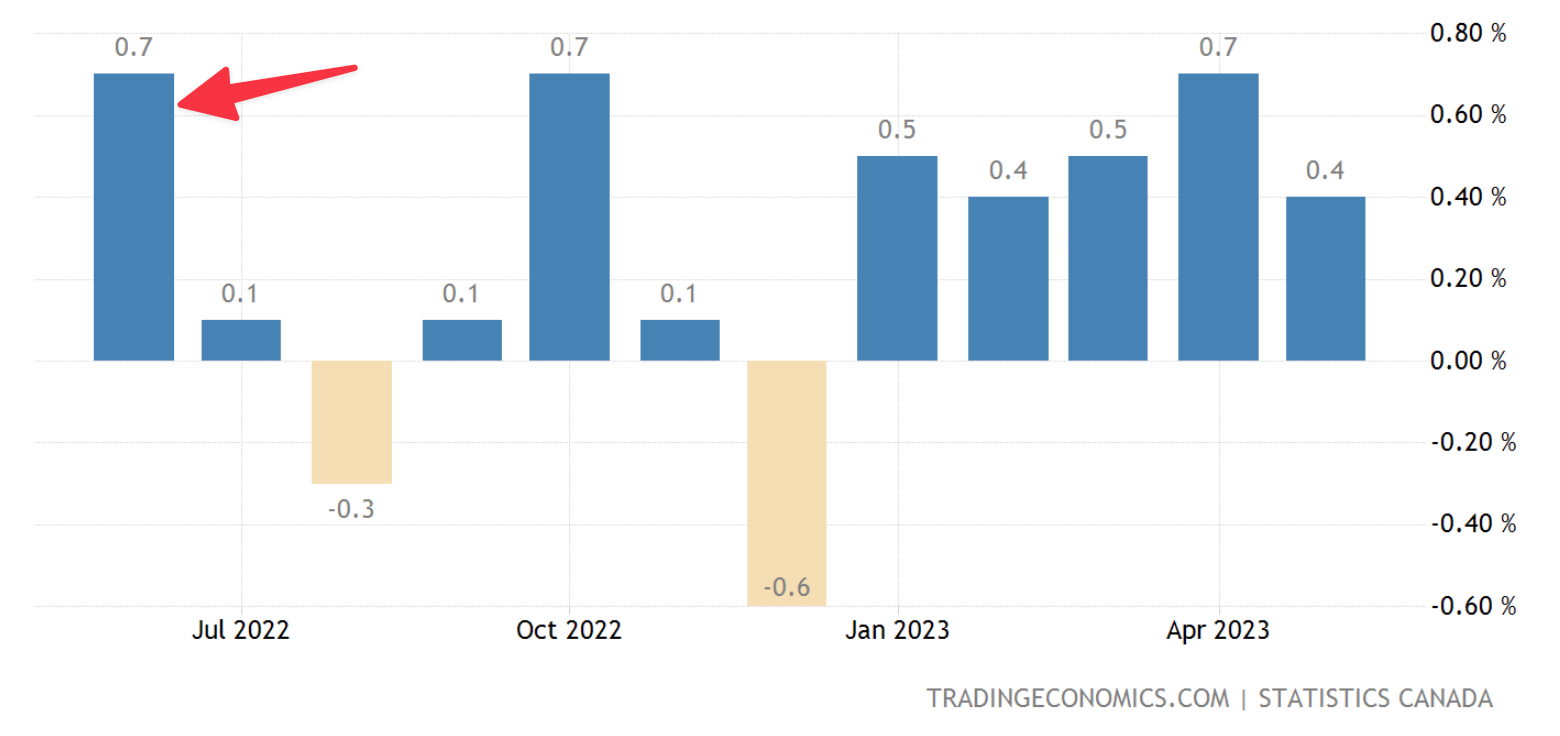

- CPI increased a scant 0.1% m/m, so it wasn't all about base effects this time.

