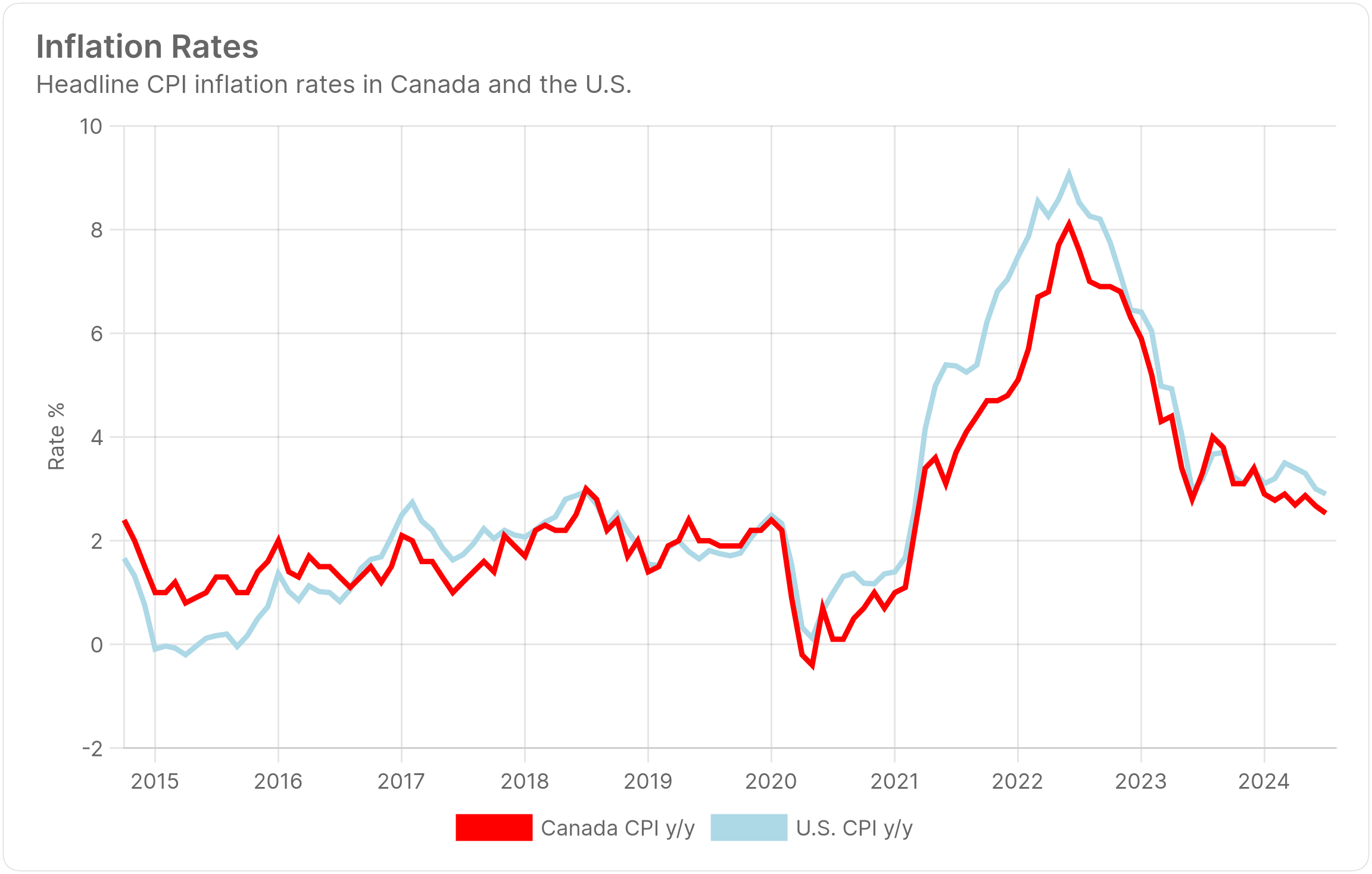

If you're a mortgage originator and none of your CRM emails include graphs, it's time to jazz them up. Visuals tell stories better than words. Charts, in particular, accelerate comprehension and turn newsletters into less blah, more ah-ha.

That's why mortgage clients and referral sources rarely grumble when you hit them with a relevant chart. ("Relevant," meaning it tells a compelling story that potentially impacts their net worth.)

That's also why we're thrilled to announce the updated AI Copilot for MLN Pro members. This revised chart builder is now easily accessible from anywhere in the Mortgage Command Centre (MCC).

