Let's fast forward to 2030 and imagine a typical Canadian shopping for a mortgage.

By then, their first question won't be fixed or variable—it’ll probably be, "Where can I get trustworthy mortgage advice the fastest, for free, on my phone?"

Eventually, millions of Canadians will end up confiding in AI mortgage chatbots to some degree, expecting speedy, accurate, pressure-free mortgage recommendations and rate quotes.

And these bots won't just be boring text; some will greet you with eerily human avatars, using technology like that from Synthesia.

Source: synthesia.io

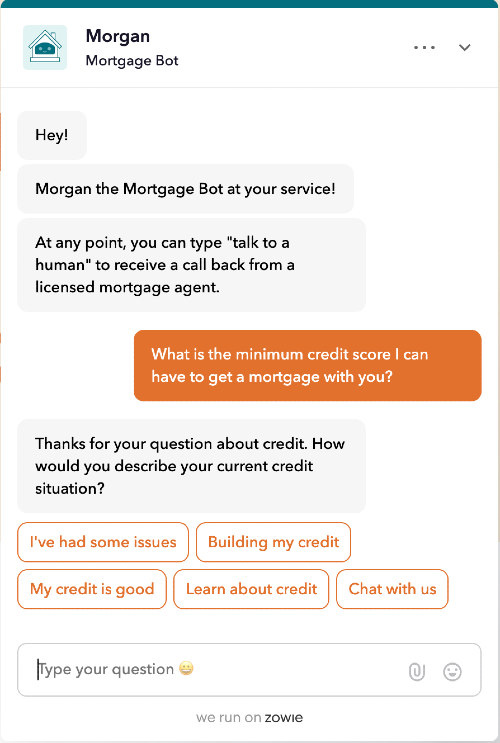

Forward-thinking brokers and lenders see this wave coming, and many plan to add bots to their websites to service existing clients or attract mortgage leads looking for 24/7 advice.

Some early-movers have already gone live—True North Mortgage, for instance, fields a bot called "Morgan."

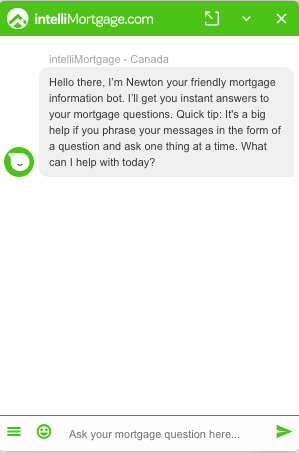

Truth be told, brokers have been dabbling in bots for years. We had one at my old shop, IntelliMortgage, but it was an old-school FAQ bot where you had to program in most of the knowledge, semantics and logic by hand. (If I could only have those 1,000+ hours back!)

Those relics are now being replaced by AI bots that gorge on vast data sets, tap into large language models, capture intent, and spit out instant answers.

The risks

Bots take enormous planning and refinement. Rushing out an off-the-shelf or weakly programmed AI bot is less “innovation” and more “liability grenade,” for at least four reasons:

- The stakes are high: Many consumers who try a lender's or broker's bot and don't find it helpful may never use that bot—or mortgage provider—again.

- Consumers who love their bot experience will tell their friends and family about it, creating word-of-mouth referrals.

- Competition will be brutal, with developers racing to build better bots; those who succeed could dominate the DIY mortgage researcher space.

- If the information provided by the bot doesn't comply with federal and provincial laws and regulations, and bot owners don't disclaim properly, the mortgage provider could have a compliance nightmare on their hands (don't rely on “the bot said it” holding up in court).

The legal minefield is vast: truth in advertising, privacy, anti-discrimination, consumer-credit rules, APR disclosures, and a parade of provincial fine print.

Let's start with that last one, how provincial regulators look at robo advice.