The Bank of Canada has sucker-punched rate floaters and the real estate market with a 25 bps rate boost.

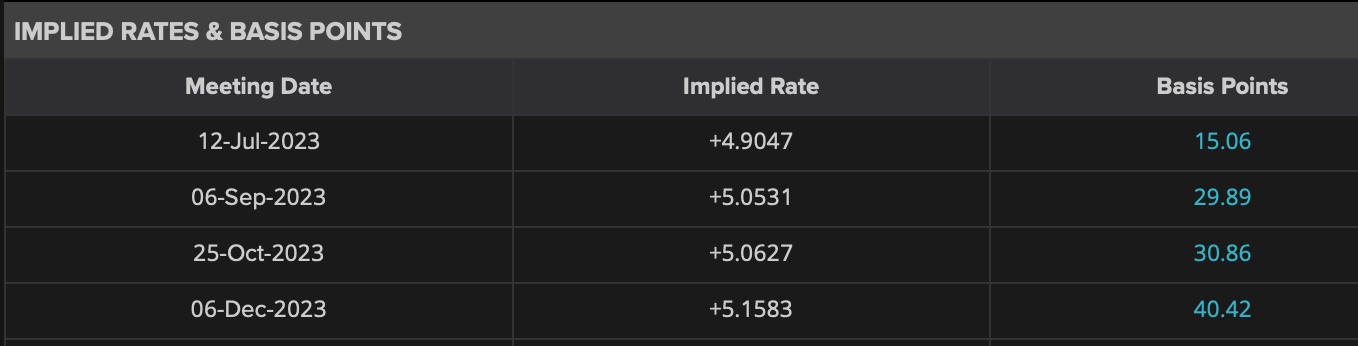

In one swift statement, it has decidedly reset rate expectations. Market odds now have a July 12 hike at a 61% probability, with potentially another increase by December. Another move would take the benchmark prime rate from 6.95% at the end of today to a nosebleed 7.20% (last seen in February 2001).