MLN NewsStream

The Bank of Canada didn't budge on rates today, but it made its intentions more transparent. At this point, it's leaning towards keeping rates steady or gently lowering them later. Team Macklem has no plans to reach for the rate-hike lever.

The Bank's key statements, like the gem below, echo this stance clearly:

“If a weakening economy puts further downward pressure on inflation … there may be a need for a reduction in the policy interest rate.”

—BoC Statement, July 30, 2025

Despite that, Can...

Private Equity's Big Bet on Canadian Mortgage Brokers

First National Financial, a non-bank powerhouse that's one of Canada's biggest broker lenders, plans to sell a controlling stake to private equity in a $2.9 billion deal.

The two groups signing the cheque are:

* Global alternative asset manager Brookfield Asset Management Ltd., which owns private mortgage insurer Sagen and developer Brookfield Residential, and

* Private equity firm Birch Hill Equity Partners Management Inc., which previously bought HomeEquity Bank.

If you’re a mortgage brok...

B-Customers Made to Requalify at Renewal

Equitable Bank has reportedly been sending out emails to a small number of 'B' customers, asking them to requalify at renewal. At least some of the borrowers in question have apparently never even defaulted.

This begs the glaring question: Why?

Here's what Equitable Bank told us about it....

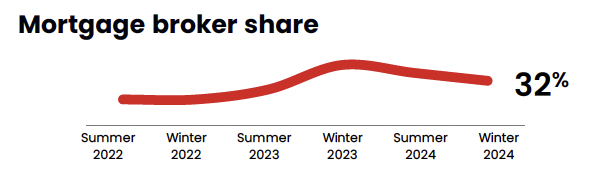

Brokers Must Innovate to Grow Share

Market share matters for mortgage brokers in ways that barely need explaining:

* Brokers, as a group, have higher public recognition and earning potential as their pie slice gets bigger.

* Lenders servicing brokers make more money.

* Mortgage shoppers become better informed as broker interactions grow. In turn, a more enlightened mortgage consumer is less likely to make costly financing mistakes.

All of this is why our industry tracks broker share like a blackjack player tracks a dealer's f...

Equifax's New Mortgage Attrition Predictor Helps Keep Borrowers Sticky

When a mortgage borrower comes up for renewal, lenders don't leave that renewal to chance. More than ever, it's a chess match with lenders using cutting-edge tech to determine:

(A) How hard it'll be to retain that customer, and

(B) How sweet their offer should be.

That brings us to Equifax, Canada's biggest credit bureau. It recently rolled out a new product called Mortgage Attrition Predictor™. Its purpose is simple: help lenders keep borrowers from bolting to competitors.

We're about to bre...