It's a dark day for successful Canadian investors, seven-plus-figure entrepreneurs, and even mom-and-pops with their appreciated cottages.

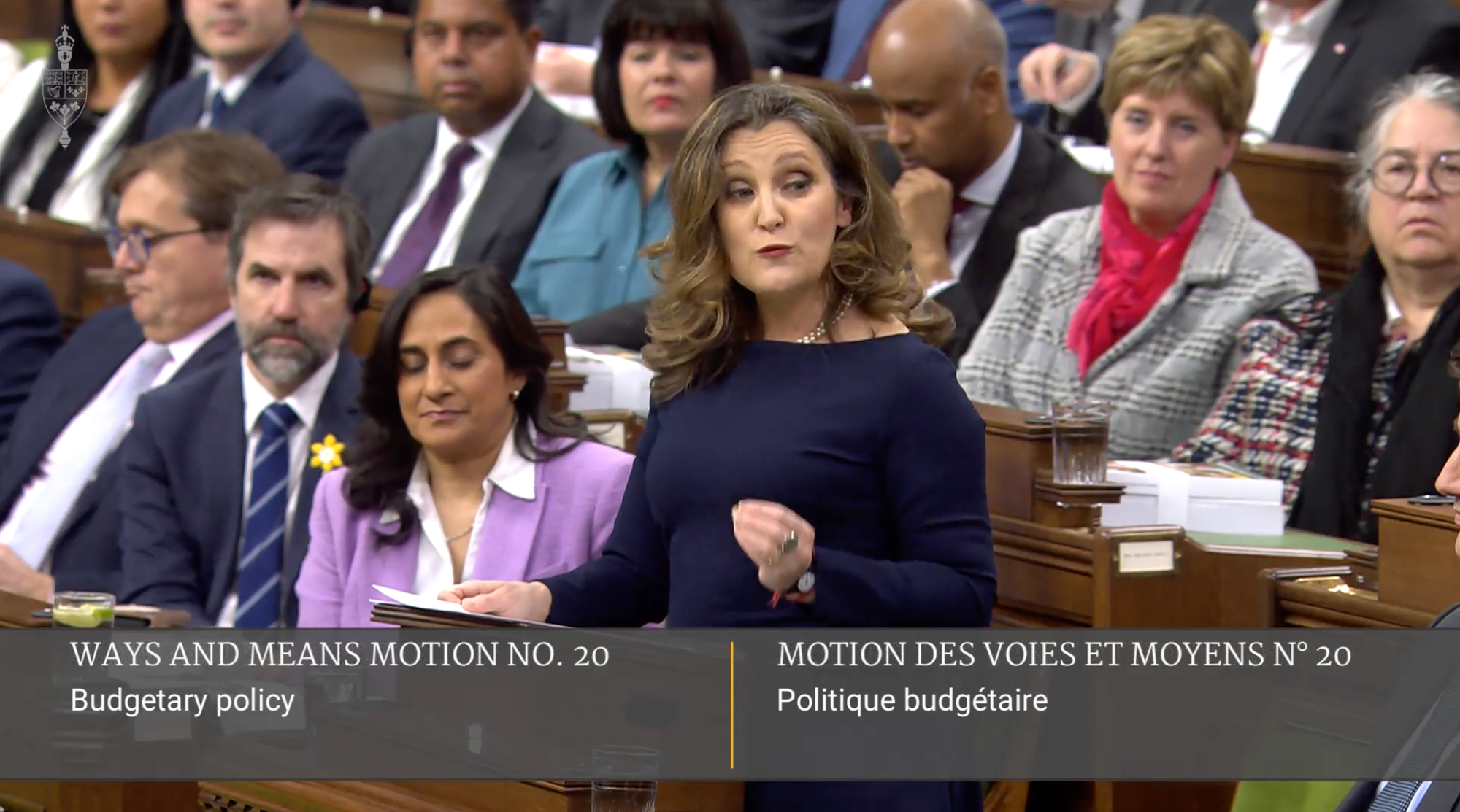

Our friends in Ottawa are cranking up the capital gains tax to fuel their latest splurge—$39 billion in net new spending and $39 billion of red ink annually for the next two years.

Effective June 25, Uncle Justin will tax two-thirds of your capital gains versus one-half today. This starts at dollar one for corporations and trusts, but the new 2/3 inclusion rate applies only to capital appreciation over $250,000 for individuals. It's the first change to capital gains inclusion since dial-up internet was a thing, 23 years ago.

Comments

Sign in or become a MortgageLogic.news member to read and leave comments.

Just enter your email below to get a log in link.