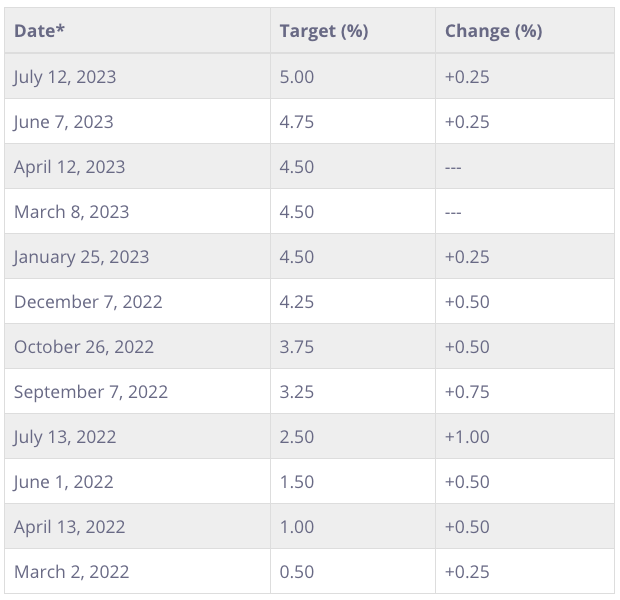

When this rate hike cycle began in early 2022, few envisioned Canada's overnight rate with a 5-handle—certainly not the 1 in 2 borrowers who chose floating rates at the time.

But that's precisely what we've got. Canada’s overnight rate just hit 5%, and more borrowers just hit the panic button.

Today's move boosts the benchmark prime rate north of 7% for the first time in over 22 years. For an average adjustable-rate borrower, their monthly mortgage payment could leap by roughly $14 per $100,000 balance. For rate floaters, that's an extra 51 bucks a month based on the average Canadian mortgage balance.

With two-thirds of mortgagors reporting trouble "meeting their financial commitments,” today's hike is tear-worthy for floating-rate debtors.

Minimum uninsured qualifying rates should rise tomorrow to:

• 8.40% on a variable mortgage

• 9.20% on a HELOC

* These federal "stress test" rates are based on the lowest nationally available prime lending rates.

Key forecast update

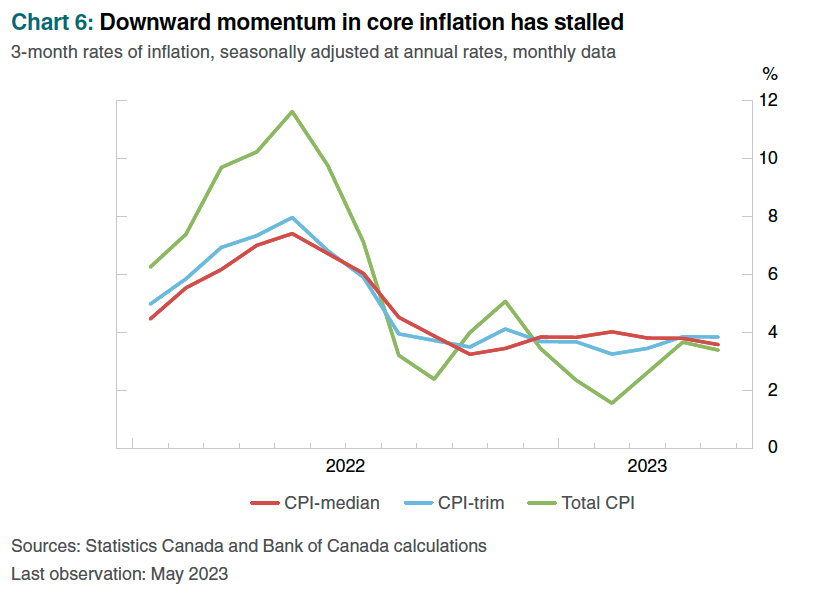

The BoC now projects that CPI inflation will "hover around 3% for the next year."

That can't be understated as it departs from the Bank's prior messaging.

"Governing Council remains concerned that progress towards the 2% target could stall," it said today—as well it should be if its new forecast comes to pass.

On the face of it, this guidance suggests the Bank is more willing to let the overnight rate ride at 5% further into 2024.

The bond market was unconvinced. Its immediate reaction to the announcement was to take Canada's 5-year yield just slightly lower.

