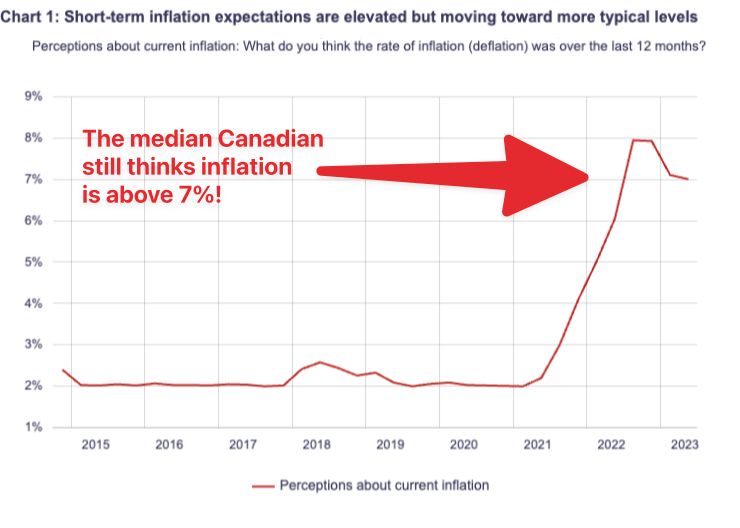

Typical Canadians think inflation is dramatically higher than it is. That's a problem when you're a central bank trying to convince people you're bringing inflation back to 2%.

The bank's latest data also reveal that both consumers and businesses expect inflation to remain almost double the target two years from now.

It's enough to make you want to crush inflation expectations with another hike next week. And that's exactly what Team Macklem may do.

The latest #OIS# pricing implies a 54% hike probability for the July 12 meeting. And that may be low given limited improvements in the BoC's areas of concern: "excess demand, inflation expectations, wage growth and corporate pricing behaviour." Albeit, Friday's crucial jobs data could trump all of that.

The BoC's closely watched consumer survey was a mixed bag in other respects:

See end of story for mortgage implications.