Macklem and company won't love this number. Canadian inflation has surprised to the upside at 4.4% in April. The market expected 4.1%.

Macklem and company won't love this number. Canadian inflation has surprised to the upside at 4.4% in April. The market expected 4.1%.

Macklem and company won't love this number. Canadian inflation has surprised to the upside at 4.4% in April. The market expected 4.1%.

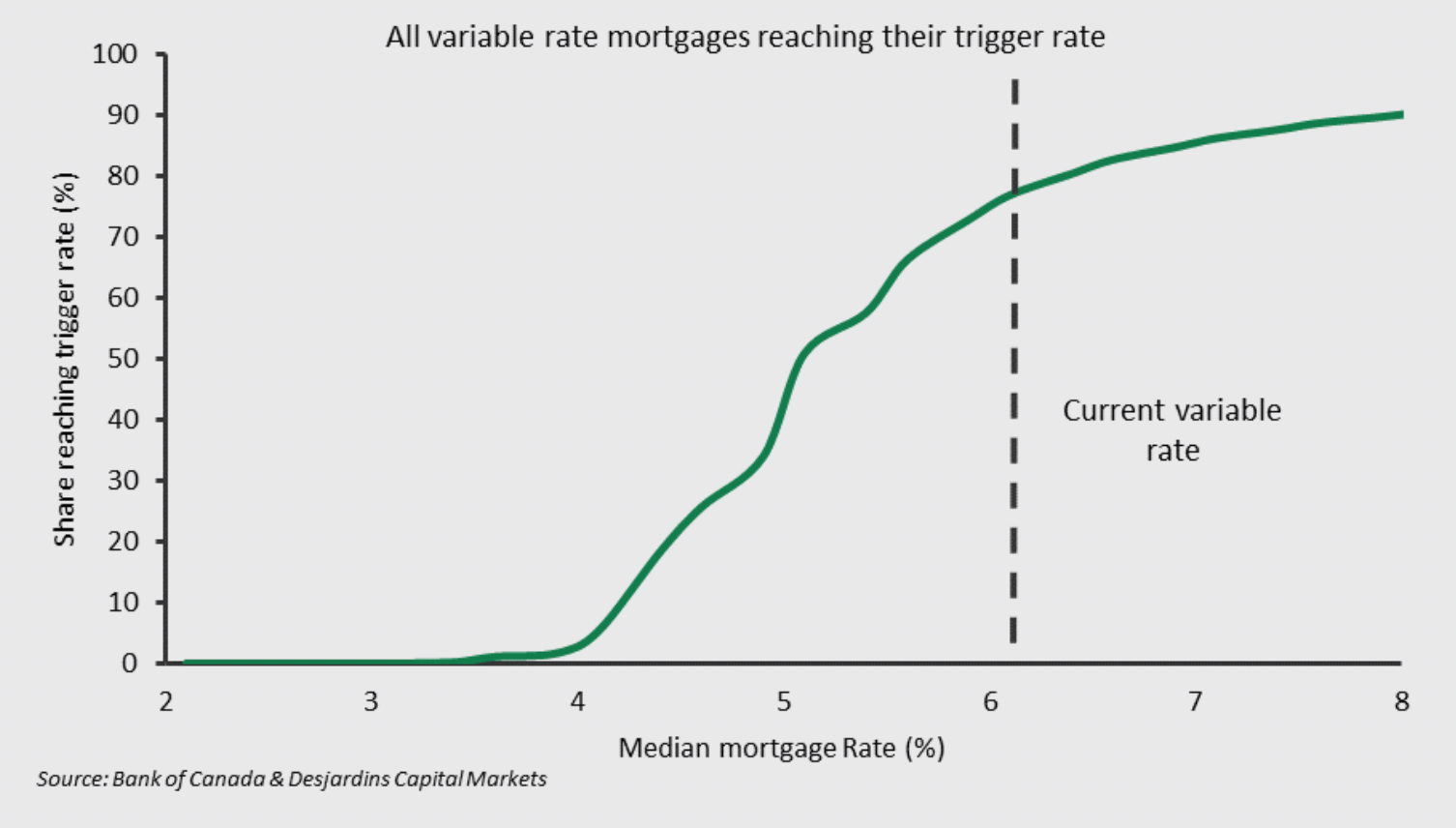

* Trigger risk fades: Of the 1 in 3 mortgages with floating rates, about 75-80% have fixed payments, and about "three-quarters" of fixed-payment variables have hit their trigger rate, estimates Desjardins Economics. The BoC's pause has eased trigger rate concerns, but if rates do resume higher "

