MLN NewsStream

💡See also: 5yr Yield Up 4 Bps As Oil Soars

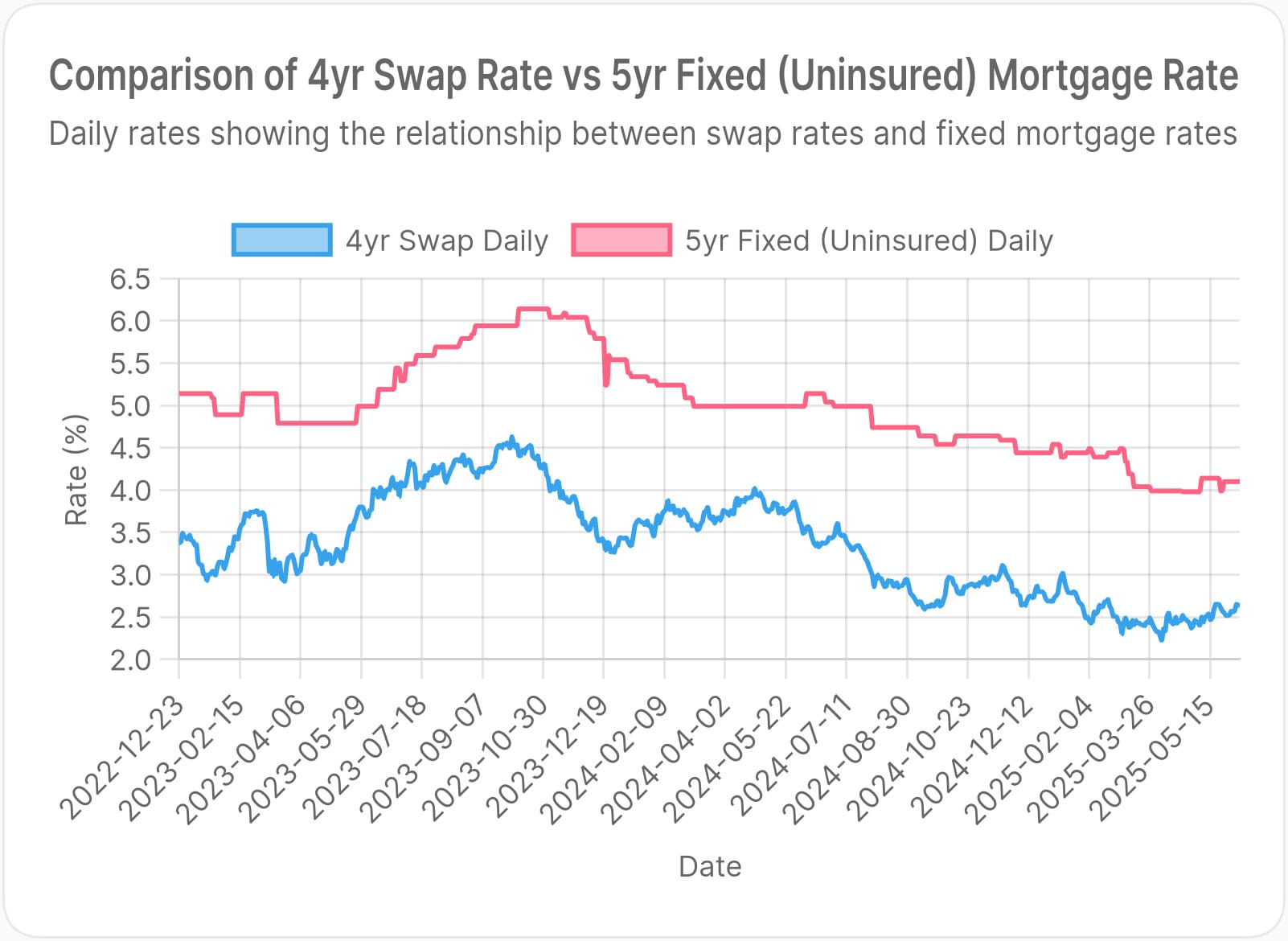

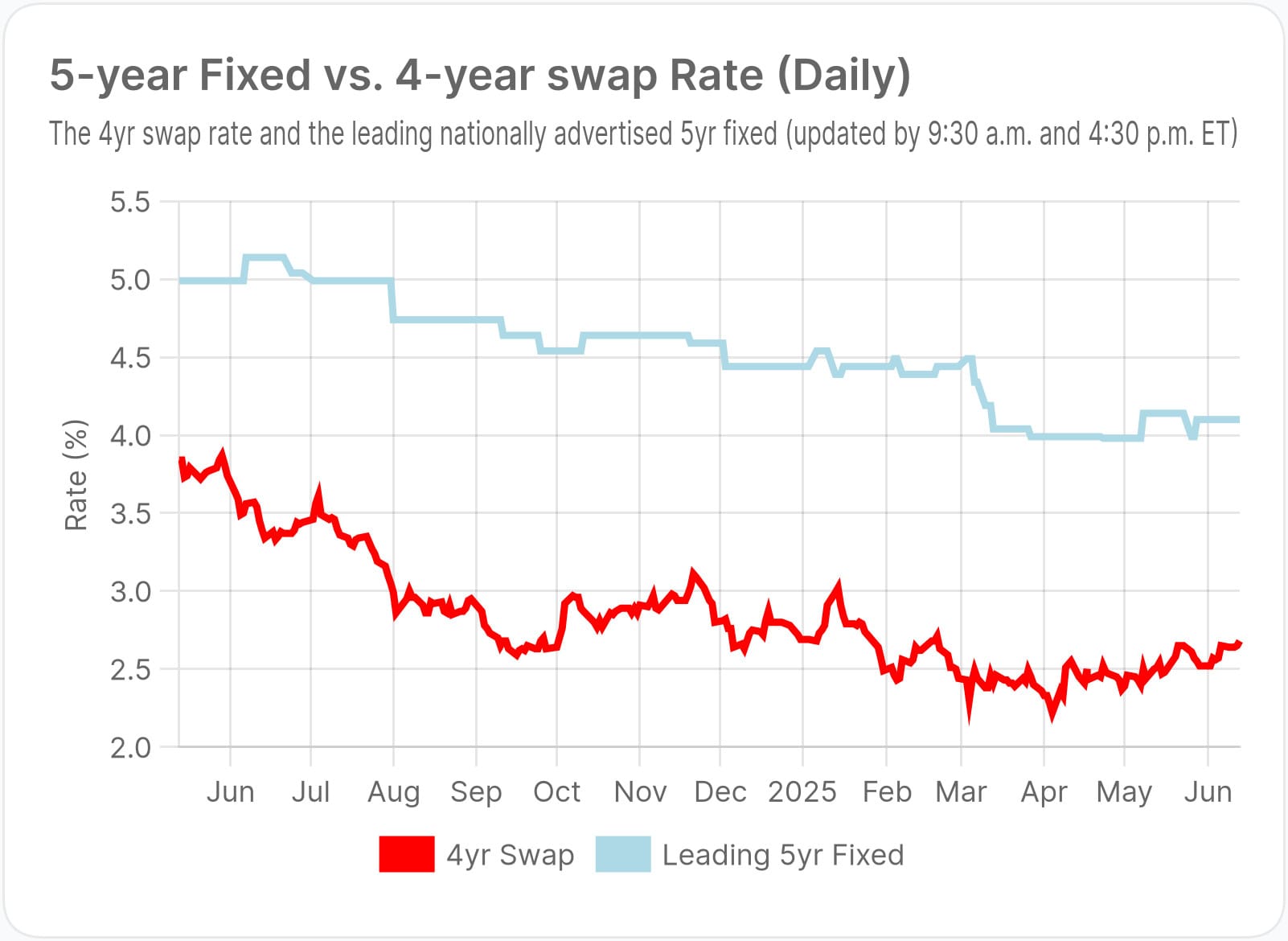

New MLN members frequently hear us comment on Canada's 4-year swap rate and wonder, "Why is it so important for mortgages?"

Here's a chart that shines a spotlight on why.

Swap rates and fixed rates move like train tracks for a reason. Most importantly, it's because banks price fixed mortgages using swap rates as a benchmark.

The main reason they do this is that swaps help banks manage interest rate risk in their mortgage portfolios.

How it works...

Nine Agents: $1 Billion of Originations. How AI-Powered Pine is Scaling

Pine announced yesterday that it joined the billion-dollar club—$1 billion in mortgages under administration (MUA) that is. We caught up with CEO Justin Herlick last week to find out why this particular milestone deserves more than a polite golf clap from the fintech peanut gallery.

He explained that Pine, which has received $50 million in venture funding, is vertically integrating its mortgage business with home shopping, using the properly.ca real estate platform it bought in 2023.

The compa...

Downside Surprise to U.S. Inflation

U.S. inflation came in cooler than expected, much to the delight of those who worship at the altar of cheap borrowing. Nonetheless, some economists are reminding everyone that this might be the part in the horror movie where the lights come back on—right before the axe drops.

Here's the breakdown of this morning's numbers:...

Ownwell Turns Old Clients Into New Deals

One of the hardest things for some mortgage advisors is coming up with natural reasons to talk to past clients.

That's a problem because, if you're an originator, deals depend on conversations.

But what if the conversations were started for you, with almost no effort on your part? That's the idea behind Ownwell.

Ownwell turns past clients into future deals by automatically sending them personalized homeownership reports that grab attention.

The information gets people thinking about options...

CRA Provides Update on Income Verification Tool

The 2024 Fall Economic Statement announced that the Canada Revenue Agency (CRA) had reached out to mortgage originators and financial institutions. Their purpose was to brainstorm the best design for a new tool to combat mortgage fraud.

Unfortunately, since CRA's industry consultation was publicized, it's been mostly crickets.

Last week, we contacted a mortgage tech executive who often has the inside track on these matters. He told us, "I think they are making no progress." He wondered if it's...