The curtains just closed on the world's most important news conference for mortgage rates: the Fed rate announcement.

If you want to know how it turned out, look no further than North America's 5-year yields. They're the financial market's real-time window into the Fed's mind, and their verdict was a resounding shrug, with yields dipping a modest 5 bps on the day.

Coming into the meeting, rate sleuths sought clarity on the five policy mysteries below, and they largely got it.

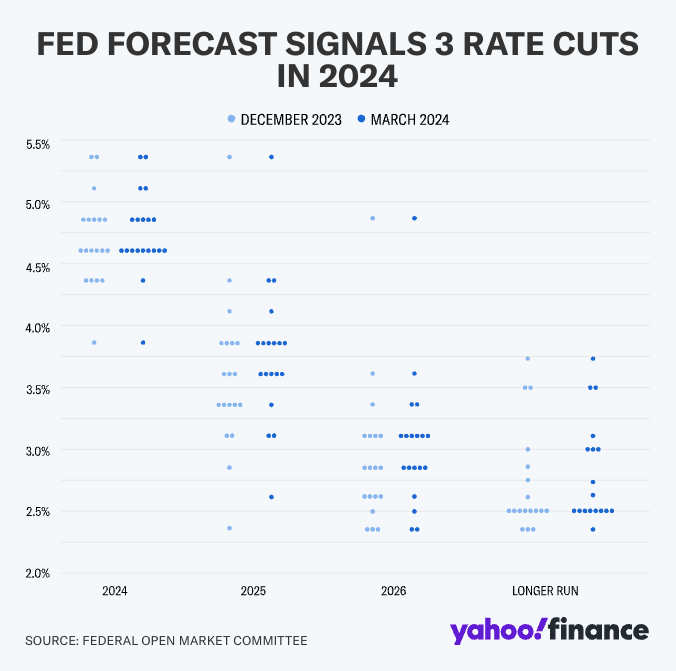

#1 - Are three rate cuts still the expectation?

- Answer: Yes. Monetary easing is likely “sometime this year,” Fed Chair Jerome Powell repeated. The Fed's fresh dot plot (projections) still show a hat trick of cuts before New Year's.

#2 - Is the Fed's #neutral rate# estimate now higher?

- Answer: Yes. The long-term "dot" ascended from 2.5% to 2.6%, ending a 2.5% plateau that's lasted since mid-2019. In theory, this means mortgage rates may not fall as much as previously expected, but let's be real, 10 bps won't break the bank. Given the spending sprees on both sides of the border, consider borrowers fortunate if neutral rate increases stopped at a mere 10 bps.

#3 - How does the Fed view this year's firm inflation data?

- Answer: Powell said higher-than-expected Jan./Feb. inflation hasn't changed the overall story of "bumpy" progress. "We were right to wait," he reflected, noting that he doesn't know if inflation's recent strength is "a bump in the road or something more." Either way, he's braced for a rocky path, and mortgagors should be too.

#4 - How worried is the Fed about growth, jobs, wages and financial conditions?

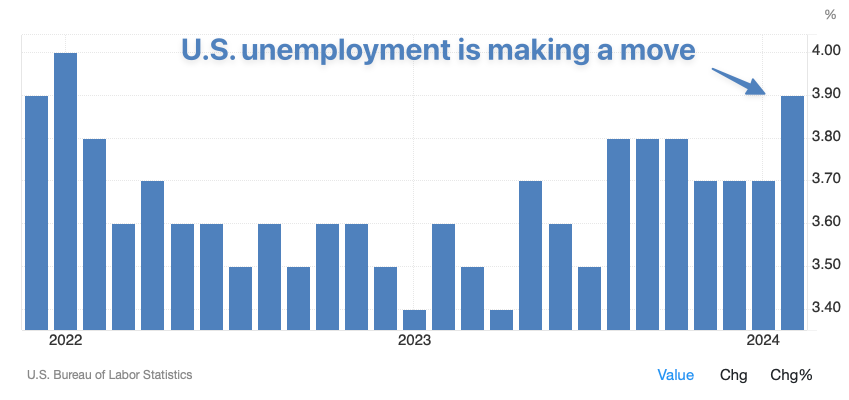

- Answer: Powell was refreshingly straightforward on this. He said that solid growth, strong employment and easier financial conditions are not significant "problems" in and of themselves. In fact, the Fed raised its inflation and growth forecasts yet still expects inflation to trend towards 2%. Regarding hot wage growth, Powell said, "Our target is not wages, it’s inflation." He confirmed that significant weakening in the labour market could justify more accelerated rate cuts.

#5 - How long will meaningful rate cuts take

- Answer: Absent a freak economic meltdown, the coming rate cut cycle could be a marathon instead of a sprint. FOMC members' crystal balls don't have core PCE inflation reaching the 2% target for almost two years. Mind you, the Fed will cut far ahead of that. Separately, Powell noted that #base effects# later this year may make it harder to make inflation progress. Seven of the next 12 months have tough comparables (i.e., monthly inflation of 0.2% or less). So, again, expect turbulence en route to 2%.

Inflation data is king

Post-Fed meeting, markets took a collective exhale, confident that rate hikes remain off the menu despite a perky economy. Powell echoed that America's policy rate is still “likely at its peak,” and traders came out of the meeting still fully pricing in a rate cut by July.

The good news for Canadian mortgagors is that rate risk appears capped, especially given the Fed's willingness to tolerate more economic effervescence. Powell suggests it's probably just a waiting game at this point (someone queue the Jeopardy theme).

"Most importantly, we’re looking at incoming inflation data," Powell said. That makes next Friday's core PCE reveal a blockbuster we'll be popcorn-ready for.

Comments

Sign in or become a MortgageLogic.news member to read and leave comments.

Just enter your email below to get a log in link.