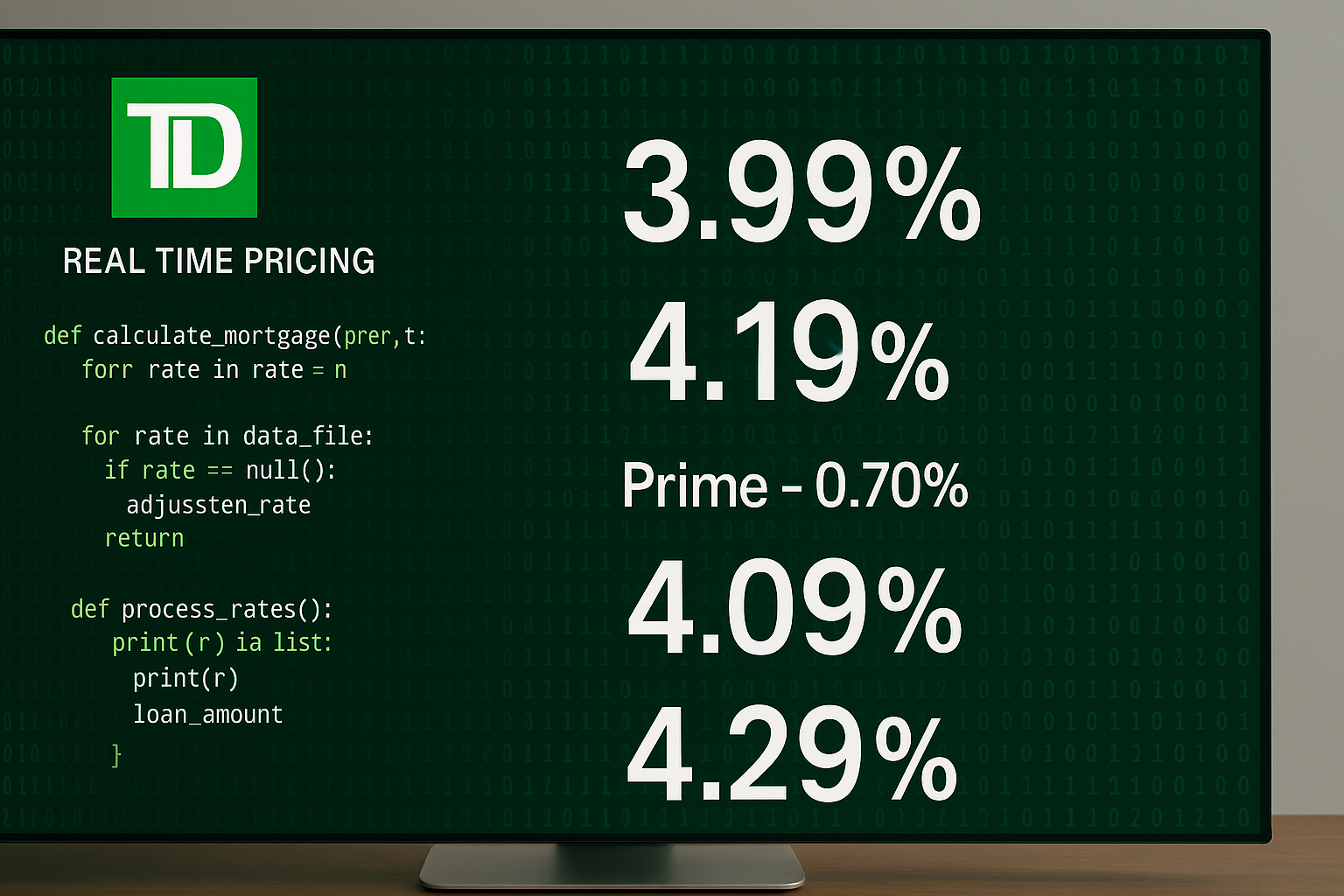

TD's rate quoting system wasn't working well—for anyone, including brokers, customers and the bank itself. So, management radically changed to a new model called "Real Time Pricing (RTP)." It kicked off today, April 1, following TD's trial run with a few mortgage industry heavyweights.

If you're a TD broker, you've probably heard much about it already, so we'll skip all the fluff. Here’s the part that actually matters if you’ve got deals to close and clients who view interest rates as a zero-sum game.

Back to top