The Finance Department and Bank of Canada better keep those foreigners happy.

That's the takeaway from a National Bank report that showed foreign investors now control ~36% of our federal debt. The long-term average is 23%.

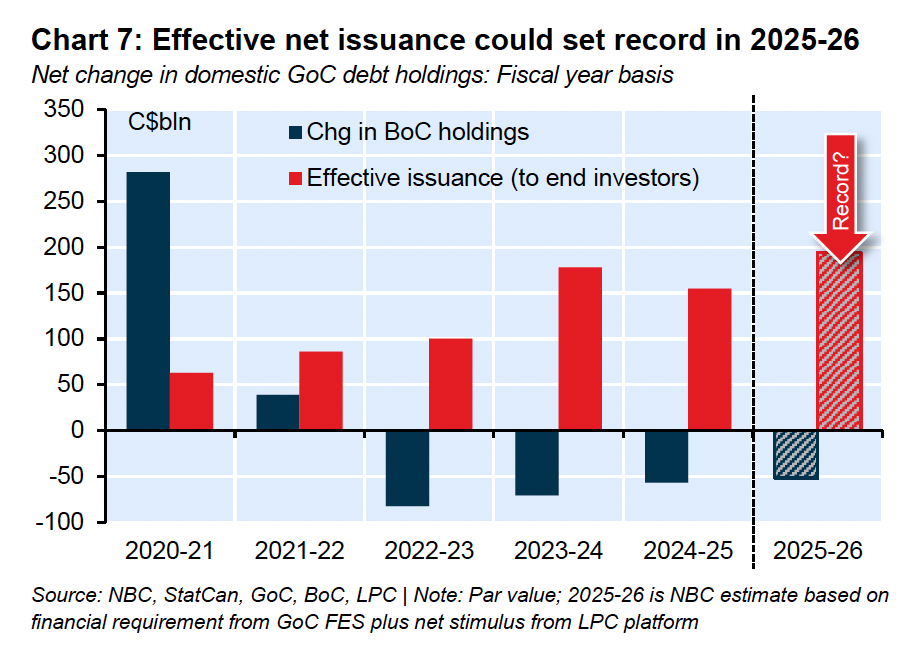

Foreign investors bought a record $91 billion worth of Canadian IOUs (bonds and Treasury bills) in the 12 months ending March 31, 2025. That's nearly 60% of the new debt churned out during that period. And it's a good thing they were bidding because Ottawa is set to amass a colossal pile of fresh #GoC# debt by March 31, 2026 (see chart below).

For those with mortgages, it's like watching a suspense thriller where the climax is the interest rate. But what does this mean for borrowers?

Three things, among others: