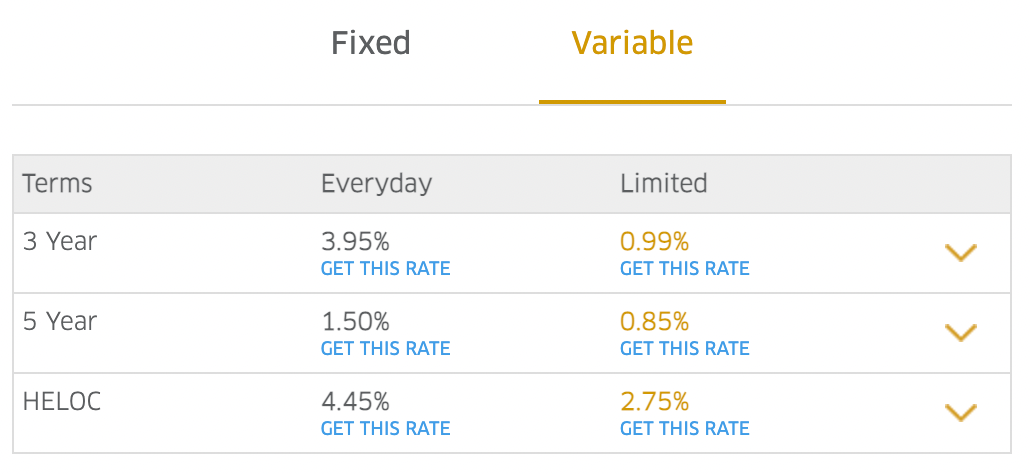

Just 14 months ago floating-rate borrowers were enjoying record-low rates like 0.85%.

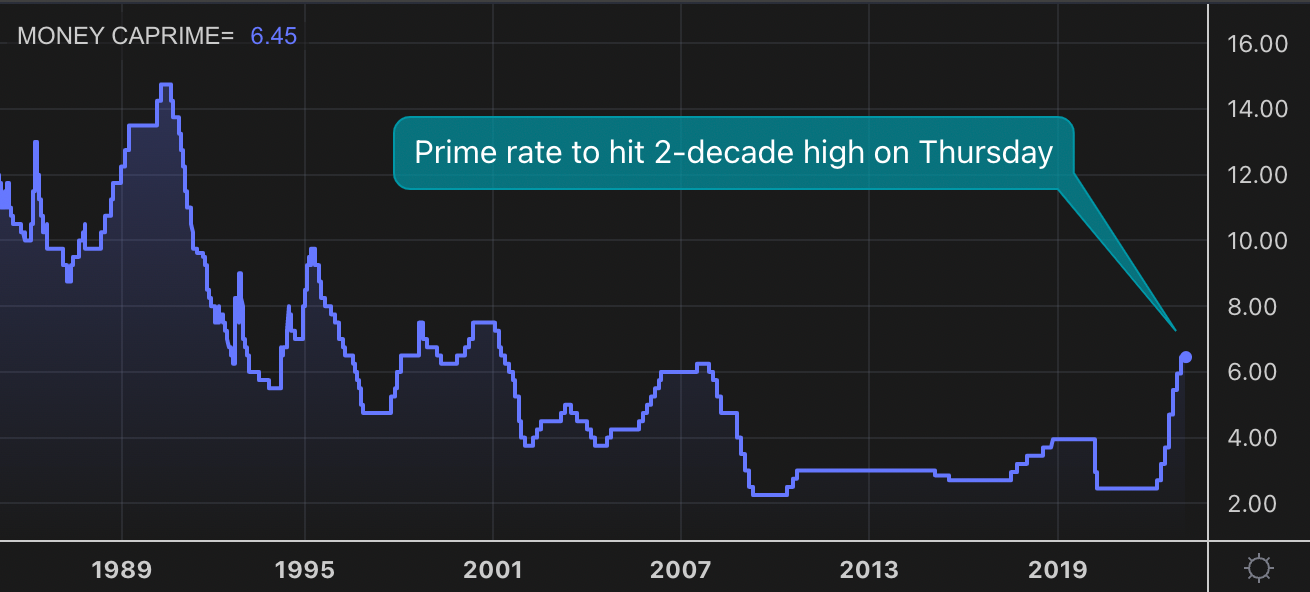

Today, after a 425 basis point spike in prime rate, team Macklem has added yet another piece of straw to borrowers' backs. He and the Bank of Canada have boosted their key rate another 25 bps to 4.50%. That matched market expectations and will drive prime rate to a two-decade high of 6.70%.

