MLN NewsStream

Last month, Japan's long-bond yields soared to unprecedented heights before temporarily retracing. Probably over 90% of Canadian mortgagors didn't even think twice about it, or once, for that matter.

Yet, Japan's debt challenges—while more extreme than most—mirror a global shift in the US$80 trillion government bond market. It may be setting up a future domino reaction that could be heading straight for everyone's wallets, Canadians included....

Trump to Double Steel Tariffs to 50% (Updated)

...

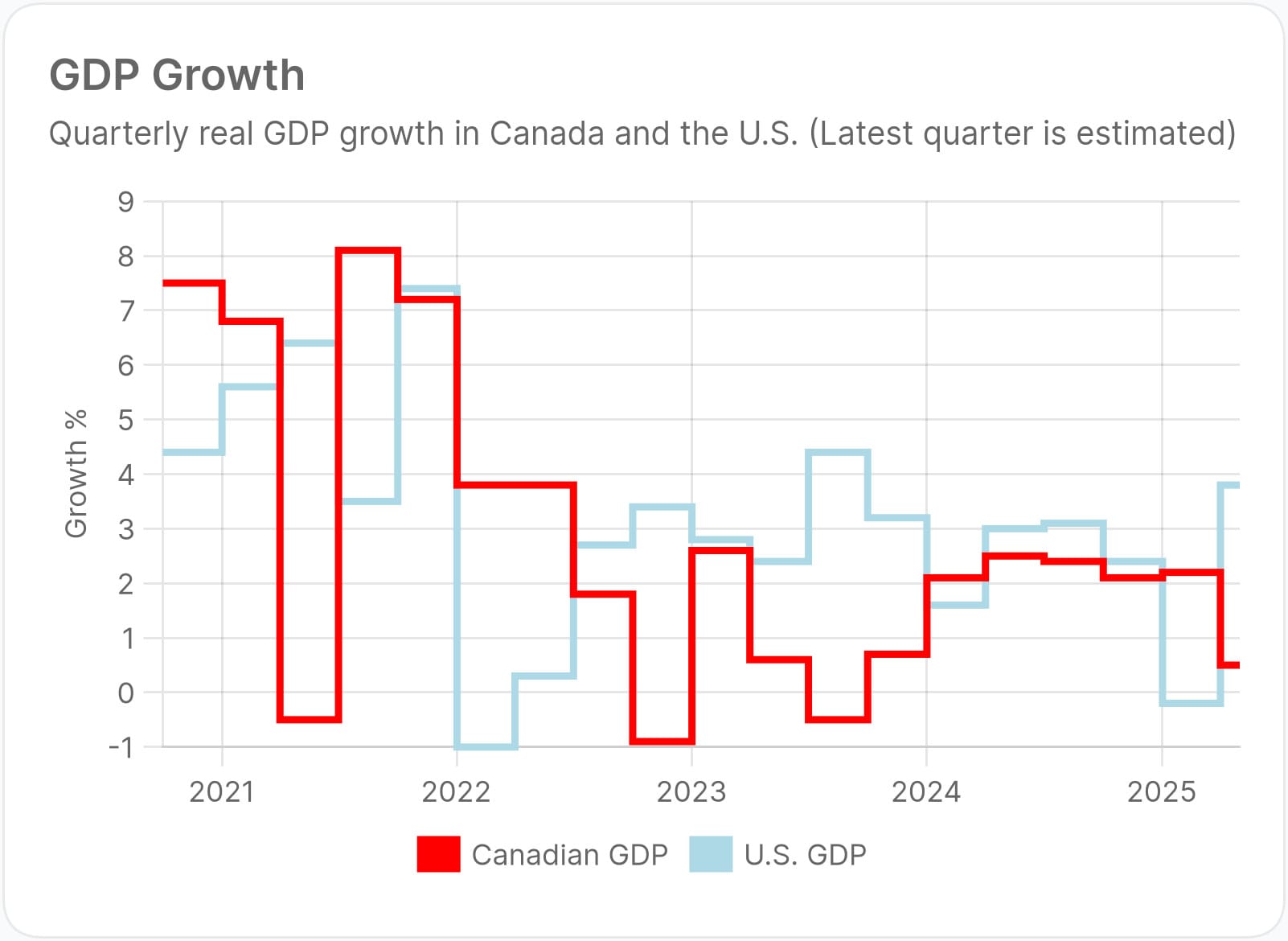

Canadian GDP Beats Estimates: Up 2.2% in Q1

Canada's economy sailed above expectations in the first quarter. The better-than-expected growth came with a big asterisk (it was driven by U.S. tariff front-running), but it was welcome nonetheless.

* Headline GDP rose 2.2% annualized in Q1 (est. 1.7% | prior [Q4] 2.1%)

* April GDP (advanced estimate) rose 0.1% m/m (est. -0.3% | prior 0.1%)

Here were the details:...

U.S. Core PCE Dips to Four-Year Low of 2.5%

Canadian mortgage rates aren't just moved by domestic inflation but by U.S. inflation too, especially by the Fed's favourite core PCE measure.

On that note, today's April core PCE numbers hit the Street's target with the precision of a Swiss watchmaker:...

Big 6 Banks: Q2 Mortgage Takes

It's been getting harder for banks to make money, as evidenced by today's rare RBC profit miss. A big culprit is the evolving economic forecast, one which now reads "more dreary with a chance of defaults." That's leading banks like RBC to stockpile larger-than-expected loan loss reserves.

Canada’s Big Six are also watching renewal waves hit like a fiscal tsunami, and most are strongly shoving customers toward multi-product relationships, something their #monoline# competitors can't really do....