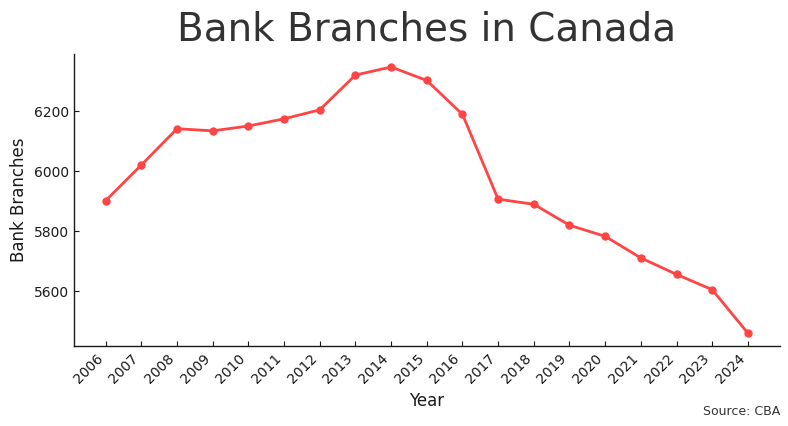

Canadian bank branches vanished at the second-quickest clip this century, according to fresh CBA data. And frankly, it wouldn’t shock many if the pace accelerated.

It's an uphill battle, but banks are trying hard to keep branches relevant in a digital world. After all, they have so much invested in them, many (especially the 55+ crowd) still value in-person advice, they're great for branding, and customers like the security of nearby branches—even if they don't use them.

But from a mortgage perspective, do branches still pay their way when AI and technology have come so far?

TD thinks so. It's wagering that AI won't meaningfully eat into demand for human advice in "the next couple of years," which is why it's poured so much money into branch mortgage specialists this year.

That strategy is central to TD’s fortunes, but it also weighs heavily on its rivals—brokers included.