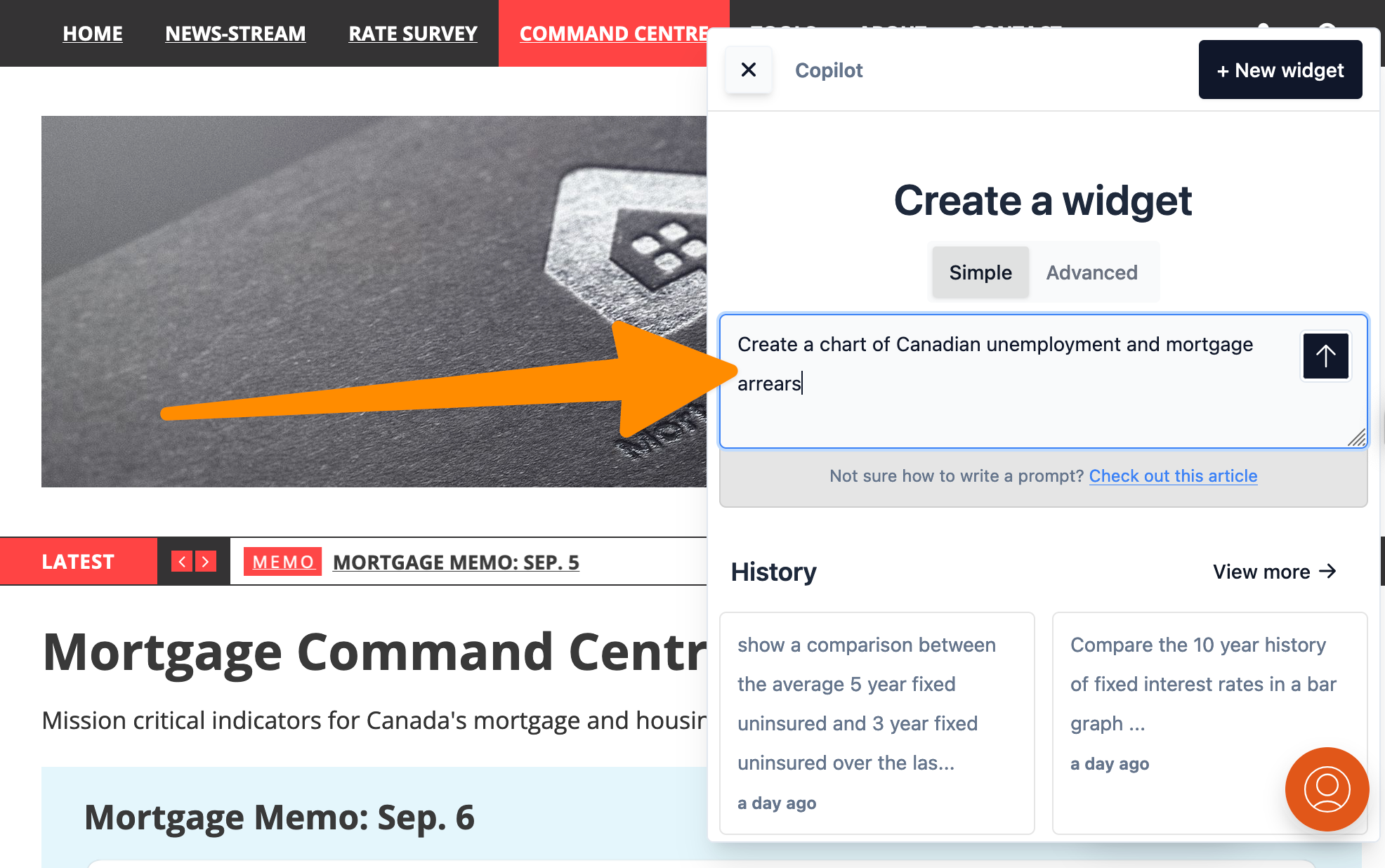

Chart Copilot 2.0 makes it faster to build custom graphs thanks to:

- Improved logic (i.e., the AI recognizes and follows instructions better)

- A more straightforward interface (just click the floating button in the lower right corner).

Along with smarter AI, the best part is that you can now see what you're doing in a pop-up "Copilot" window. No more typing a prompt and then having to scroll way up the screen like your finger's on a treadmill.

To make a chart

- Click the <Chat with your data> button in the MCC

- Tell it what you want to chart (here's all the available data)

- For example, you could type: "Create a chart of Canadian unemployment and mortgage arrears."

