MLN NewsStream

"Downside risks to employment" led to a quarter-point Fed cut today. That was foreseen.

What markets didn't know is how the Fed views future rates. Here's what they revealed:...

BoC Trims Overnight Rate 25 Bps to 2.50%

...

Underlying Inflation Stays Hot, Yet Rate Cut Odds Stay Hotter

If the BoC planned to trim rates tomorrow despite its key inflation measure above 3%—which would be a first since 1991—today’s CPI release won't convince them otherwise.

Canada's primary measure of underlying inflation landed precisely on target today at 3.05% y/y. Sure, that's still above the Bank of Canada's 3% control ceiling, but markets are betting the BoC won't care enough to scrap its easing plans.

The consensus insists that core inflation is destined to drop, and that's all BoC governo...

Mortgage Advisors: Keep Clients Awake While Housing Naps

Overall, Canadian real estate has been taking a rest for a few years. It's been sideways consolidation where nobody’s running for the exits, and nobody’s breaking down sellers' doors.

But lulls in the action don't mean mortgage pros can sit on their hands. In the bulletin below, we've got the market play-by-play for August, plus three tactics originators can apply when managing prospective homebuyers....

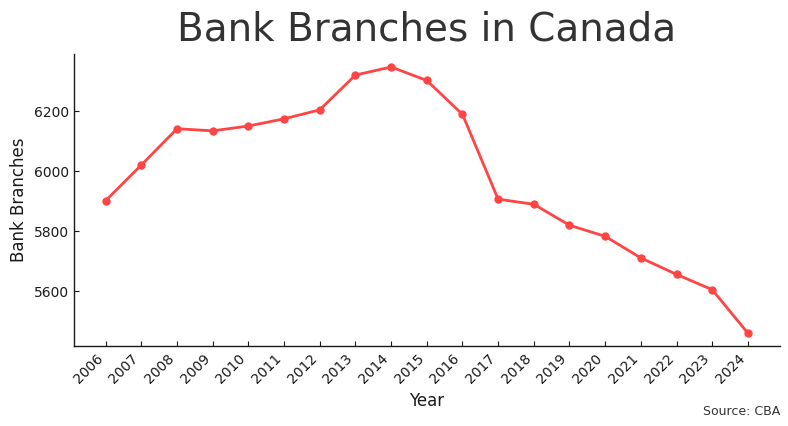

As Branches Vanish, Banks Pour Millions Into Mortgage Advice

Canadian bank branches vanished at the second-quickest clip this century, according to fresh CBA data. And frankly, it wouldn’t shock many if the pace accelerated.

It's an uphill battle, but banks are trying hard to keep branches relevant in a digital world. After all, they have so much invested in them, many (especially the 55+ crowd) still value in-person advice, they're great for branding, and customers like the security of nearby branches—even if they don't use them.

But from a mortgage p...