MLN NewsStream

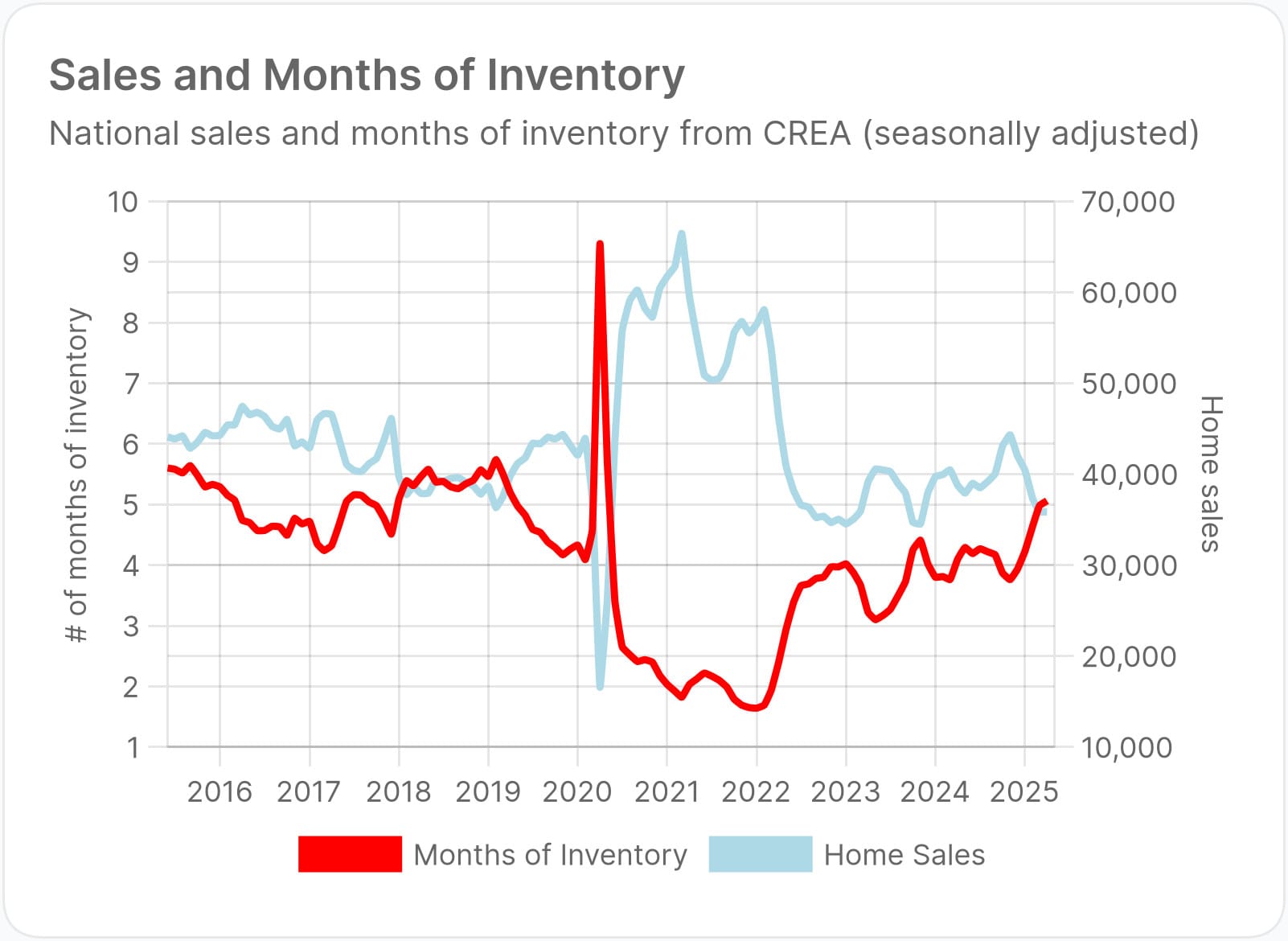

Fresh CREA figures confirm that Canada’s housing sector is once again an innocent bystander in a geopolitical bar fight, this time courtesy of Trump's tariff war.

Sales are spinning their wheels while inventory stacks up like unclaimed luggage—because when the U.S. President treats trade diplomacy like a demolition derby, buyers hit the brakes and wait for the wreckage to clear.

"There is no doubt that the ongoing trade conflict with the U.S. has weighed on consumer confidence and the housing...

Five Mortgage Rates Change: This Week in Rateland

...

Pineapple Financial Halted: Still

📰After this story went to press came word that the NYSE American exchange plans to delist Pineapple Financial.

Canada's fruity-named brokerage network, Pineapple Financial (ticker: PAPL), has lost about 96% of its stock value since its IPO.

This week, its share price belly-flopped into single-digit pennies for the first time....

Mortgage Rates: Better Than You Think

BMO came out last week saying 67% of Canadians are waiting for lower rates before buying a home. It's like a newbie poker player convinced they'll be dealt a royal flush if they wait just long enough.

But is this collective hesitation economic brilliance, or merely financial wishful thinking?

Apart from the facts that...

* market timing is a crapshoot

* rates could escalate in the meantime, and

* holdouts might find themselves in a bidding frenzy with fellow hesitators when sentiment shift...

Renewal Apocalypse Cancelled: Keep Your Doomsday Bunker Listed

The bad news: Mortgage renewals in 2025-26 are set to deliver a financial sting, as outlined in the BoC's latest Financial Stability Report (FSR).

The good news: In most cases, it'll sting more like a red ant than a bullet ant. ← Click here to see a not-so-smart man challenge a bullet ant.

The FSR gave us six mortgage tidbits worth chewing on. Here they are:...