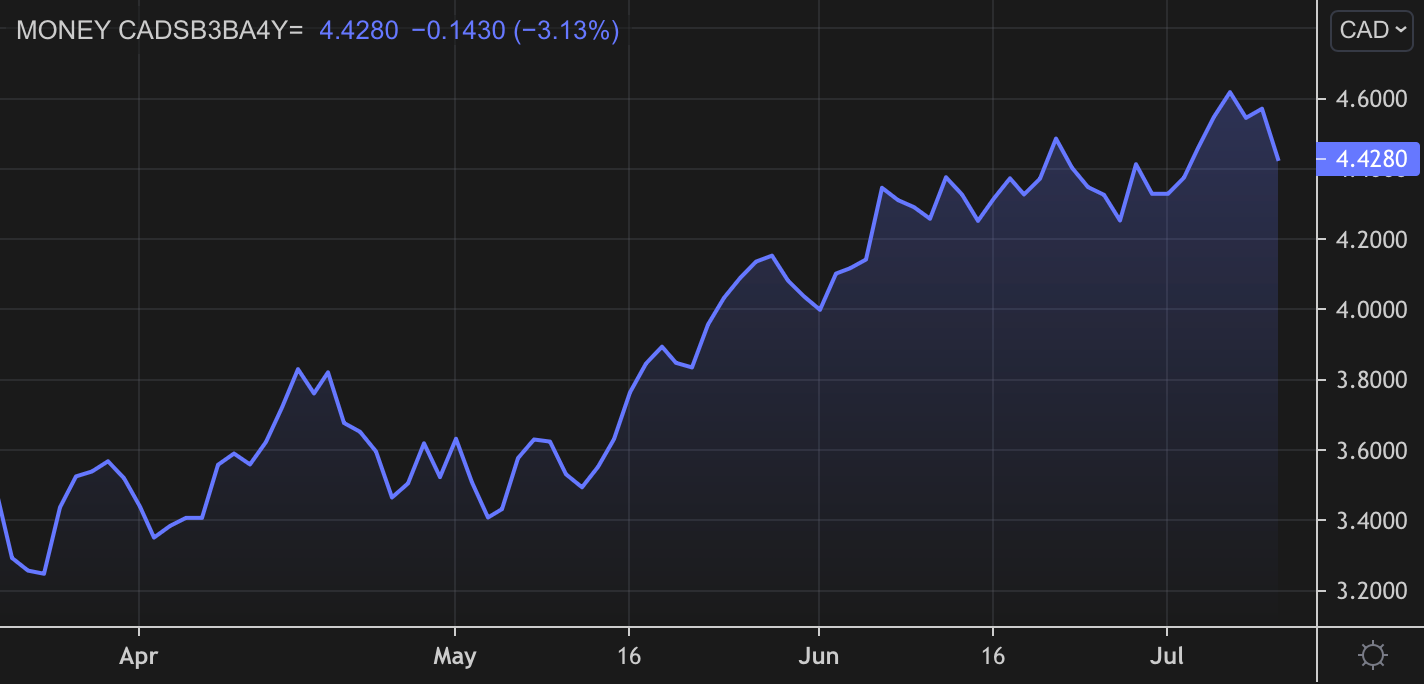

However, since the BoC's press conference at 11:00 a.m., rates have fallen further. The 4-year swap—our preferred fixed-rate indicator (chart below)—is now down over 14 bps. Albeit, yields are being mainly driven by good news in U.S. CPI. More on that below.

In the #OIS# market, traders are pricing in about a 50% chance of one more hike this year, but that's akin to the market saying it has no clue what'll happen.

Much can change before the BoC's next meeting. The most significant change could be job losses. Falling employment would help inflation return to the Bank's 1-3% control range quicker than its forecast. At this point in the rate cycle, rising unemployment should be expected. Hence, the BoC's next move might indeed be a cut.

What else the Bank said

The BoC listed four signals that it's watching closely:

- the evolution of excess demand

- inflation expectations

- wage growth

- corporate pricing behaviour.

We'll get good data on most of these metrics before the Bank's next rate meeting on September 6. Governor Macklem said today that governing council considered pausing rates again, so another hike is by no means assured if data gets more constructive in the next few months.

"We're taking it one decision at a time," Macklem said in today's press conference. "Monetary policy is working. Inflation is coming down...We think we're close."

