TDS stands for "gross debt service."

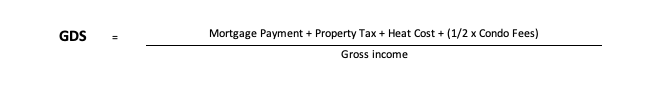

A borrower's GDS ratio equals his/her monthly cost of carrying a mortgage divided by total gross monthly income.

In other words, it's the percentage of income needed to cover basic housing costs.

Prime lenders commonly underwrite mortgage applications by assessing a borrower's GDS ratio. Typically, lenders want to see GDS ratios below 39%.

In some cases, non-prime lenders allow unlimited GDS ratios so long as the borrower has sufficient equity (down payment) and a marketable property. Solid credit doesn't hurt for GDS exceptions, either.