Canada's mortgage rate market has been deader than a mausoleum. Leading 5-year uninsured rates haven't changed for weeks, and the only nationally-best offer that moved this week was the insured 4-year fixed, up five bps. Mortgage rates have been in limbo largely because yields are stuck

Canada's mortgage rate market has been deader than a mausoleum. Leading 5-year uninsured rates haven't changed for weeks, and the only nationally-best offer that moved this week was the insured 4-year fixed, up five bps.

Mortgage rates have been in limbo largely because yields are stuck in a channel, searching for direction.

Back to topWhen a central bank stops hiking rates, there inevitably come times when they second-guess themselves. Today is going to be one of them. The real estate numbers that CREA just dropped displayed a resilience that doesn't jibe with 300-425 bps of rate increases and potential recession. BoC governor

When a central bank stops hiking rates, there inevitably come times when they second-guess themselves. Today is going to be one of them.

The real estate numbers that CREA just dropped displayed a resilience that doesn't jibe with 300-425 bps of rate increases and potential recession. BoC governor Tiff Macklem, who's already publicly stated his upside rate bias, will take notice.

Let's get to the highlights:

Back to topSome have called it the worst-kept secret in the mortgage industry. Now, the secret is reportedly becoming a reality. While not official yet, here's what we've been told thus far...

Some have called it the worst-kept secret in the mortgage industry. Now, the secret is reportedly becoming a reality.

While not official yet, here's what we've been told thus far...

Back to topCMHC CEO Romy Bowers told the Globe and Mail this week that she's against extending insured amortizations beyond 25 years. “It’s better to focus on increasing the supply versus making it easier for people to borrow more money," she said. "We feel, from a policy

CMHC CEO Romy Bowers told the Globe and Mail this week that she's against extending insured amortizations beyond 25 years.

“It’s better to focus on increasing the supply versus making it easier for people to borrow more money," she said. "We feel, from a policy perspective, it’s probably not the best move in a supply-constrained environment."

And she may be right.

But to be clear, she's essentially saying she doesn't think longer amz are a good idea anytime soon—because supply isn't about to meet demand—not for above-median-income buyers in key real estate markets.

Meanwhile, her government is happy to boost demand with other policies, like:

We can't speak for Ms. Bowers, but it's possible that she doesn't recognize or value the economic utility of extended amortizations.

But she should. All regulators should.

Paying down a mortgage is financially unsound for hundreds of thousands of insured borrowers. Many are far better off accelerating high-interest debt payments, making RRSP contributions, investing in education, funding a business, etc.

Why on earth would someone pay down a 4.50% mortgage costing them $441 of interest per $10,000 borrowed, for example, when they have a 22% credit card costing them $2,104 per $10,000?

Forward-thinking policymakers could easily help countless Canadians retire better off with a bit of payment flexibility. All they'd need to do is let insured applicants qualify with a 25-year amortization but set their payments at 30, 35 or 40 years.

Making this modest tweak wouldn't drive up home prices. Nor would it create any significant financial system risk—quite possibly the opposite.

What it would do is help hard-working, overtaxed Canadians get a little further ahead.

Yes, a minority of debtaholics would take longer to pay off their mortgages, and yes, many would spend the extra cash on frivolities, but prudent borrowers would funnel their freed-up cash to uses with higher returns. That's vital because Canadians have enough nanny-state policies that disadvantage responsible borrowers in order to protect the reckless from themselves.

Is it likely that rule makers will act on something like this near-term? Probably not. In a period of housing unaffordability, it's bad optics to promote anything that seems to give borrowers more leash. But longer amortizations are sound policy if done right. Maybe someday we'll have fewer in-the-box technocrats making policy and more who think like home economists.

Back to top