Mortgage research is changing under our feet.

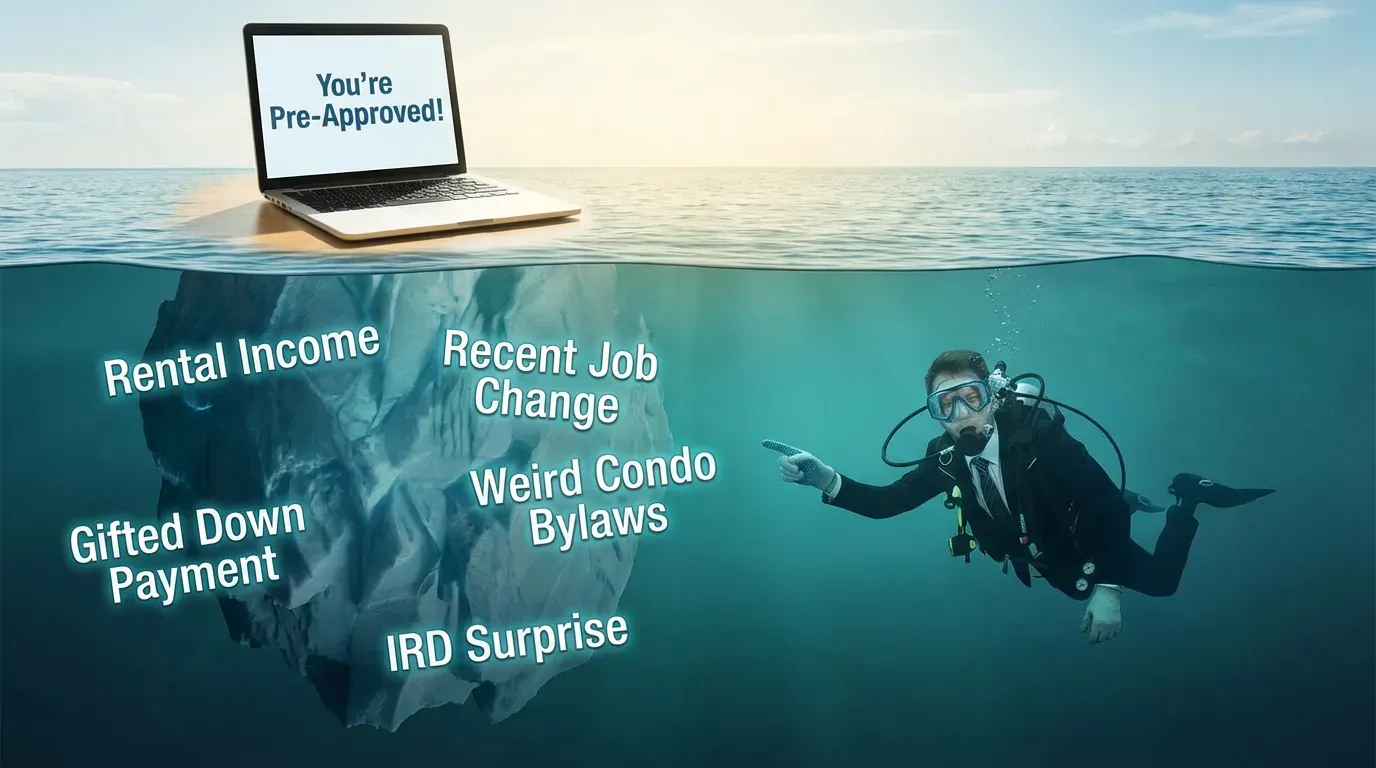

AI tools like ChatGPT now serve up instant, authoritative-sounding answers on rates, qualification rules, and product options before anyone even thinks about calling a broker or lender.

A recent Psychology Today article warns that when coherent answers are this easy to get, people may be more inclined to rely on them — rather than engage in the harder, more time-consuming work of developing a deeper understanding.

For mortgage originators, this creates both a challenge and an opportunity, and recognizing it is the difference between adapting to the AI era and watching it adapt around you.

ℹ️

Building strategies to counter this trend sits at the centre of our mission at MLN because AI carries existential consequences for those who assume it’s a passing fad or slow-moving trend.