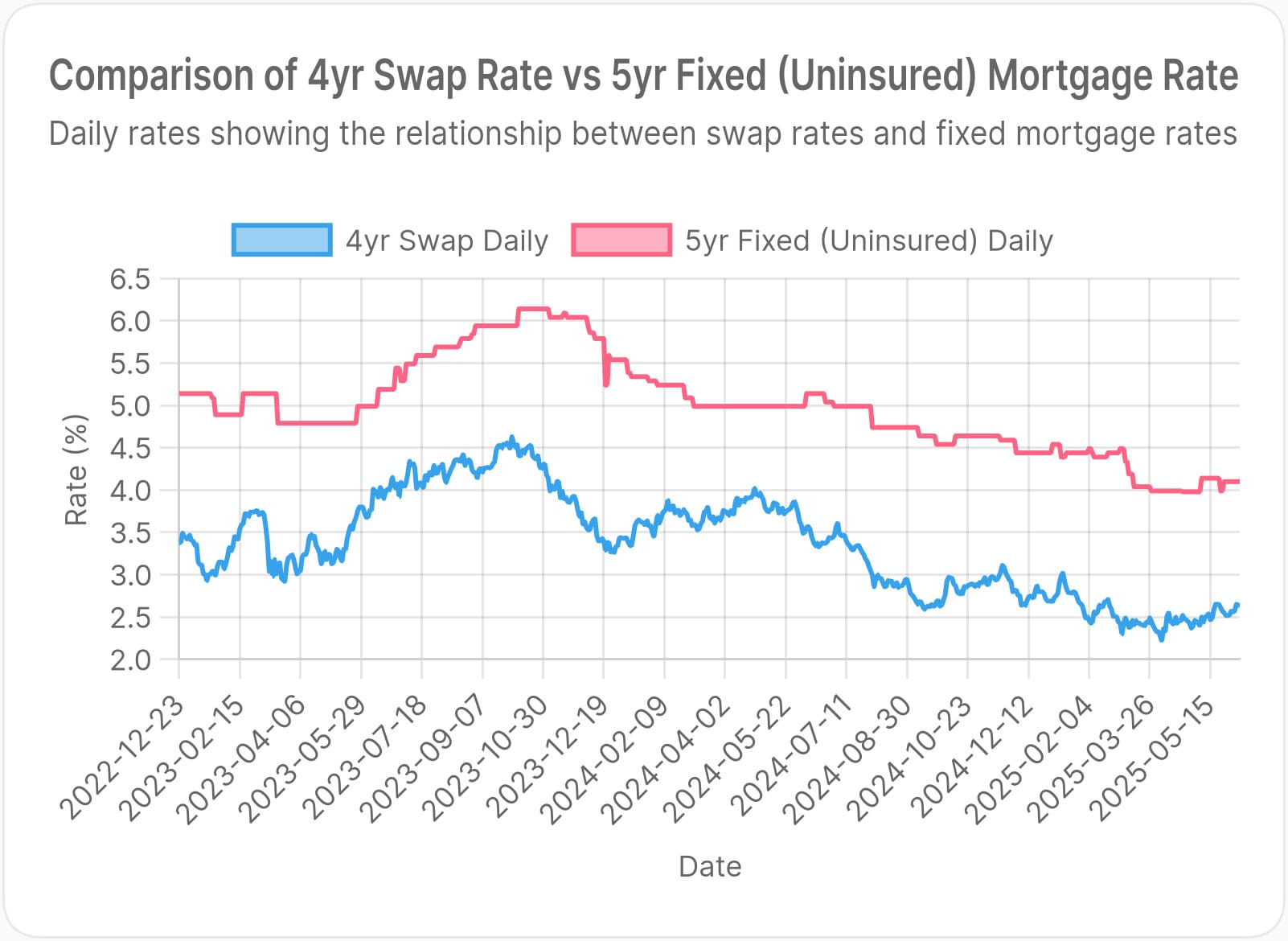

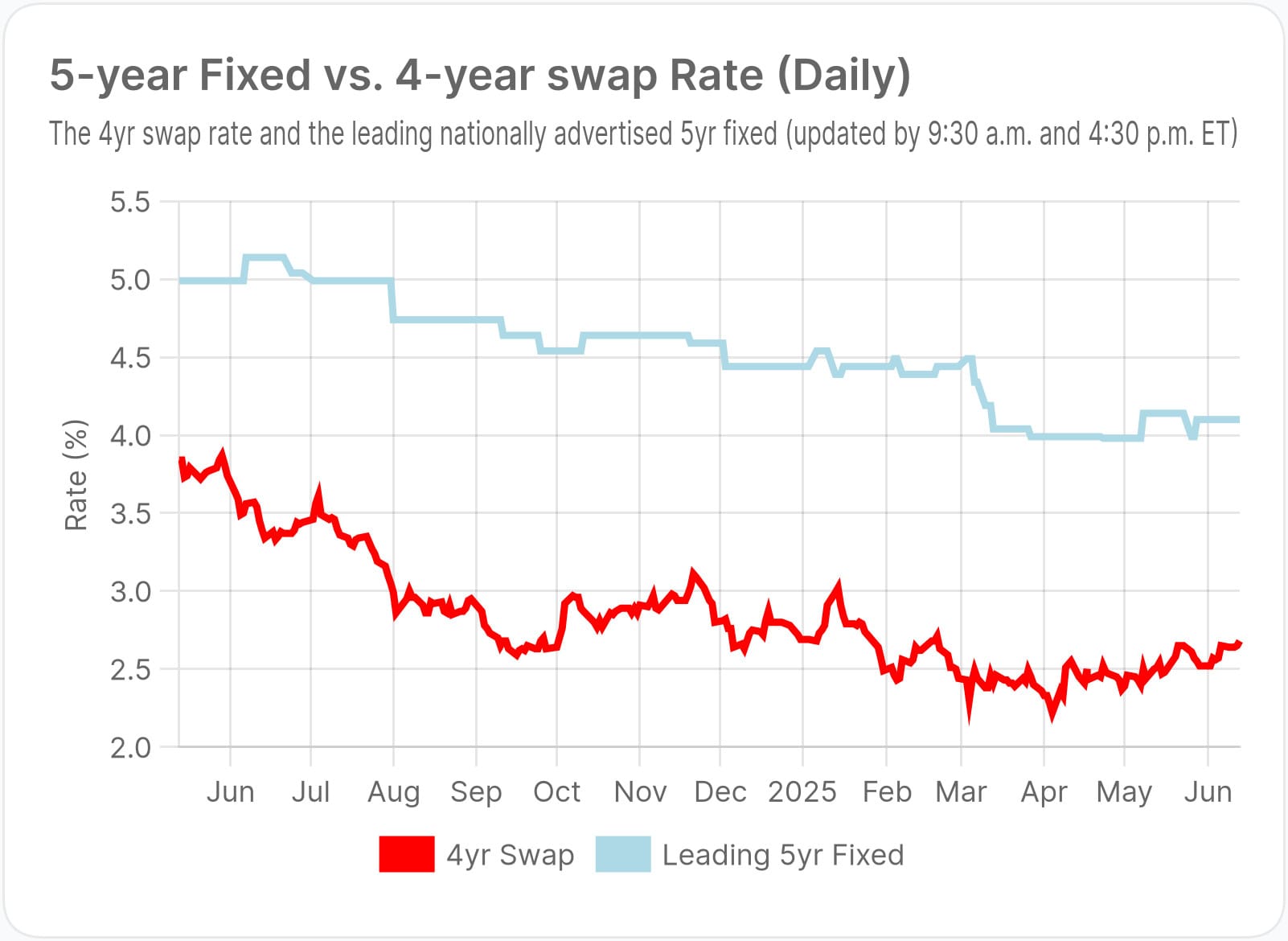

New MLN members frequently hear us comment on Canada's 4-year swap rate and wonder, "Why is it so important for mortgages?"

Here's a chart that shines a spotlight on why.

Swap rates and fixed rates move like train tracks for a reason. Most importantly, it's because banks price fixed mortgages using swap rates as a benchmark.

The main reason they do this is that swaps help banks manage interest rate risk in their mortgage portfolios.

How it works

When funding mortgages, banks often borrow at variable (floating) rates and lend at fixed rates (e.g., fixed-rate mortgages). This creates a mismatch. If floating rates rise, the cost of borrowing increases, yet the mortgage income remains fixed, squeezing profitability.

To avoid getting wedgied by rising rates, banks reach for their favourite derivative: the interest rate swap. Here's an oversimplified example of what happens when banks use an interest rate swap.

With fixed mortgages, think of the swap rate as a fixed interest rate that the lender must pay to turn borrowers' fixed-mortgage payments into a stream of floating-rate payments.

The capital markets crowd calls this a "pay-fixed, receive-floating swap," and it's a very common way to hedge in the mortgage market.

So, why would a bank bother with this financial contortion?

Well, what swaps effectively do is let the bank profit from the spread between the yield it earns on the mortgage and its net cost after the hedge, all with significantly reduced interest rate risk. It's bank alchemy at its best, and it works to the tune of billions in earnings annually.

New at MLN

Since swaps play a starring role in fixed mortgage pricing, MLN now updates the 4-year swap rate twice daily in the Mortgage Command Centre.

You can monitor the chart below either daily or weekly, but if you’re a serious mortgage pro, make it part of your regular diet. We'll explain why in a moment.

Bonds: the imperfect indicator

Most Canadian mortgage advisors track fixed-rate funding costs by following the 5-year government bond yield. Two factors explain why:

- Bond data is way easier to find than 4-year swap data.

- Most folks don't understand how swaps work or why they're essential.

Bond yields are easier to grasp, but they can be misleading.

Swap rates provide a cleaner read on funding cost pressure, for three reasons:

Back to top