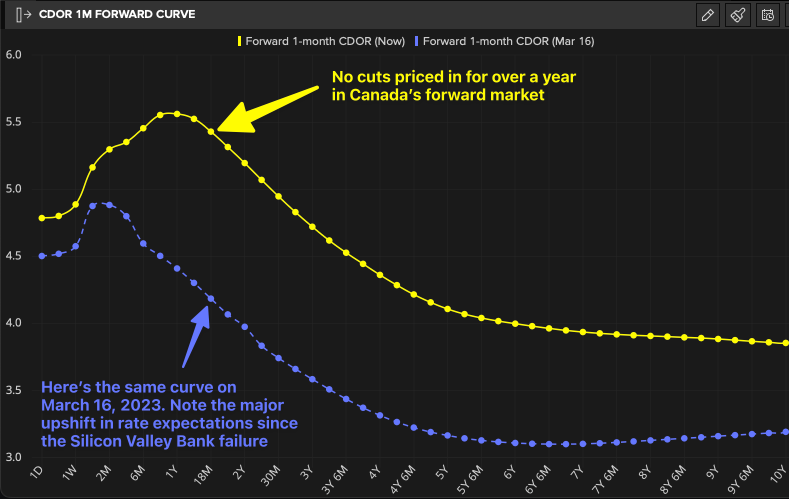

The chart above shows how much Canada's roller coaster rate outlook has changed in just 90 days.

The purple line shows the Bank of Canada cuts that were expected this year, just after the Silicon Valley Bank drama in March.

The yellow line shows where the market now thinks the BoC is headed, give or take.

We still get cuts either way, barring an external inflationary shock. It's just that now we have to wait longer for them. On top of that, investors now believe the average implied BoC rate over the next five years will be 104 bps higher than they thought in March.