Mortgage impact to date

"...Approximately one-third of mortgage holders have been directly affected by higher rates," the Bank said in its MPR. "As this share increases over the coming quarters, more households will face higher debt-service costs." That's why they say monetary policy operates with a lag.

"Mortgage holders with variable-rate fixed payments could be particularly exposed," it said. "As these borrowers renew their mortgage and return to their original amortization schedule, they could face large increases in payments."

Albeit, adjustable-rate mortgage (ARM) borrowers are performing better than fixed-borrowers, according to all lenders we speak with. And they've withstood 10 payment increases in record time, just 16 months.

The BoC essentially confirmed this, noting, "...The delinquency rates on mortgage loans are near all-time lows. This is true even for variable-rate mortgage holders with variable payments, who have felt the largest impact of elevated interest rates so far."

In the press conference today, I asked Senior Deputy Governor Rogers (video below) if the risk from rate resets was overhyped from a financial stability and inflation perspective.

After all, ARMs are performing better than fixed-rate mortgages and government policy is helping borrowers stay in their homes. Unfortunately, Ms. Rodgers didn't weigh in on that, focusing instead on the pain borrowers feel, which we're all well aware of.

As a result, we might as well answer our own question. We've seen nothing to date to suggest the BoC meaningfully fears payment resets from a financial stability perspective. Indeed, such resets (while heartbreaking for many households) will help slow inflation and end the rate pain quicker.

"The short answer why house prices keep going up is supply...There's just more demand than there is supply."—BoC Senior Deputy Governor Carolyn Rogers today

Other highlights

Here are a few other nuggets of note from the BoC's 10:00 a.m. ET statement:

- "...The downward momentum [in CPI] has come more from lower energy prices, and less from easing underlying inflation." (We've got to keep watching oil!)

- "...With three-month rates of core inflation running around 3½-4% since last September, underlying price pressures appear to be more persistent than anticipated."

- "The economy will move into modest excess supply early next year."

- "With the large price increases of last year out of the annual data, there will be less near-term downward momentum in CPI inflation."

The real inflation test begins on August 15. That's when we'll get July inflation, which has a much tougher comparable of 0.1, versus the layups we've had these prior six months.

Welcomed CPI news down south

Today's much bigger story for global markets was U.S. CPI. It landed this morning below expectations—a welcomed relief.

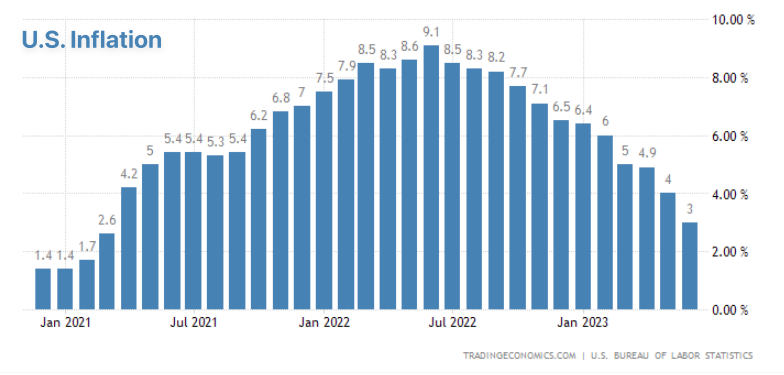

U.S. headline CPI clocked in at 3.0% in June versus a 3.1% expectation. That was the slowest American inflation reading since March 2021.

The improvement was primarily due to base effects, but we'll take it. If U.S. inflation starts with a "2" next month, it could do wonders for inflation expectations, given humans tend to be extrapolating creatures.

"Base effects," in this case, refers to the massive 1.2% June 2022 monthly inflation print dropping out of the annual calculation.

The other good news was the Fed's favoured "core services excluding housing" measure. It was little changed in June but dipped to 4% y/y, the smallest increase since 2021. "There’s no denying that this reading provides significant evidence of progress towards taming inflation," Desjardins Economics said today.

That, and the slowest job growth in 2.5 years, raises the probability that the Fed's expected 25 bps hike on July 26 will be its last of this cycle. Futures markets imply a 92% chance of a Fed hike at that meeting and the first cut in May or June next year. Since the U.S. wags our tail economically, that should give variable-rate borrowers at least a glimmer of hope.