For weeks, we've been a Debbie Downer—warning that today's inflation report promised more frights than a Stephen King novel. And man, did StatsCan deliver a shocker.

Year-over-year inflation comparables and rocketing oil prices set us up for a doozy. But these numbers aren’t just bad; they're more like 'take your lunch money, give you a wedgie and swipe left on your Tinder profile' kind of bad.

Canada's not-so-hidden inflation dragon has re-emerged from its cave—breathing fire at 4%. Here are the sriracha-hot details:

- Annual inflation: 4.0%, up from July's 3.3% (consensus: 3.8%)

- Monthly inflation: Up 0.4% (consensus: 0.2%)

- Average core inflation (y/y): 4.0% vs. 3.75% in July

- Average core inflation (3-month): 4.5% vs. 3.5% in July

One key culprit this month was crude oil, which is high-stepping to a new 11-month high near $93/bbl. Technical analysis suggests potential continuation to at least $95+, barring contrary news.

Mortgage interest costs and rent were also a driver. But, that "is partly the lagged reaction to the Bank’s rate hikes in June and July, so shelter price growth will soon slow," says Capital Economics. In large part, the BoC is looking right through mortgage interest costs, a catalyst of their own doing.

What keeps the BoC most on the edge of their boardroom chairs are the core readings — especially the 3-month ones. And, "Previously, the Bank had been concerned that underlying trends looked like they were stuck around 3.5%," reported BMO Economics today. That view "now seems almost quaint."

Market reaction

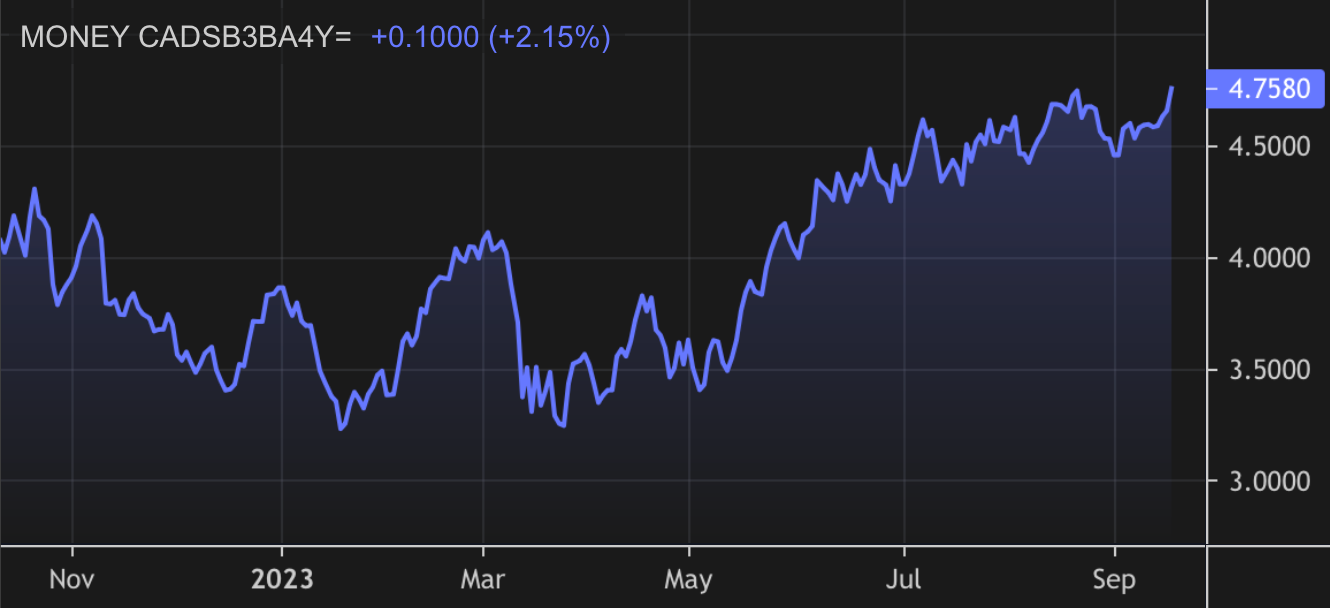

Canada's 4-year swap rate—a short-term leading indicator for fixed mortgage rates—is surging. It's up 10 bps as this is being written.

Chances of an October 25 BoC hike have doubled to 41%, with another hike now fully priced in by Q1 of 2024. But if we do get another 25 bps BoC bump, it'll likely be sooner.

Cuts are once again entirely off the board in the next 12 months—as this #OIS#-implied rate table below from Refinitiv Eikon illustrates.

Comments

Sign in or become a MortgageLogic.news member to read and leave comments.

Just enter your email below to get a log in link.