Market share matters for mortgage brokers in ways that barely need explaining:

- Brokers, as a group, have higher public recognition and earning potential as their pie slice gets bigger.

- Lenders servicing brokers make more money.

- Mortgage shoppers become better informed as broker interactions grow. In turn, a more enlightened mortgage consumer is less likely to make costly financing mistakes.

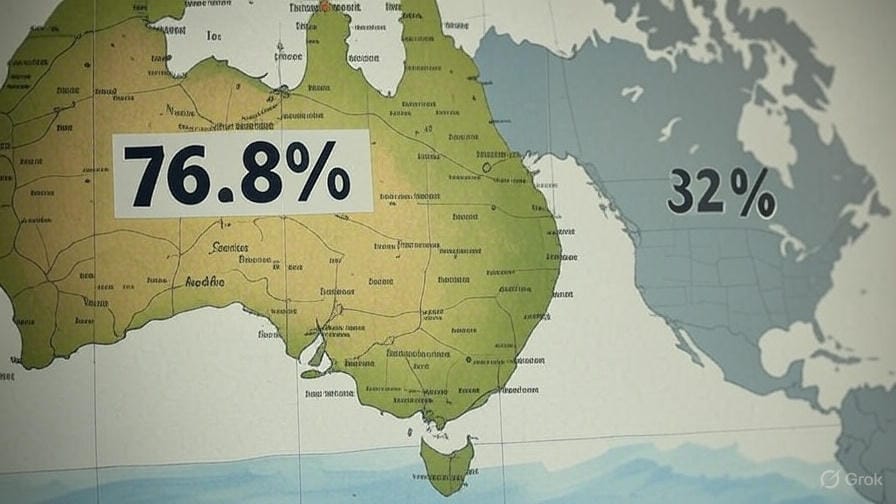

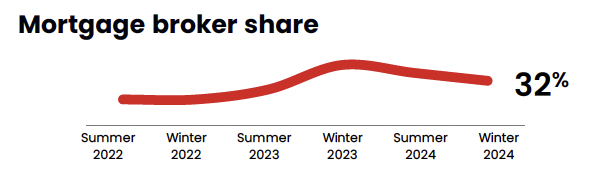

All of this is why our industry tracks broker share like a blackjack player tracks a dealer's face card. The most consistent source of this data is Mortgage Professionals Canada (MPC). Its latest survey suggests almost 1 in 3 borrowers (32%) closed their mortgage with a mortgage broker in the past year.

That's down from the all-time high of 34% in 2023.

One-third might not impress your dinner guests, but in a market with $655 billion of originations in 2024 (source: CMHC), every 1% swing is over $6 billion of loans.

(Side note: If you happen to be a fintech pitching “We just need 1% of the mortgage market!” on Shark Tank or Dragons’ Den, be prepared to be escorted out faster than someone trying to sell diet water. The last time we checked, the best of the best online brokers haven't even approached this number.)