With no major Canadian data to stir the pot on Friday, the 5-year yield meandered like a Bay Street economist after a three-martini lunch. Here's what moved it, and in which direction.

Back to topMLN Alerts In ET

News-Stream

With no major Canadian data to stir the pot on Friday, the 5-year yield meandered like a Bay Street economist after a three-martini lunch. Here's what moved it, and in which direction.

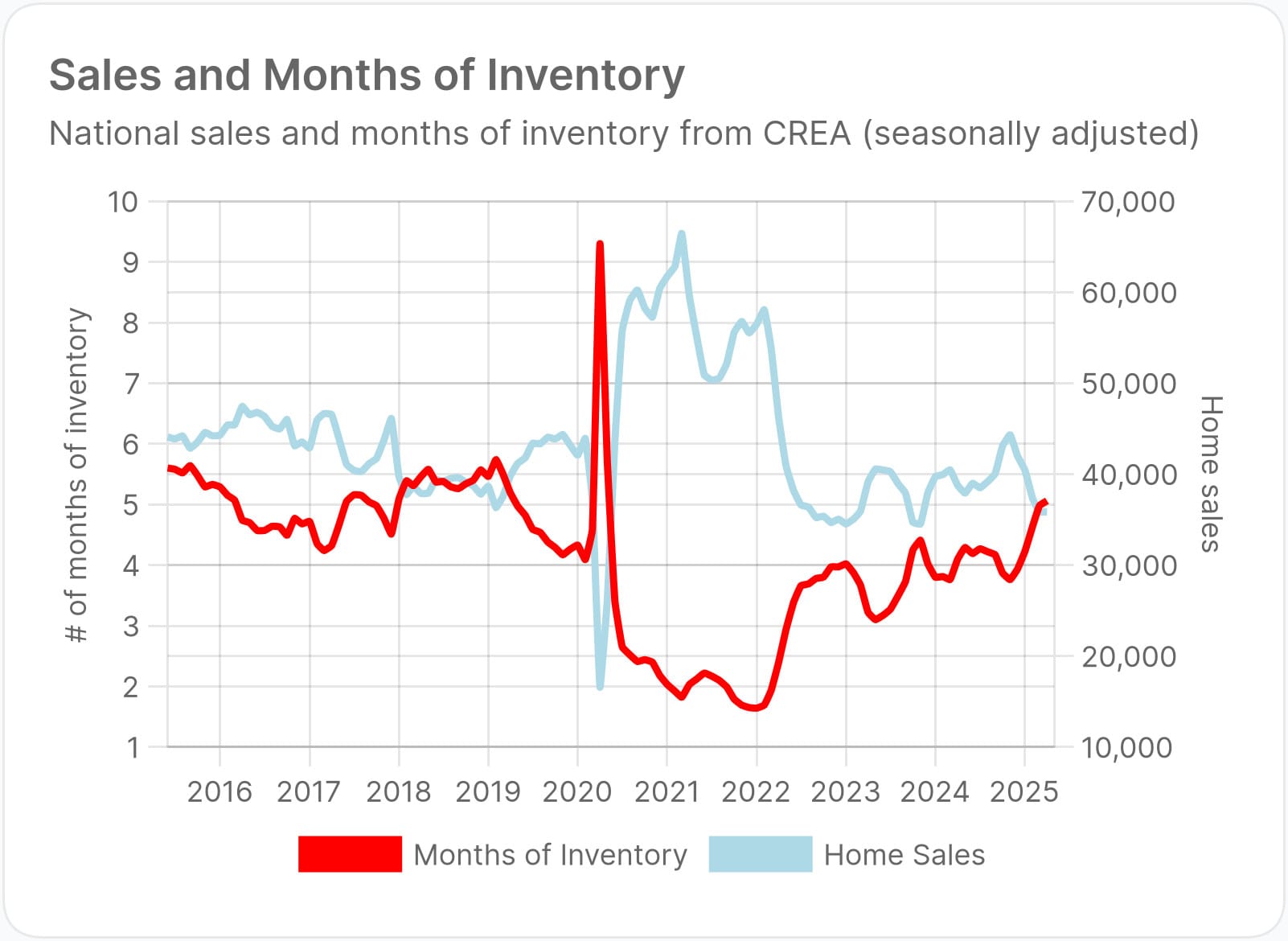

Fresh CREA figures confirm that Canada’s housing sector is once again an innocent bystander in a geopolitical bar fight, this time courtesy of Trump's tariff war. Sales are spinning their wheels while inventory stacks up like unclaimed luggage—because when the U.S. President treats trade diplomacy

Trump's Trade War: A Temporary Ice Age for Real Estate

Fresh CREA figures confirm that Canada’s housing sector is once again an innocent bystander in a geopolitical bar fight, this time courtesy of Trump's tariff war.

Sales are spinning their wheels while inventory stacks up like unclaimed luggage—because when the U.S. President treats trade diplomacy like a demolition derby, buyers hit the brakes and wait for the wreckage to clear.

"There is no doubt that the ongoing trade conflict with the U.S. has weighed on consumer confidence and the housing market across the country," said National Bank Economics, adding that "potential buyers [are] waiting for more economic visibility before acting."

In the event any sellers are still clinging to hope like it’s 2021, here's the latest reality check:

Back to topA hefty helping of U.S. economic data has Canadian yields on the down escalator. Here was Thursday’s menu of bond movers and which way they nudged rates.

5yr Yield Down 10 Bps After U.S. Data Barrage

A hefty helping of U.S. economic data has Canadian yields on the down escalator. Here was Thursday’s menu of bond movers and which way they nudged rates.

Back to topCanada's 5-year yield tiptoed upward as markets braced for Thursday’s data deluge. Otherwise, the day's trading had all the excitement of a beige wallpaper convention. Here's what nudged Canada’s 5-year yield on Wednesday, and in which direction.

5yr Yield Up 3 Bps in Quiet Session (Updated)

Canada's 5-year yield tiptoed upward as markets braced for Thursday’s data deluge. Otherwise, the day's trading had all the excitement of a beige wallpaper convention.

Here's what nudged Canada’s 5-year yield on Wednesday, and in which direction.

Back to top📰After this story went to press came word that the NYSE American exchange plans to delist Pineapple Financial. Canada's fruity-named brokerage network, Pineapple Financial (ticker: PAPL), has lost about 96% of its stock value since its IPO. This week, its share price belly-flopped into single-digit pennies for the

Pineapple Financial Halted: Still

Canada's fruity-named brokerage network, Pineapple Financial (ticker: PAPL), has lost about 96% of its stock value since its IPO.

This week, its share price belly-flopped into single-digit pennies for the first time.

Back to topThe bond market exhaled after April’s U.S. inflation data showed tariffs hadn’t yet jacked up price levels—though that’s more a temporary reprieve. Most economists continue to think recession is a bigger risk than inflation. But that chapter isn't yet written, especially with supply

5yr Yield Unchanged After U.S. CPI Undershoot (Updated)

The bond market exhaled after April’s U.S. inflation data showed tariffs hadn’t yet jacked up price levels—though that’s more a temporary reprieve.

Most economists continue to think recession is a bigger risk than inflation. But that chapter isn't yet written, especially with supply chain snarls making headlines.

Here's a broader look at what played on Canada's 5-year yield on Tuesday, and in which direction.

Back to top