Demand for CMHC's multi-unit mortgage insurance skyrocketed 28.7% last year.

Borrowers and lenders have increasingly relied on it to buy, build or refinance multi-unit rental properties.

Unlike uninsured mortgages, CMHC multi-unit financing allows:

- lower down payments

- lower interest expense (lower rates)

- easier debt servicing, thanks to stretched-out amortizations

Take a $15.6 million, 48-unit construction loan under MLI Select, for example. A qualified insured borrower can save ~12% on the monthly payment and buy with $3 million less down, versus a conventional mortgage.

In 2024 alone, CMHC's multi-product helped fund 283,000 housing units. That makes it pivotal to the Carney government’s housing supply dreams.

The challenge is that CMHC is the only game in town for insured multi-unit financing. That's why the price it charges for insurance premiums is so impactful.

And now, those premiums are going up, in some cases, a lot.

Unfortunately—and God bless them—CMHC's specialty is not providing simple, straightforward, and comprehensive explanations of its commercial policy changes. It would be swell if they created a side-by-side before-and-after comparison of each change—you know, to help people understand this stuff. But alas, we ask too much.

What's changing

Starting on July 14:

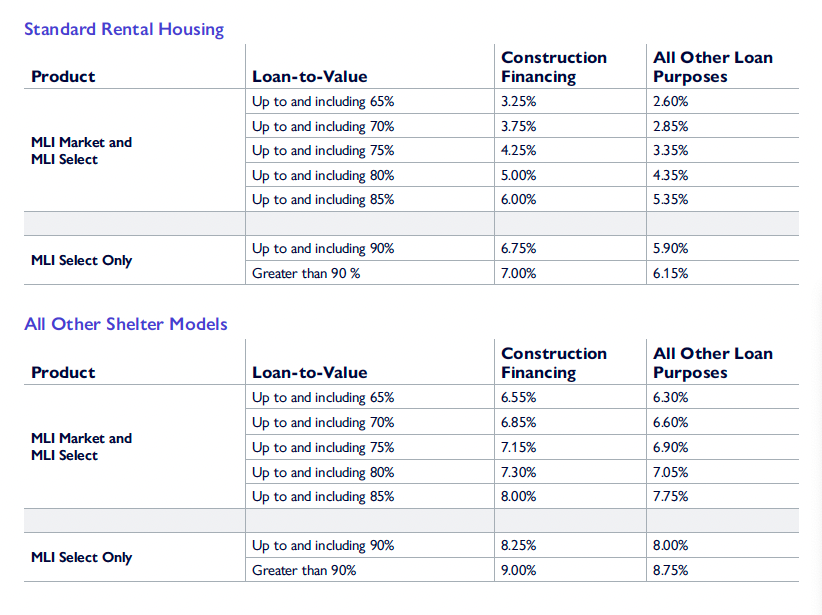

- NEW: CMHC is standardizing the pricing for all multi-unit (MU) insurance products, including MLI Select. Fewer pricing tables to confuse customers are a good thing.

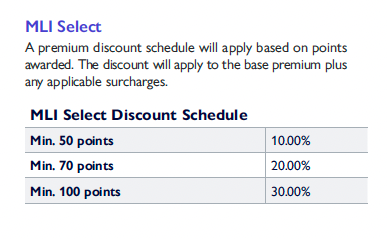

- NEW: A new premium discount schedule for MLI Select applications will take effect. The purpose: to lower premiums "based on the level of social outcomes achieved by the borrower, such as affordability, accessibility, or energy efficiency," CMHC says.

- NEW: Premiums are heading higher for CMHC’s standard ("Market") insurance for retirement homes, student housing, single room occupancy and supportive housing, says Nadeem Keshavjee, President, Founder at GreenBirch Capital.

- Fortunately, there are effectively no changes to premiums for CMHC's "Market" insurance for standard rental housing.

- NEW: MLI Select is getting pricier for those pushing the LTV and amortization envelope. Here's the upcoming pricing:

We're talking some hefty price hikes here, my friends. MLI Select premiums prior to the change "ranged from [only] 2.55% to 4.05% regardless of the leverage or amortization," Keshavjee says. (See this)

For non-standard housing (e.g., student rentals at 85% LTV, the purchase premium goes from 6.10% to 7.75%, he adds.

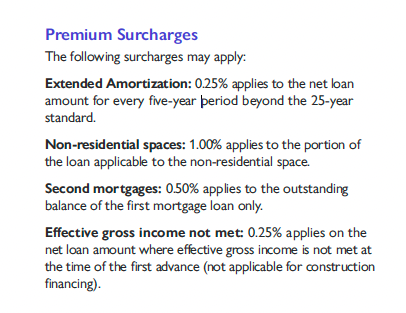

- As for current premium surcharges, they'll remain unchanged in all cases. Just note, however, that CMHC never used to levy a premium surcharge for extending MLI Select amortizations beyond 25 years. Now it does. So if you want a 40-year amortization, that's another 75 bps on top of the MLI Select premiums in the above table.