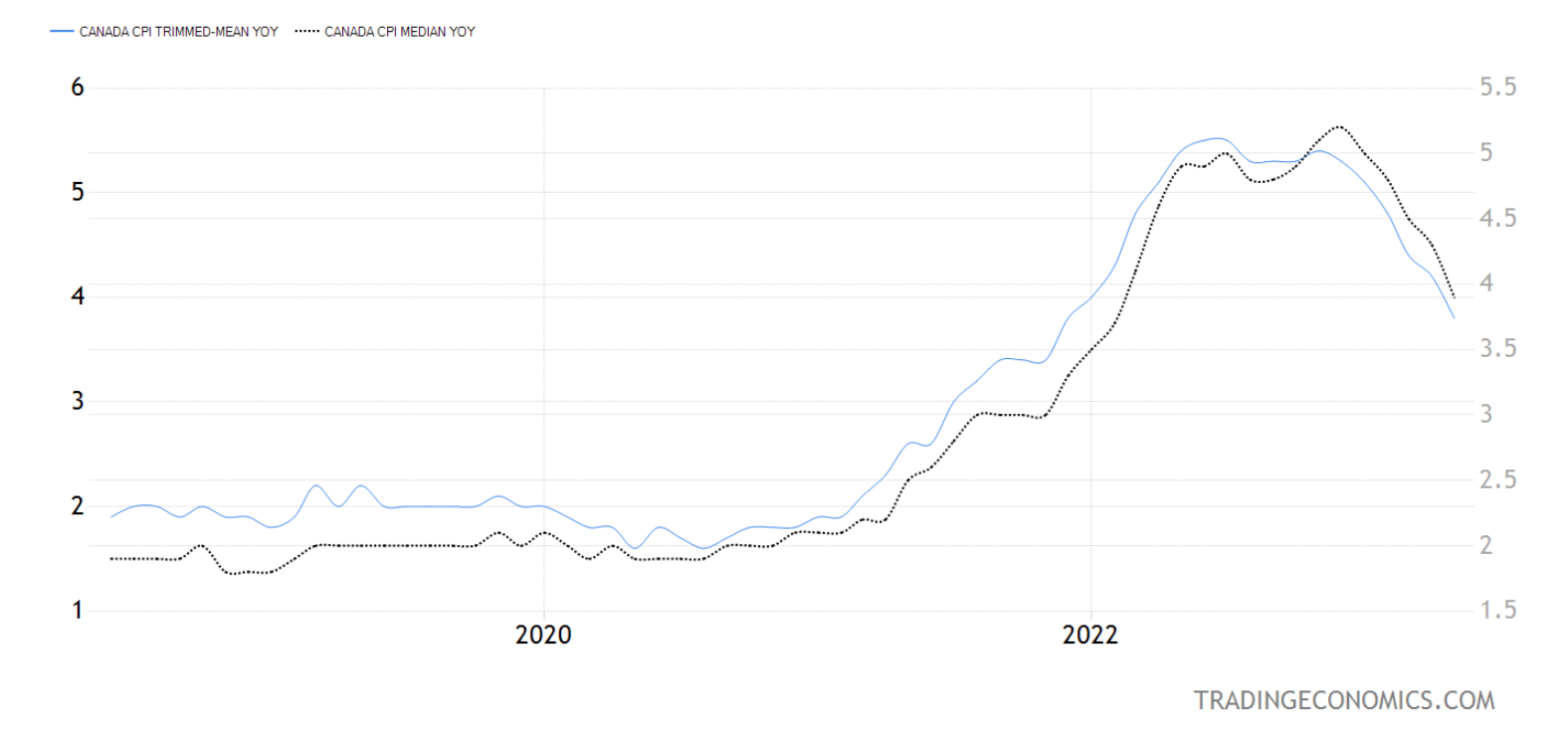

- Core inflation finally dipped below 4%, with the BoC's two main measures easing to 3.9% annualized on average (+0.2% m/m).

