⏩

The short of it: In 2024, the BoC should loosen its grip and give rates a snip. The market's magic 8-ball now shows 5-6 target rate cuts in 2024. Until that seems imminent, the BoC will keep playing hardball—trying to deter premature rate celebrations and home-buying exuberance. But ultimately, inflation is the boss.

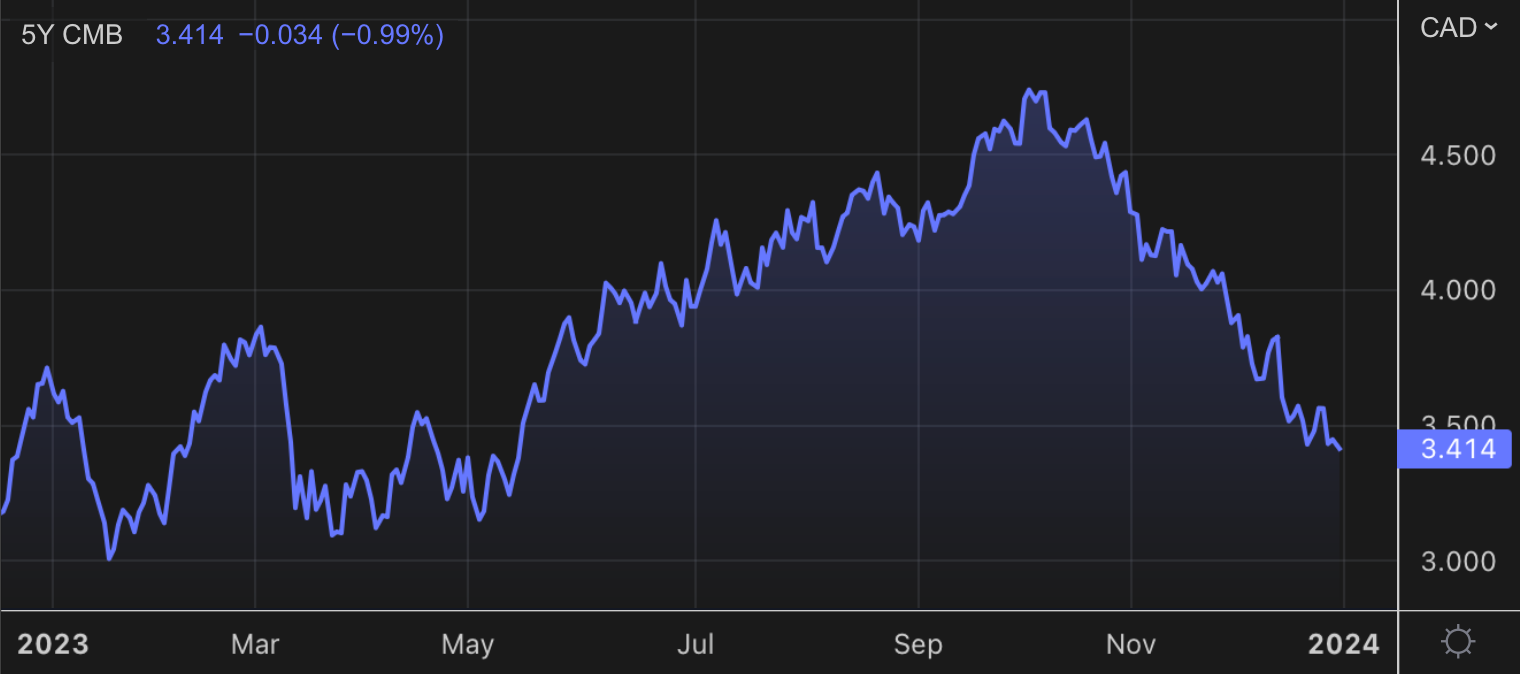

Fittingly, yields on all the most common fixed-rate funding cost indicators closed at 7-month lows to end the year. And they all finished 2023 lower than 2022. That includes the 5-year #GoC#, 4-year swap, 5-year CMB (see chart below), and so on.

If forward rate markets are right, it's all just a precursor to what's to come in 2024. "It truly is just a matter of time before rate cuts commence," BMO Chief Economist Doug Porter said in a recent report. "The market is looking for spring rate relief..."

On that note, here are five factors that will play on mortgage rates in 2024:

Comments

Sign in or become a MortgageLogic.news member to read and leave comments.

Just enter your email below to get a log in link.