Interest rate commentators have long relied on overnight index swaps (#OIS#) and forward markets to crystal ball rate direction. Now, with CORRA elbowing CDOR aside as Canada's financial benchmark rate, some of those forecasting tools are going the way of the floppy disk.

That's led MLN on a hunt for a more effective rate indicator, and we recently found one in the brand new CORRA forecast curve.

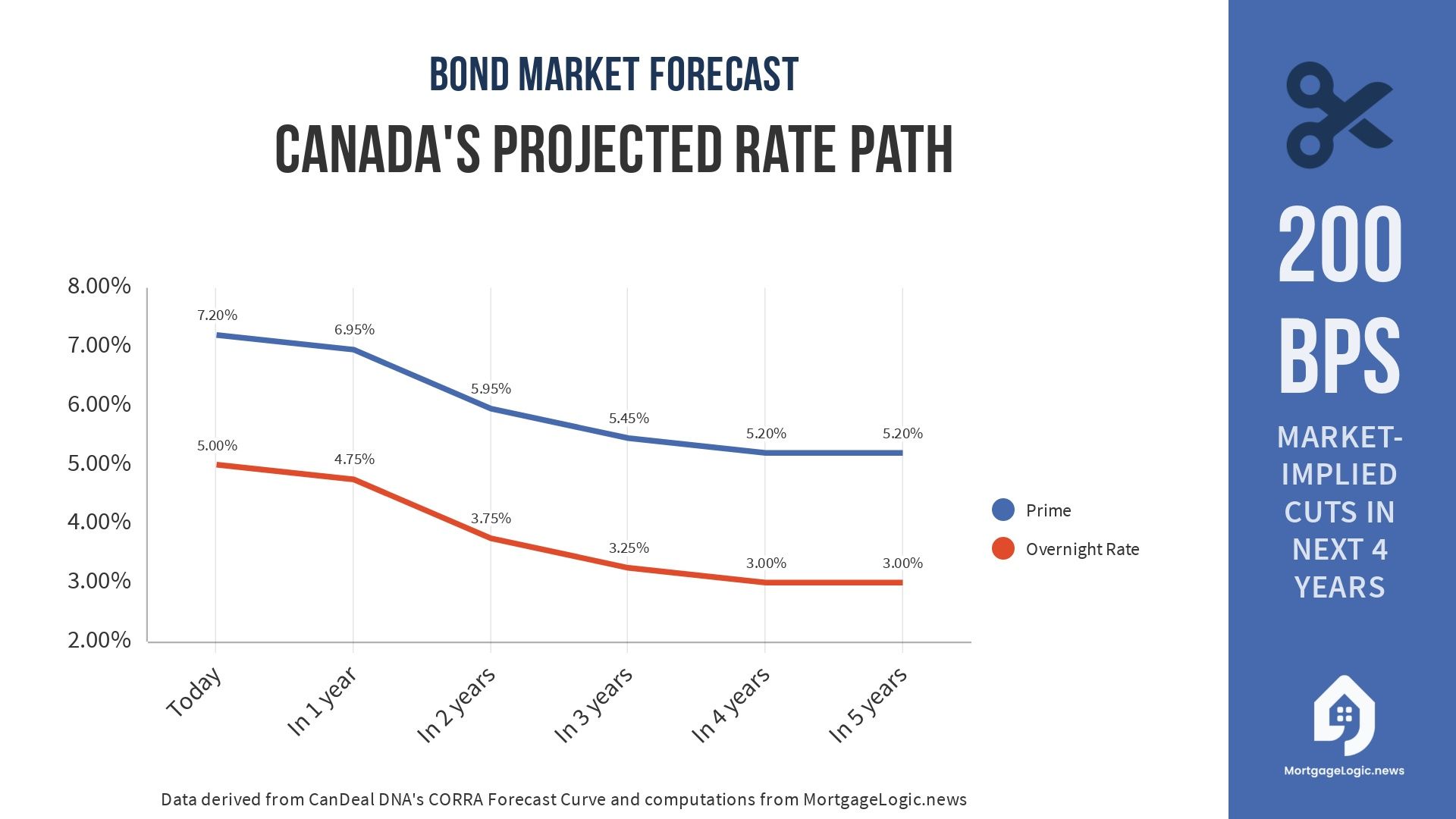

Published exclusively by CanDeal DNA, the leading provider of valuations for Canada's fixed-income market, the CORRA forecast curve reflects bets from institutional traders on where the Bank of Canada will take its key lending rate over the next five years. It'll be the basis for MortgageLogic.news' weekly long-range outlooks, as well as the default rates in MLN's exclusive amortization simulator.

Despite the massive variability in any market rate forecast beyond 6-12 months, this new tool should improve forecast accuracy and get better over time (as liquidity builds in its underlying derivatives).

For MLN subscribers, it's a secret sauce for cooking up more realistic hypothetical mortgage scenarios, without the usual dash of wishful thinking.

Here's why the CORRA forecast is a step up from prior projection tools and what it's forecasting now.