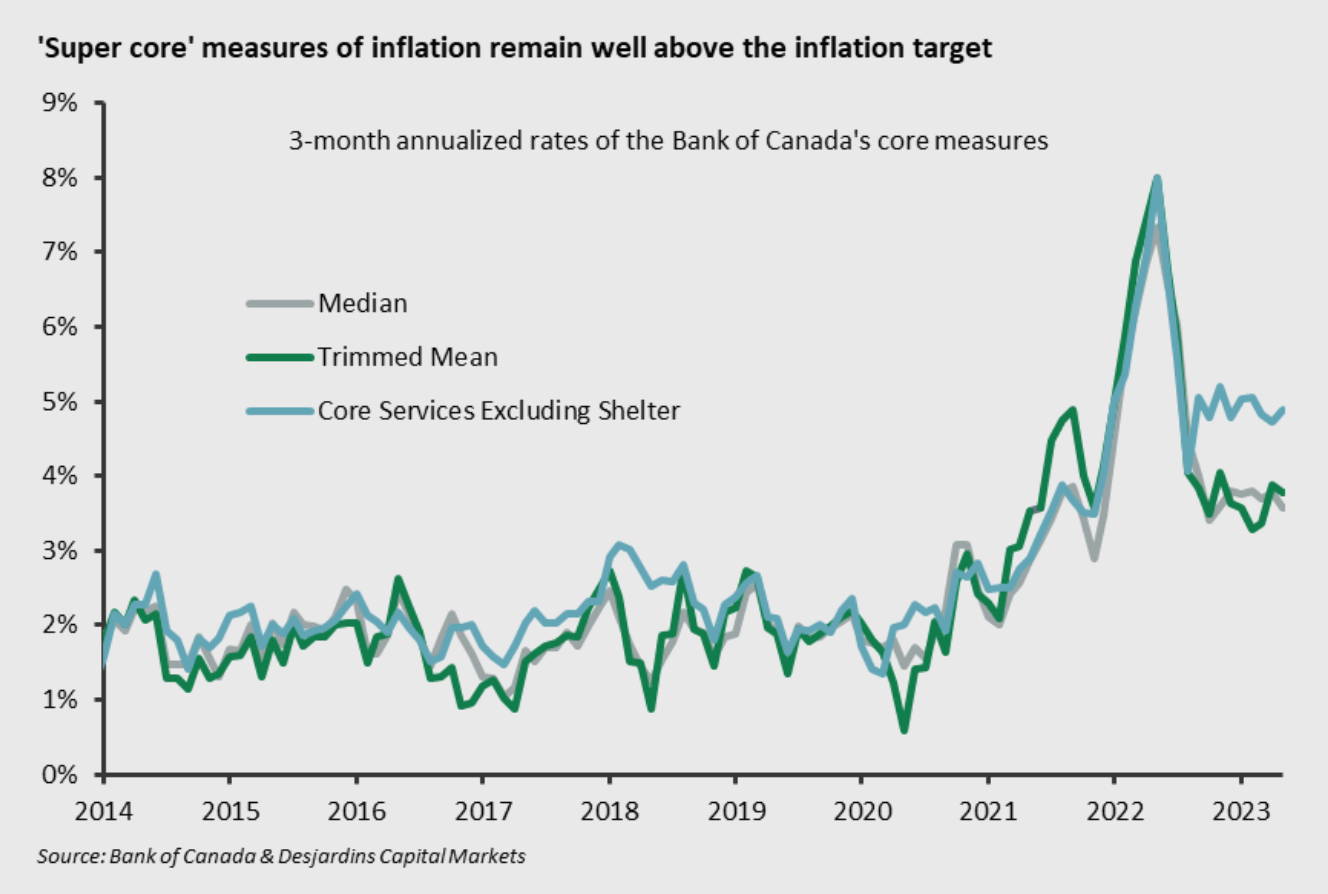

- The BoC's favoured 3-month core measure slowed 20 bps to 3.6%. That's meaningful progress, but 3.6% is still not 2.0%.

- One sobering stat was 3-month "core services excluding shelter"—a measure the BoC has grown fond of this year. It went the wrong way, accelerating 20 bps to 4.9%.

- We have one more easy comp (June 2022's 0.7% m/m print), and then comparables get tougher for a while—so tough they could slow CPI's progress until the January report in February 2024.

- The mortgage interest cost index—3.8% of the CPI basket—jumped almost 30% (+29.9%). It was the "largest contributor to the year-over-year CPI increase," said StatsCan. The agency was quick to point out that "Excluding mortgage interest cost, the CPI rose 2.5% in May, following a 3.7% increase in April.” Now, guess who influences mortgage costs the most in this country. That's right, the people fueling this index are the same people who need CPI lower.

- Various economists today are now reaffirming their view for sub-3% headline inflation before year-end, potentially even next month.

- Odds are, Tiff & Co. will whack borrowers once more. #OIS# probability is 57% for another hike on July 12, but let's see how employment data shakes out next week. Implied chances of an additional hike before year-end fell to 1 in 3 after today's CPI.

- Desjardins Economics rate analyst Royce Mendes, one of the least wishy-washy guys in the talking heads business, summed up the BoC's stance as:

"With measures of recent price growth continuing to run above 3 ½%, it looks almost like a done deal that the Bank of Canada will raise rates another 25bps in July." - Canada's 5-year yield was down one bps as of 10:30 a.m. ET today, despite the U.S. 5-year being up five bps. If the July 7 jobs report shows worsening unemployment and we get no more hawkish developments out of the U.S. through next week, there's still a chance 2023 5-year yields could top out below last October's high.