The Bank says it expects CPI inflation to fall "down to around 3% in the middle of this year." That'll give borrowers hope since 3% is the top of its inflation target. The BoC sees CPI back at the 2% midpoint target next year.

Essential quotes from the BoC's January 25 statements:

- "We expect to pause rate hikes...That is a conditional pause."—Governor Tiff Macklem

- "It's far too early to talk about cuts."

- "...Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases."

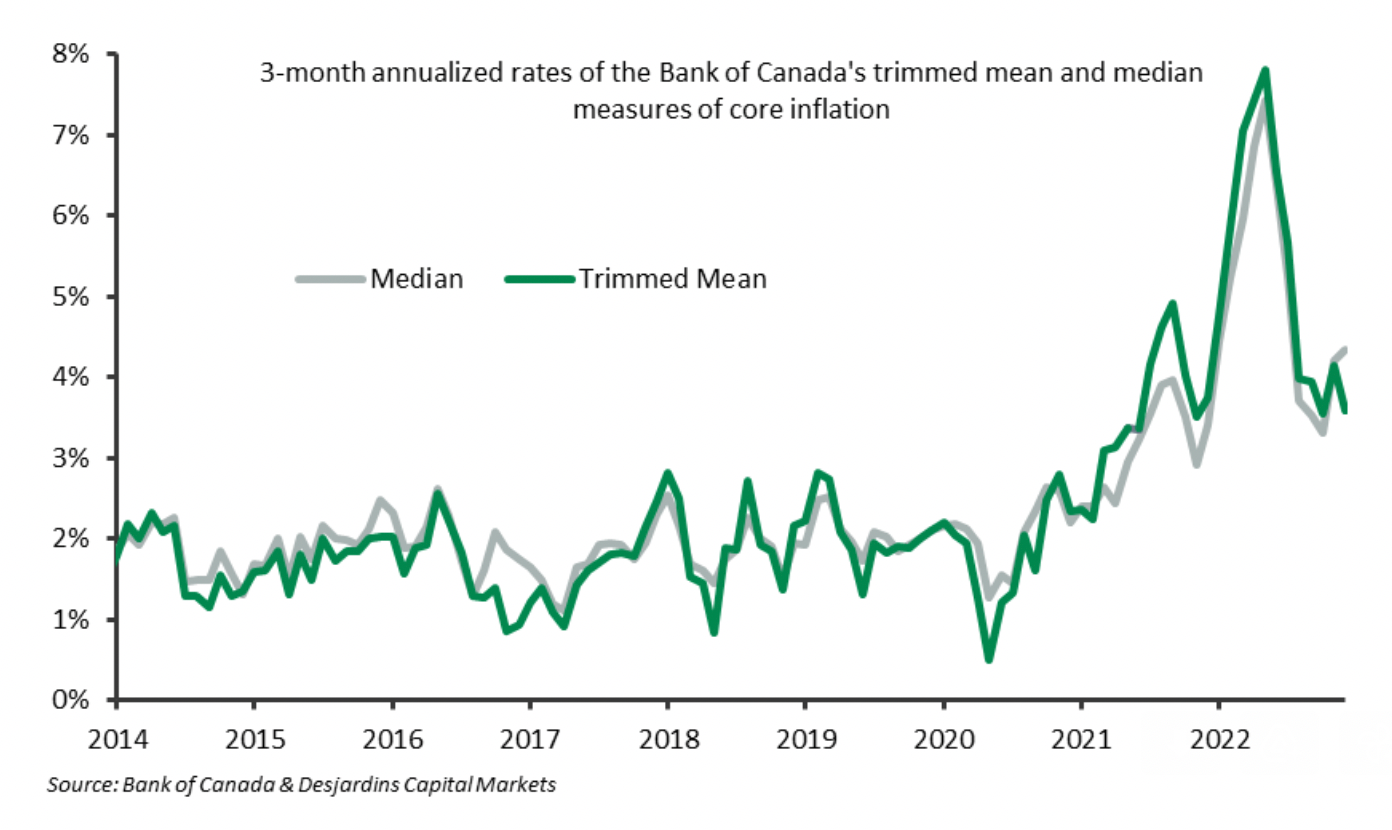

- "Year-over-year measures of core inflation are still around 5%, but 3-month measures of core inflation have come down, suggesting that core inflation has peaked."

