Canada’s economy took a bruising in August 2025, shrinking 0.3% instead of the Street's flatline (0%) estimate.

One could cite several culprits, but the main suspects are predictable: U.S. tariffs and a business confidence crisis.

Retail sales somehow managed to look chipper, however, climbing in two-thirds of sub-sectors. Canadians are still willing to shop through economic pain, at least until their credit runs out.

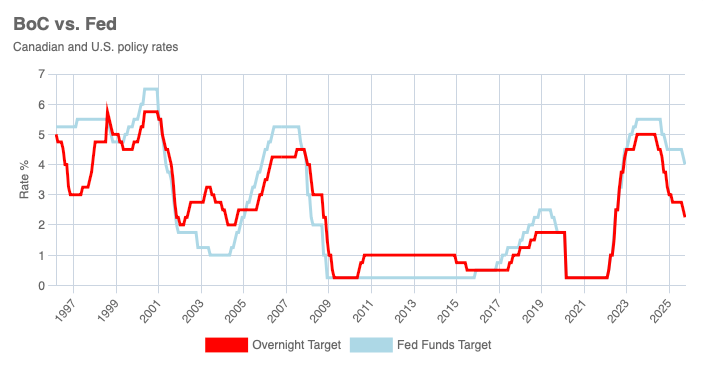

Preliminary September data (+0.1%) suggest only a meek rebound, leaving Q3 GDP tracking around +0.4% annualized. That's steady enough to avoid panic, not enough to celebrate, but at least consistent with the BoC's forecast.