Mortgage borrowers need rate relief like a desert hiker needs water, but the Bank of Canada is keeping rate cuts a mirage with no oasis in sight.

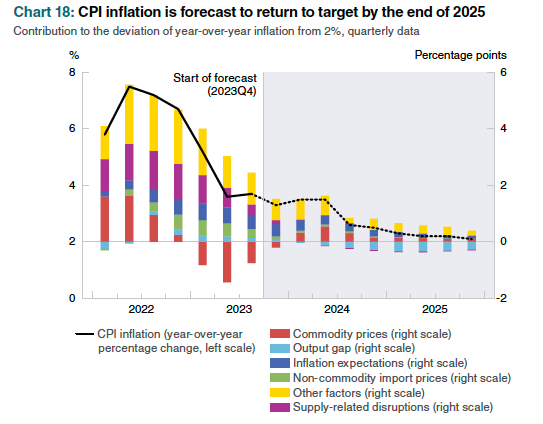

The BoC extended its rate pause today as expected—but moved the goalposts. The Bank now projects "that inflation will stay around 3½% until the middle of 2024," it said. That's up from 3% in its previous July forecast.

The Bank essentially implies it has a worse grip on inflation than it's been leading us to believe.

But the market isn't buying it.