MLN NewsStream

Rate markets care as much about what people think inflation will do as what inflation is actually doing. This explains the fervent wait for the Bank of Canada's quarterly inflation outlook report.

Well, the Q2 numbers are finally out, and their influence on mortgage rates could be filed under “technically exists.”...

This Rate Pattern Is So Good It’s Scary

💡Important: The revelations that follow stand out as some of the more significant we've published at MLN. As far as we know, this strategy hasn't appeared in other outlets. Mortgage advisors may find it beneficial to convey the findings to clients and referral partners.

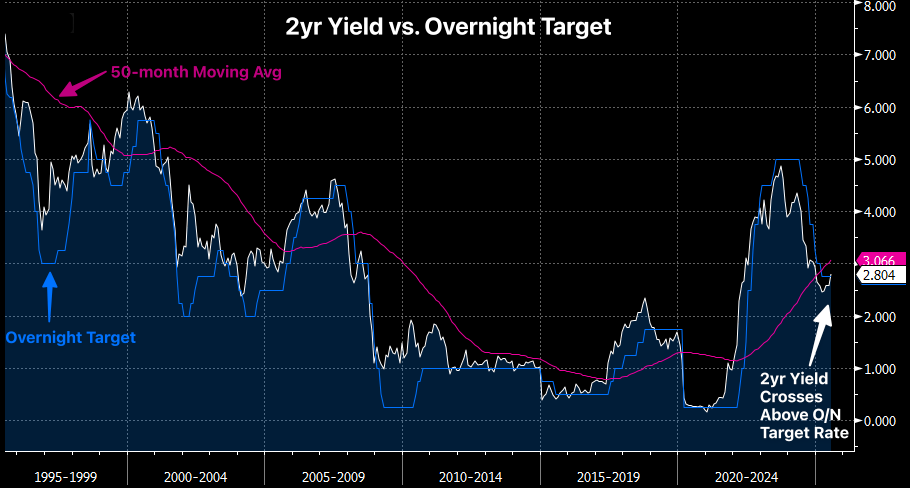

For the first time in more than two years, Canada's 2-year yield is trading above the overnight target rate.

This is a big deal for two reasons:

1. Two-year yields tend to sniff out Bank of Canada policy moves long before th...

Canada’s Real Estate Stalemate Continues

Much like the broader economy, real estate's mostly drifting, looking for directional inspiration. June CREA data confirms the market is stuck in an arm wrestle between positive and negative forces. We'll dissect those details shortly, but first, here were the highlights:...

Underlying Inflation Worsens: The BoC’s Deer-in-Headlights Moment

Fresh inflation prints just landed on both sides of the border, and judging by the data, tariff-flation is a thing. It's not a five-alarm fire—yet—but it’s enough to keep central bankers frozen like they’re watching a teleprompter glitch.

As mortgage pros, we have to prepare clients for the possibility that this freeze may not thaw for months. More on that below.

Let's start with the June numbers:...

Takeaways From CRA's Income Checker Consultation

The CRA has shared highlights from its industry consultation on the government's new Income Verification Tool.

It promises to use the broker and lender feedback it received to "inform" its design of the tool, citing two stats as reasons to complete this project:

1. Mortgage Professionals Canada warns that “for every $1 lost to fraud it takes $4 for lenders to recoup.”

2. "The foreclosure process on a property where the borrower is unable to make their payments can take up to a year, and cost...