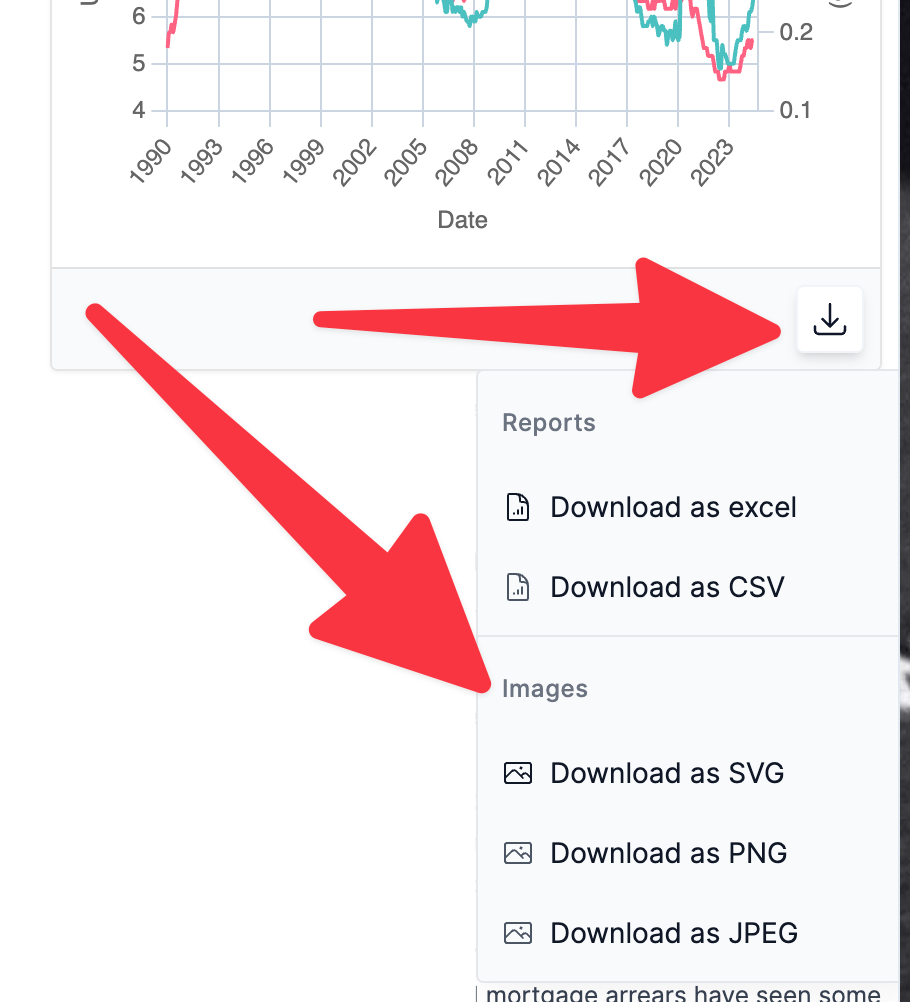

- Make your chart pretty (change colours, line thickness, the title, the subtitle, etc.)

- Download the chart or chart data (see below)

Tips for better charts

- Here are all the chart types you can choose from

- To change the chart colour to red, for example, type:

"Change the line colour to red" - To eliminate points on chart lines, type:

"Remove points on the chart lines" - To make chart lines thicker, type:

"Increase line thickness by 1 point" - If you see a chart with blank space [like this], type:

"Start the chart at January 1990"

(pick a date where you see chart data start) - To hide the legend, type:

"Hide the legend" - To change the title, type:

"Change the title to "X" (pick whatever you want)

If you have any questions, email support anytime at info @ mortgagelogic . news. Meanwhile, plot it like it’s hot.

Mortgage Bytes

- Macklem hints at home price bump: Don't be surprised to see "some pickup in housing prices" as rates drop, Governor Macklem said last week. But higher home prices don't necessarily mean higher overall shelter inflation—not if we get lower rates, immigration and rents, he says. (Here's his response to MLN's question about it.)

- Ourboro update: Shared equity investor, Ourboro, says it anticipates removing its waitlist "this fall." The company, which takes an equity stake in people's homes in exchange for down payment funds, has seen "overwhelming" demand. Chief Product Officer Alex Kjorven told MLN last week that there's no waitlist for homebuyers with 10% down, however (Ourboro contributes the other 10% in exchange for half the appreciation). She says that once the company's pilot with an undisclosed major bank is over, the company expects to have ample capital to meet demand. "We have phenomenon institutional backing," she says, including Fengate Asset Management.