- Housing prices likely have "further to go" on the downside, but will bounce back "later in the year" thanks to supportive fundamentals, said deputy governor Wilkins.

"All this presents a high barrier for further interest rate hikes," Capital Economics wrote Wednesday. "We continue to [believe] that the Bank is underestimating how quickly core prices will decline."

8 more things you need to know:

- Canada's benchmark prime rate should jump to 6.70% tomorrow. The last time we saw a rate like that was in March 2001, in the midst of the dot-com crash.

- Payments on Canada's average adjustable-rate mortgage will jump almost:

• $14 a month on every $100,000 of mortgage balance

• $48 a month on Canada's average mortgage balance of $343,612 - The federal stress test rate will climb to:

• 8.70%, 9.20% or higher on HELOCs. Ouch!

• 7.50% on the lowest insured variable rates

• 8.15% on the lowest uninsured variable rates

Not long ago, these are rates that only sub-prime borrowers would have qualified at. Clearly, no mortgage applicant is going to be choosing a variable-rate mortgage if his/her debt ratios are tight. - The vast majority of variable-rate borrowers have now hit their trigger rates. Among the record number of floating-rate borrowers in 2021-22, debt ratio data suggests at least 1 in 5 have their backs against the wall—meaning they can't take much more of this. That certainly factored into BoC thinking to some degree.

- Markets expect the next BoC move to be a rate cut in October. That's according to implied future rates from the overnight index swap market (source: Refinitiv Eikon). Take such projections with a large grain of salt as they'll continually change as the year goes on.

- If current spreads don't change, the lowest nationally-available variable rates will rise tomorrow to:

• 6.15% (uninsured)

• 5.50% (insured) - "The share of income going to mortgage interest payments is anticipated to continue rising as more homeowners renew their mortgages at higher rates."—MPR

- Markets are pricing in only a 10% chance of another 25 bps hike at the next Bank of Canada rate meeting on March 8.

Inflation outlook brightens

Inflation comparables in the next six months are looking rosier — i.e., those big fat monthly inflation prints we saw early last year will now start falling out of the annual CPI calculation.

Barring the unforseen, that means we should start making serious headway on annual CPI inflation starting, starting with the next February 21, 2023 report. Albeit, we still need to see monthly readings below 0.3%.

As always, the BoC will focus mostly on core CPI. It's adamant that 3-month core measures (CPI-median and CPI-trim) drop more before it stops thinking about further hikes.

Post-hike mortgage strategy

Assuming one leans on market forecasts and factors in the lowest nationally-available rates, short-term fixed rates will remain the play for most well-qualified risk-tolerant borrowers.

We just have to remember one thing. Today's "pause" will have everyone and their dog predicting that rates have peaked. The BoC knows this. And this psychology is counterproductive to inflation progress because people will buy more stuff (even houses) if they think rates are coming down.

Adding to the danger is the fact that unemployment—admittedly a lagging indicator—is still near a record low. That's highly unusual after such extreme monetary tightening.

This why we have to take the BoC seriously when it says it's "prepared to increase the policy rate further if needed to return inflation to the 2% target." If core CPI unexpectedly moves consecutively higher in the months ahead, that's exactly what it will do. That makes locking in some or all of one's borrowing potentially appropriate for mortgagors facing payment risk.

For those who do feel the need to lock in longer than a year, do yourself a favour and pick a lender with a fair prepayment charge. And try to stick to medium terms like a 3-year fixed, as opposed to a 5-year fixed.

The reason is simple. With potentially lower rates and economic volatility ahead, the probability of needing to break one's mortgage within a few years has rarely been higher.